Clinical-stage biopharm company aTyr Pharma (aTyr Pharma Stock Quote, Charts, News, Analysts, Financials NASDAQ:LIFE) has been a down-in-the-dumps stock for a while now, but Roth Capital Partners analyst Kumaraguru Raja sees potential in the company’s lead drug candidate for fibrotic lung disease. The analyst resumed coverage of the stock on Friday with a “Buy” rating and $9.00 target price, implying at press time a one-year return of 325 per cent.

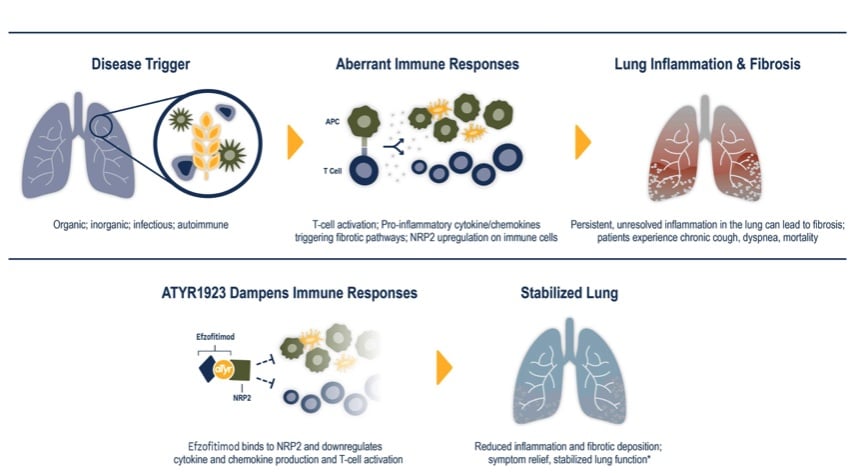

aTyr Pharma is focused on developing novel tRNA synthetases for the treatment of interstitial lung disease (ILD) and other immune-related diseases. The company’s lead clinical candidate is efzofitimod, a first-in-class, fully patented tRNA synthetase currently being tested in a Phase 3 trial for the treatment of pulmonary sarcoidosis, while the company is also planning to develop efzofitimod for other ILDs.

The Phase 3 trial enrolled its first patient in the US in September, 2022, and its first patient in Japan was dosed by partner Kyorin last month. Raja expects complete enrolment in 2024, with data coming in 2025 and a projected commercial launch in 2026.

“Efzofitimod has received Fast Track designation from the U.S. Food and Drug Administration (FDA) which will potentially expedite its development. Efzofitimod also has an orphan drug designation from the FDA and the European Medical Agency (EMA). We believe there is a large market opportunity across patient populations with interstitial lung diseases as few safe and effective treatment options exist,” Raja wrote in his report.

Raja noted that efzofitimod was safe and efficacious in its Phase 1a/2a trial in 37 patients with pulmonary sarcoidosis, with no drug-related severe adverse events or signs of immunogenicity. In the trial, 33 per cent of patients treated with 5 mg/kg of efzofitimod successfully tapered their steroids to zero with an observed improvement in lung function. Mild and moderate drug-related adverse events were seen in 33 per cent of patients receiving the highest dose of 5 mg/kg, which was comparable to placebo and with the most frequent adverse events being those associated with the disease pathology.

“In our view, enzofitimod is expected to have a differentiated product profile compared to corticosteroids, immunosuppressants, and immunomodulators with high efficacy and a comparatively better side effect profile. Efzofitimod is also being developed for other interstitial lung disease,” Raja said.

Raja’s valuation of aTyr Pharma is based on the after-tax, risk-adjusted net present value (NPV) of potential future cash flows from efzofitimod in pulmonary sarcoidosis, with the probability-adjusted (55 per cent), fully taxed (30 per cent) NPV (with a 15 per cent discount rate) of potential cash flows through 2038 being $470 million, or $9.00 per share.

Share

Share Tweet

Tweet Share

Share

Comment