Shares of kneat.com (kneat.com Stock Quote, Charts, News, Analysts, Financials TSX:KSI) have been relatively flat over the past year, but investors should see some upside over the next 12 months. So says Echelon Capital Markets analyst Rob Goff, who provided an update to clients on the document validation software company on Tuesday where he reiterated a “Speculative Buy” rating on the stock.

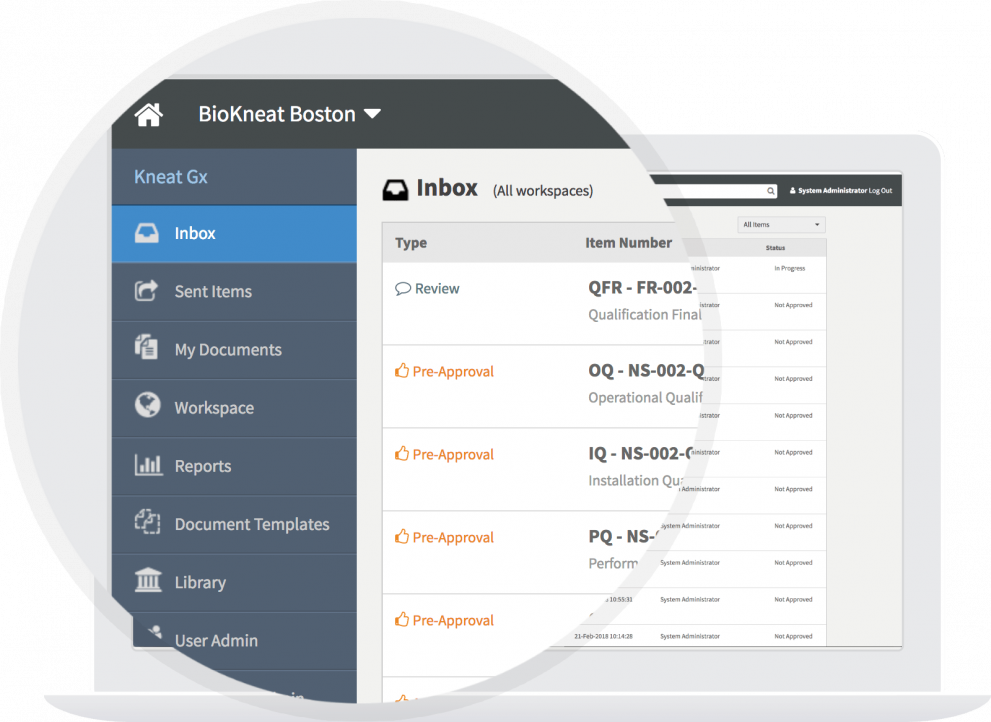

A Canadian company with operations in Limerick, Ireland, kneat’s Gx SaaS platform allows for equipment and computer validation and document management and compliance. The company announced on Monday a €15 million secured debt financing to fund its operations. The financings consist of three term credit facility commitments of €5 million each. Kneat says it will draw the first facility during the current quarter.

“The financing we are announcing today provides Kneat with greater financial flexibility as we continue building out the next-gen platform for quality management and supports us on our way toward profitability,” said Eddie Ryan, CEO of Kneat, in a statement.

“With our strong revenue growth, improving gross margins, and ongoing wins inside the world’s largest pharmaceutical companies, we continue to consolidate our leadership position in digital validation for the life science industry,” he said.

Kneat shares have been in the $2.50-$3.00 range over the past year, with a two-year high having come in mid-2021 at around $4.60. Goff has maintained a 12-month target on KSI of $4.20 per share, which at press time represented a projected return of 56 per cent.

“We maintain our bullish view toward the Company’s organic growth where its successful transition to a SaaS model has supported building momentum,” Goff wrote.

On valuation, Goff said KSI currently trades at 5.9x 2023 EV/Revenue and 8.8x 2023 EV/Gross Profits, which compares to its (larger, slower growth, according to Goff) peers such as Veeva Systems at 12.7x and 17.4x, respectively, and Aspen Technology at 9.3x and 12.2x, respectively. Goff said this makes kneat an attractive investment.

“We see KSI shares continuing to command a premium to their Canadian peers given the strength of its land-and-expand profile, its target market expansion and attractiveness as a mid- to longer-term takeout,” he said.

Looking ahead, Goff is forecasting kneat’s revenue to go from $23.7 million in 2022 to $34.7 million in 2023 and to $48.1 million in 2024. EBITDA is projected to go from negative $2.9 million in 2022 to negative $4.8 million in 2023 and to positive $1.2 million in 2024.

“KSI continues to highlight that full deployment across its current SaaS clients would support baseline revenues in excess of $50 million. We look for the $50 million benchmark to be increased reflecting recent and prospective new contract wins. We are optimistic that KSI will move to a target of $100 million in two years with the inclusion of adjacent markets where services are being developed,” Goff said.

Share

Share Tweet

Tweet Share

Share

Comment