Paradigm Capital analyst Alexandra Ricci is staying bullish on Canadian security tech company Zedcor Inc (Zedcor Stock Quote, Charts, News, Analysts, Financials TSXV:CA), keeping a “Buy” rating on the stock in a Tuesday report to clients while nudging up her target price from $0.75 to $0.80 per share. Ricci said Zedcor plans on almost doubling its count of security towers by the end of 2023, causing her to raise her estimates on the company and stock.

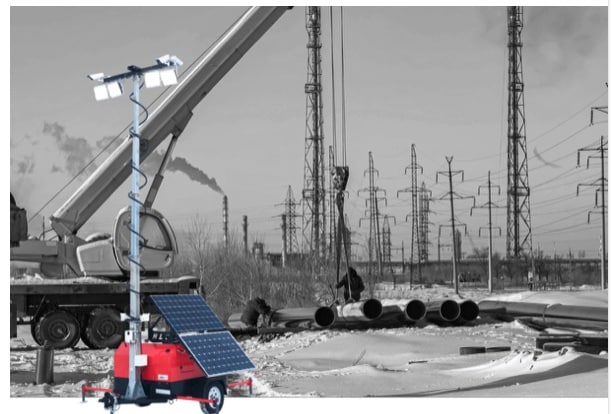

Calgary-based Zedcor provides security and surveillance services and tailors custom solutions for customers, with offerings in surveillance and live monitoring through its proprietary MobileyeZ security towers, along with surveillance and live-monitoring of fixed site locations and provision of security personnel. Zedcor also has high-level security guard services for enterprise customers and currently has a fleet of over 450 towers over 80 fixed site locations across a number of industries.

Currently with a $45-million market cap, Zedcor last reported earnings in November where its third quarter 2022 saw revenue climb 57 per cent year-over-year to $5.8 million and $2.1 million in adjusted EBITDA compared to $1.4 million a year earlier.

Zedcor’s share price performed very well in 2022, returning 56 per cent for the year and rising to about a double over the last few months. But there should be more where that came from, according to Ricci, whose $0.80 target represented at press time a projected one-year return of 29 per cent.

“ZDC has a winning combination of technology and unique targeted customers which puts the company in a strong position to attract long-term, large-scale contracts. Growth opportunities are likely to come through fleet expansion, geographic expansion and diversification of its customer base,” Ricci said.

Ricci recently met with management, with the outcome being a lift to her aspirational, “blue-sky” picture for the company by 2026, which includes 2,000 towers operational and making for about $81 million in revenue. Ricci said management has stayed consistent in its priorities, with a focus on geographic expansion and fleet growth, and that has led to quarterly forecast beats on a consistent basis. For 2023, management is targeting to add about 450 towers to its fleet as well as aiming to expand operations into two US states by mid- to late-year.

As a result of the meetings, Ricci has now revised her estimates and is calling for Zedcor to finish 2022 with $21.3 million in revenue compared to $13.6 million for 2021 and moving to $29.2 million for 2023. On earnings, she is forecasting $7.2 million for 2022 and $9.2 million for 2023.

“We currently value the company using an 8.5x EBITDA multiple on 2023; our security basket trades at 8.5x. Following slight revisions to our 2023 forecast we are raising our target price to $0.80 (was $0.75),” Ricci wrote.

Share

Share Tweet

Tweet Share

Share

Comment