A recent quarterly miss is more of a blip than anything to worry about with Canadian overnight air cargo company Cargojet (Cargojet Stock Quote, Charts, News, Analysts, Financials TSX:CJT). That’s the scoop from Beacon Securities analyst Ahmad Shaath, who in a Monday update to clients reiterated a “Buy” rating, saying cost-cutting moves by the company will help to keep profit margins level going forward.

Shares of Cargojet dropped almost 11 per cent on Monday after the company released its fourth quarter 2022 financials, which featured revenue up 13.2 per cent year-over-year to $267.0 million and adjusted EBITDA down 8.4 per cent to $82.9 million.

Cargojet, which has air cargo services across North America along with an ACMI (aircraft, crew, maintenance and insurance) business and an international charter plane service, said it plans on continue developing its strategic partnerships in an effort to bolster business through any upcoming macro slowdowns.

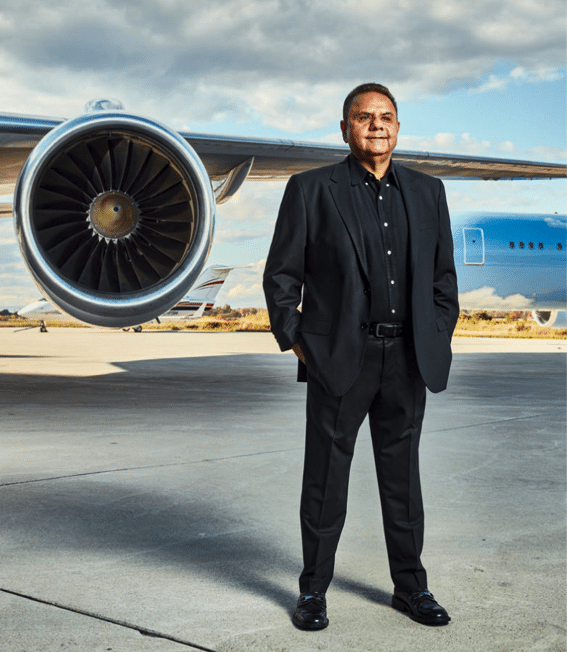

“The continued global increase in e-commerce demand has produced strong growth in our Domestic and ACMI business segments during the Quarter. We continue to monitor various macro risks including a potential recession, which may have impact on consumer spending. As such, Cargojet continues to carefully manage its strategy to match the capacity required with actual customer demand,” said Cargojet President and CEO Ajay Virmani in a press release.

Looking at the quarterly results, Shaath said Q4 revenue of $267 million was ahead of his estimate at $263 million as well as the consensus at $260 million, and he noted that an abrupt end to the holiday season along with ACMI route shuffles by DHL affected ACMI revenues, which came in at $61 million compared to Shaath’s forecast at $70 million. Domestic revenue was $101 million compared to Beacon’s call at $111 million, while the company’s all-in charter revenues were a surprise to the upside at $27 million compared to Shaath’s forecast at $15 million.

Earnings were a miss, however, with CJT’s $83 million in adjusted EBITDA coming in “well below” Shaath’s $92 million forecast as well as the Street’s at $91 million. Shaath related that management were caught by surprise by volume levels falling off significantly after the US Thanksgiving period, which impacted the Q4 top and bottom lines.

“Based on management commentary on the call and our discussion with them, our view is that December was a blip in what can be described as a knee-jerk reaction to negative economic sentiment,” Shaath wrote.

“While the macro picture remains uncertain, the fundamental driver of low penetration of e-commerce sales remains in play. The route reshuffles, mainly by CJT’s strategic partner DHL, will have a minor impact on ACMI revenue. Offsetting that is the strong demand environment for all-in charter, which CJT have been able to capitalize on to offset some of the headwinds in the other revenue lines,” he said.

Shaath said there’s now improved visibility into the rest of Cargojet’s 2023 and he has introduced his 2024 forecast. For the current year, the analyst is estimating revenue and EBITDA of $1,006.0 million and $355.0 million, respectively, and for 2024 he is estimating revenue and EBITDA of $1,045.0 million and $383.0 million, respectively.

“We maintain our BUY recommendation and $205.00 target price. CJT shares currently trade at 6.7x EBITDA (FY23E), which we haven’t seen since 2015-2016 period. Thus, we believe shares represent an exceptional risk/reward trade,” Shaath wrote.

At press time, Shaath’s $205 target implied a 12-month return of 82 per cent.

Share

Share Tweet

Tweet Share

Share

Comment