Is CPP indexed to inflation?

As of my last update in September 2021, CPP (Canada Pension Plan) benefits are not directly indexed to inflation. However, there is a mechanism in place to adjust CPP benefits periodically based on the Consumer Price Index (CPI).

The CPP uses the CPP Indexing factor, which is calculated based on the growth in average weekly wages and changes in the CPI. The indexing factor is applied to adjust CPP benefits annually. This helps ensure that CPP benefits keep pace with the general cost of living increases over time.

Keep in mind that policies and regulations may change, so it’s always a good idea to check with the official website of the Government of Canada or the Canada Pension Plan for the most up-to-date information on CPP indexing and benefits.

Does the Canada Pension Plan Increase with Inflation?

The CPP benefits are adjusted based on changes in the Consumer Price Index (CPI) and the average weekly wage growth. This adjustment is made using the CPP Indexing Factor. The indexing factor is applied annually to ensure that CPP benefits maintain their real value by accounting for inflation.

While the CPP benefits are not strictly tied to inflation rates, the indexing factor helps to provide some level of protection against the eroding effects of inflation over time.

Is the Canada Pension Plan Growing?

The Canada Pension Plan is a contributory, earnings-related social insurance program that provides income for retirees in Canada. It is funded through contributions from employers, employees, and self-employed individuals. The CPP invests these contributions to generate income, and the investment returns contribute to the growth of the plan’s assets over time.

The plan’s growth is influenced by various factors, including the number of contributors, investment performance, economic conditions, and changes to the program’s rules and regulations. The CPP’s financial health is regularly monitored and evaluated by the CPP Investment Board and the government of Canada to ensure its sustainability and ability to provide retirement benefits to future generations.

For the most current information on the growth and status of the Canada Pension Plan, I recommend checking official sources such as the CPP Investment Board or the Government of Canada’s official websites.

