Echelon Capital Markets analyst Andrew Semple is getting positive vibes from US cannabis play MariMed (MariMed Stock Quote, Charts, News, Analysts, Financials OTC-MRMD), saying in a Tuesday report that growth catalysts are materializing both over the medium and long term.

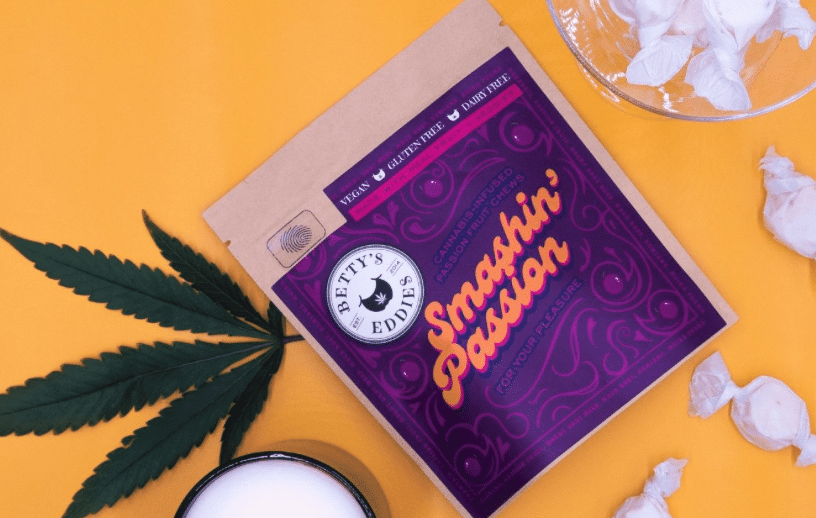

Massachusetts-based MariMed, which has brands such as Betty’s Eddies, Nature’s Heritage and K Fusion and focuses on both the medical and adult-use ends of the market, announced its first quarter 2023 earnings on Monday.

The company posted revenue up ten per cent year-over-year but down four per cent sequentially to $34.4 million, while gross margin slid from 54 per cent a year ago to 45 per cent and adjusted EBITDA fell from $10.4 million to $7.1 million. (All figures in US dollars.)

Company highlights over the quarter included the closing on a $35 million credit facility and closing on the acquisition of Ermont to acquire a vertical cannabis operation in Quincy, MA.

“We reported our 13th consecutive quarter of positive adjusted EBITDA, and we expect to generate our fourth consecutive year of positive operating cash flow,” said CEO Jon Levine in a press release. “MariMed is one of the only companies in the cannabis industry to report positive cash flows and positive EBITDA over this extended period of time.”

Looking over the Q1, Semple called it a solid quarter for MariMed, with the $34.4 million topline landing above his estimate at $33.3 million and in-line with the consensus at $34.7 million. Semple said the sequential drop in sales was primarily from normal seasonality along with some expected increases in competition, while the year-over-year step up came from consolidation of business in Maryland and organic growth in retail and wholesale activities.

On earnings, Semple said the $7.1 million in adjusted EBITDA was above his forecast at $6.7 million and in-line with the Street’s call at $7.2 million. Semple also said management’s reiterated guidance for 2023 of sales over $150 million and adjusted EBITDA over $35 million is a positive and points to another yea of solid growth ahead.

“These results speak to our thesis that MariMed is delivering craft-quality products at scale and its truly premium product portfolio has mitigated the impact of pricing declines. New product launches (with MariMed beginning to venture into value category flower) and innovative product formats also likely helped to sustain strong wholesale performance,” Semple wrote.

With the update, Semple maintained a “Speculative Buy” rating on MRMD and $1.00 target price, which at press time represented a one-year projected return of 110.5 per cent.

“We see healthy upside in the current share price with an implied return of 111 per cent to our price target. Our bullish view is further supported by MariMed’s bolstered balance sheet, ample growth opportunities within existing markets and in new states via M&A, as well as a major pick-up in the adult-use sales in Maryland given that MariMed is one of the largest wholesale suppliers in the state and the first sales are expected to begin on July 1, 2023,” Semple wrote.

Share

Share Tweet

Tweet Share

Share

Comment