The latest quarter came in under expectations, but with an impressive growth trajectory on tap and improving cash flow fundamentals, investors will be wanting to get on board with UGE International (UGE International Stock Quote, Charts, News, Analysts, Financials TSXV:UGE). That’s according to Naji Baydoun, analyst for iA Capital Markets, who provided an update to clients on Friday where he reiterated a “Speculative Buy” rating and C$3.00 target.

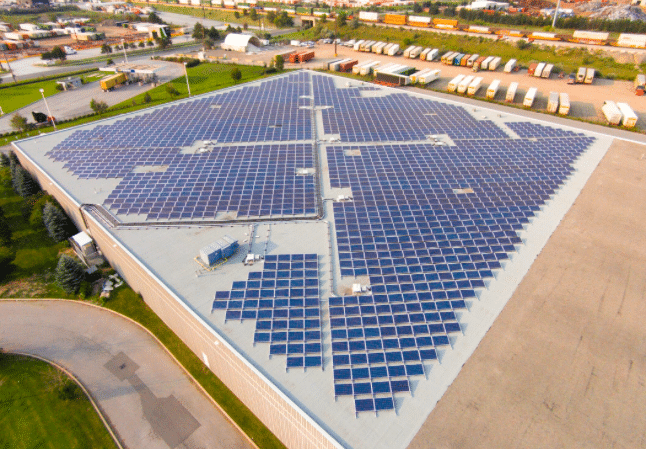

Solar and storage project developer and operator UGE International announced its first quarter 2023 financials on Wednesday, coming in with revenue of $522K, which represented a 43 per cent year-over-year improvement. Gross margins were at 41 per cent compared to 43 per cent a year ago and the net loss was $2.8 million compared with a loss of $1.6 million a year earlier. (All figures in US dollars except where noted otherwise.)

The company, which is dual-headquartered in Toronto and New York, said it reached commercial operation on one project with 1,432 KW in rated capacity, bringing its total to 3,758 KW as of quarter’s end, while the company’s backlog grew to 313 MW compared with 135 MW a year ago.

“In Q1 2023, UGE continued to grow its business of developing, building, financing, and operating commercial and community solar facilities. The Company experienced one of its strongest growth quarters in its history, highlighted by declaring NTP (notice to proceed) on 10 MW of projects and COD (commercial operation) on a 1.4 MW project in Texas,” UGE said in a press release.

On the quarter, Baydoun said the $0.5 million topline compared to the consensus at $0.7 million and his own estimate at $0.5 million, while adjusted EBITDA at negative $2.2 million was greater than the EBITDA loss of $1.7 million forecasted by the Street and Baydoun’s negative $1.8 million.

“Lower-than-expected energy generation revenues were offset by higher-than-forecast EPC and engineering services revenues; however, the lower EPC and engineering margins and ever-increasing G&A costs continued to remain a drag on near-term profitability,” Baydoun wrote.

“UGE has continued to execute on its strategy and has reached NTP on ~12.8MW of capacity recently (~20MW targeted in 2023), providing a path to commissioning a significant amount of new projects over the near term. With the impressive start to the year, UGE is well on its way to achieving its target of adding ~100MW to its backlog in 2023 and remains well-positioned to execute on a scale-up of its operating portfolio,” he said.

On profitability, Baydoun said the goal is still in sight but might take a little longer to achieve, saying that in 2023 the acceleration of capacity deployment will be more of a catalyst. Profitability could be achieved in 2024, the analyst said.

By the numbers, Baydoun is calling for full 2023 and 2024 revenue of $3.0 million and $8.0 million, respectively, and 2023 and 2024 adjusted EBITDA of negative $8.1 million and negative $3.4 million, respectively. At press time, his C$3.00 target represented a projected return of 136.2 per cent

“UGE offers investors: (1) improving growth and cash flow fundamentals (driven by its strategic pivot towards contracted project development), (2) exposure to the high-growth community solar market in the US (~20-30 per cent+ CAGR through 2030), (3) attractive risk-adjusted project returns (double-digit equity IRRs), and (4) a discounted valuation compared with peers,” Baydoun wrote.

Share

Share Tweet

Tweet Share

Share

Comment