It’s now day two in a selloff of Aslan Pharmaceuticals (Aslan Pharmaceuticals Stock Quote, Charts, News, Analysts, Financials NASDAQ:ASLN) after the biotech firm released results from a Phase 2b clinical trial. But Roth Capital Partners analyst Dylan Dupuis says the market reaction has been too severe. In a Friday note to clients maintained a “Buy” rating on the stock, arguing that investors appear to be missing the bigger picture on Aslan’s lead drug candidate for atopic dermatitis (AD).

Aslan Pharma, whose clinical program focuses on inflammatory skin diseases, announced on Thursday topline data from its Phase 2b dose-ranging study of eblasakimab in adult patients with moderate-to-severe AD. The company said eblasakimab met the primary endpoint of per cent change from baseline in the Eczema Area and Severity Index score at week 16 versus placebo with statistical significance in three dosing arms. Aslan also said eblasakimab was generally well-tolerated at all dose levels, with low rates of conjunctivitis and injection site reactions, supporting the potential for a differentiated safety profile.

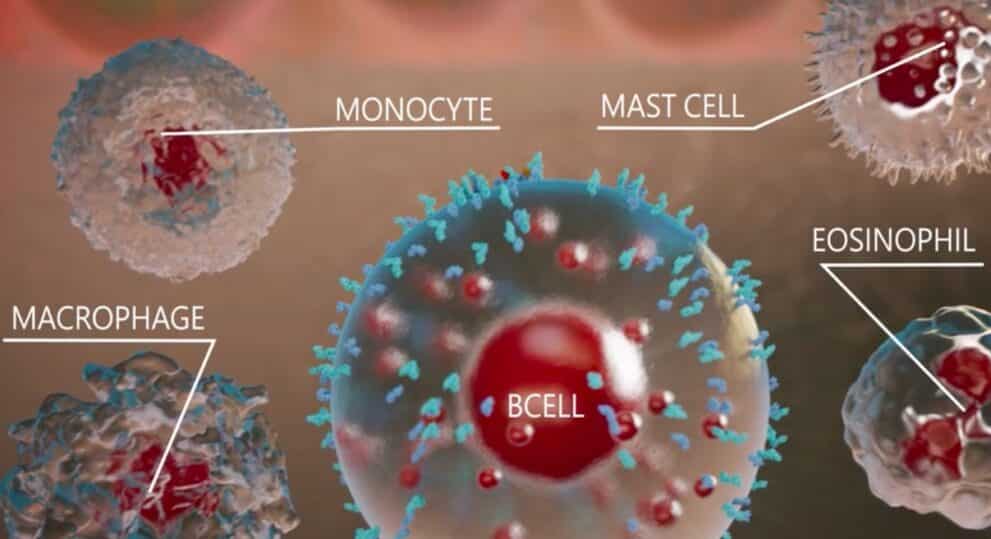

“We are delighted to announce these positive topline data from the TREK-AD study, which support recent translational studies we have published showing eblasakimab’s unique mechanism of action may provide a more efficient and targeted approach to blocking Type 2 signalling, which is responsible for allergic inflammation,” said Aslan CEO Dr. Carl Firth in a press release.

Looking over the results, Dupuis said they featured: efficacy observed at the 600mg dosed once every four weeks (Q4W) which he sees as differentiating in AD; competitive and statistically significant results across multiple doses for all efficacy endpoints; a well-tolerated safety profile; and efficacy at multiple doses that gives optionality for dose selection ahead of a Phase 3 trial, expected to start in 2024.

“One of the key take-aways from these results is that the TREK-AD trial demonstrated efficacy at the 600mg Q4W dose. This is the first case of a biologic achieving efficacy with a Q4W dosing regiment,” Dupuis wrote.

Yet ASLN shares dropped 24 per cent on Thursday and took another big loss on Friday as well, a situation that was undeserved, Dupuis says. The analyst thinks the market reaction focused on placebo-adjusted efficacy rates, where the trial’s placebo rates were considerably higher than those observed in other AD trials.

Dupuis said Aslan had noted a trend in increasing placebo rates in more recent AD trials and has theorized it to be due to modern trials increasingly involving so-called biologically naive patients, who traditionally are less engaged in the day-to-day care of their disease, and thus, receive improved care upon enrolling in a study such as TREK-AD.

“The trial met the primary and multiple secondary endpoints including at the Q4W dose regimen which we view as differentiating. Despite this, shares sold off following the results as investors focused on placebo adjusted efficacy. We believe the sell-off on the data is overdone given the results and current value of ASLN shares relative to the AD opportunity,” Dupuis wrote.

With his “Buy” rating, Dupuis maintained a one-year target price of $15.00, which at press time represented a projected return of 421 per cent.

Share

Share Tweet

Tweet Share

Share

Comment