Paradigm Capital delivered a Flash Note on Electra Battery Materials (Electra Battery Materials Stock Quote, Charts, News, Analysts, Financials TSXV:ELBM), saying investors should be on the lookout for near-term catalysts from the lithium-ion battery materials company.

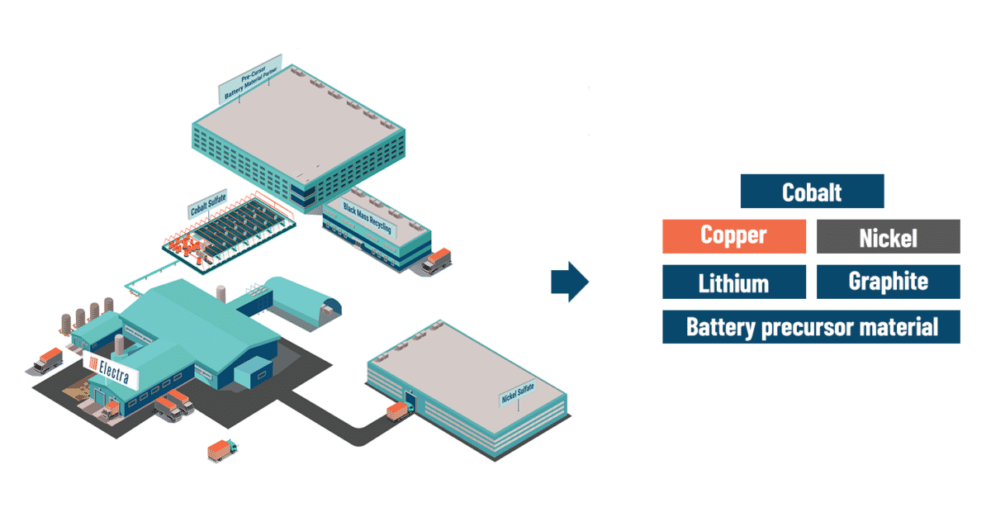

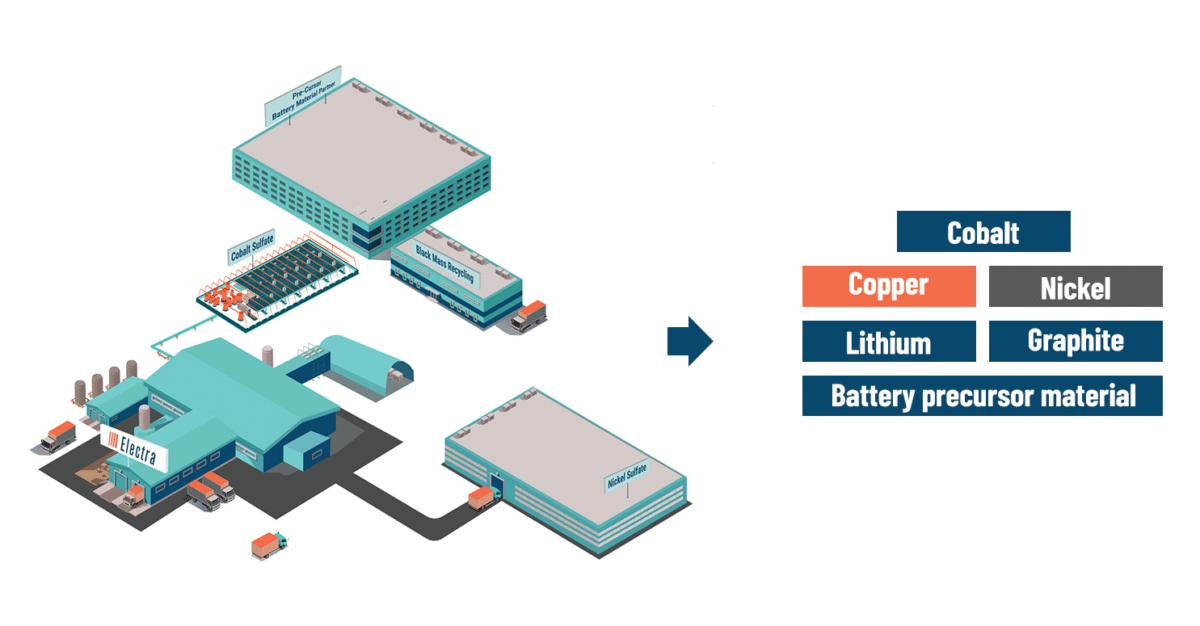

Toronto-headquartered Electra is a processor of low-carbon, ethically-sourced battery materials, currently developing a cobalt sulfate refinery and operating a black mass demonstration plant. The company announced on Monday an investment from the Three Fires Group, a first nation-owned investment vehicle, for up to $20 million.

Electra intends on completing a non-brokered private placement for units priced at $1.10 per unit and consisting of one common share and one warrant at $1.74 for 24 months. With the deal, Three Fires will have the right to nominate up to two board members to Electra plus the right to participate in future financings to maintain its pro-rata ownership.

“Following a successful black mass recycling trial at our battery materials park in Temiskaming Shores, the strategic investment by Three Fires will help us to prioritize our focus and accelerate development of a permanent 2,500 tonne per annum recycling refinery, resulting in near-term cash flow at a low capital intensity while we continue to advance the cobalt sulfate refinery,” said Electra CEO Trent Mell in a press release.

Electra won a contract last year for a three-year supply of 7,000 tonnes of battery grade cobalt to LG Energy Solution and the company is aiming to build a new cobalt sulfate refinery in Bécancour, Quebec.

On the recycling end, Electra last month provided an update on its black mass refinery trial, first launched last year at the company’s Ontario facility. The project aims to recover high-value elements from shredded lithium-ion batteries using a proprietary process, with Electra calling it the first plant-scale recycling of black mass material in North America for recovering critical metals such as lithium, nickel, cobalt, copper, manganese and graphite.

Commenting on Electra’s progress, Paradigm analyst Gordon Lawson said the company will need to secure $10 million more in financing in order to get the Three Fires investment off the ground.

“Going forward, we will look for the company to secure the additional $10 million in financing from third-party and various government stakeholders to confirm the Three Fires investment, expected to be facilitated as a non-brokered private placement,” Lawson wrote.

“Other near-term catalysts include results from a strategic review process, shipment of products to customers, delivery of key equipment to the refinery and the Bécancour pre-feasibility study expected in H2/23 where Electra has been invited to develop a cobalt sulfate refinery,” he said.

Share

Share Tweet

Tweet Share

Share

Comment