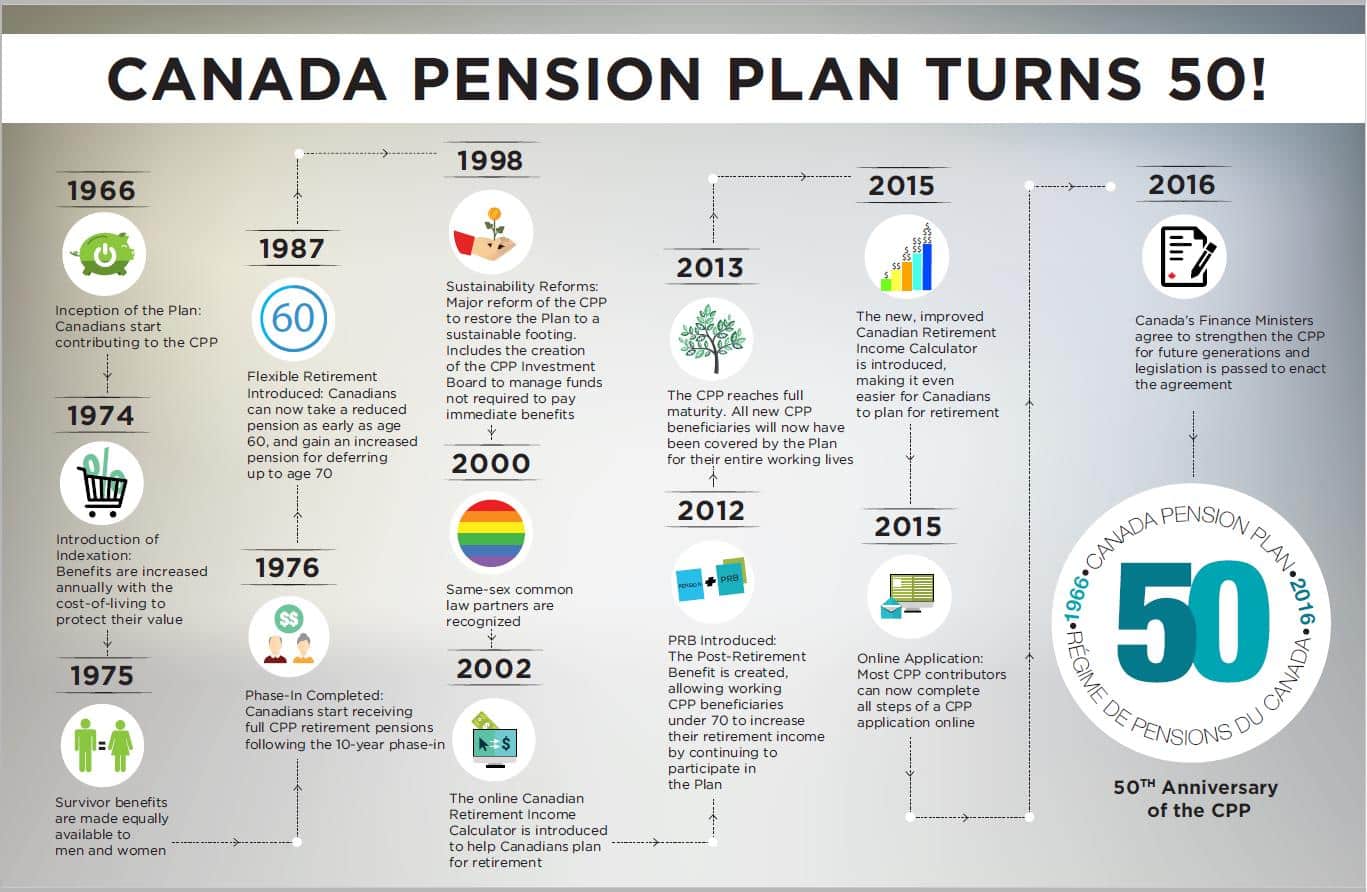

How long has the Canada Pension Plan been active?

The Canada Pension Plan (CPP) was established on January 1, 1966. It was created through the passage of the Canada Pension Plan Act in 1965. The CPP is a social insurance program designed to provide a stable and dependable pension for retired contributors, disability benefits for contributors who become disabled, and survivor benefits for the families of deceased contributors.

Since its inception, the CPP has been an important pillar of Canada’s retirement income system, providing financial support to retired and disabled individuals as well as surviving dependents. The CPP is funded through contributions from both employees and employers, as well as self-employed individuals. These contributions are pooled and invested by the CPP Investment Board to help ensure the sustainability and growth of the plan over time.

Who manages the Canada Pension Plan?

The Canada Pension Plan (CPP) is jointly managed by several entities responsible for different aspects of the plan’s administration and investment.

- Canada Pension Plan Investment Board (CPPIB): The CPPIB is an independent organization responsible for investing the CPP’s funds to achieve a maximum rate of return without taking on undue risk. The CPPIB is accountable to the CPP contributors and beneficiaries and operates at arm’s length from the government. It manages the investment of CPP funds in various assets globally, such as equities, bonds, real estate, and infrastructure projects.

- Employment and Social Development Canada (ESDC): The ESDC is a federal department that plays a key role in the overall administration and policy development of the CPP. It sets the contribution rates, monitors the plan’s sustainability, and makes changes to the plan as needed.

- Service Canada: Service Canada is a federal agency responsible for providing CPP-related services to Canadians. This includes processing CPP applications, calculating and disbursing CPP benefits, and assisting with inquiries related to the CPP.

- Provincial and Territorial Governments: The CPP is a cooperative program involving the federal government and most provincial and territorial governments in Canada. They collaborate in the governance and administration of the plan, and any significant changes to the CPP typically require the approval of at least two-thirds of the provinces, representing at least two-thirds of the Canadian population.

The combination of these entities ensures that the CPP is managed efficiently and in the best interest of its contributors and beneficiaries, providing a stable and secure pension system for Canadians.

ChatGPT

Writer

ChatGPT is a large language model developed by OpenAI, based on the GPT-3.5 architecture. It was trained on a massive amount of text data, allowing it to generate human-like responses to a wide variety of prompts and questions. ChatGPT can understand and respond to natural language, making it a valuable tool for tasks such as language translation, content creation, and customer service. While ChatGPT is not a sentient being and does not possess consciousness, its sophisticated algorithms allow it to generate text that is often indistinguishable from that of a human.