Echelon Capital Markets analyst Stefan Quenneville delivered updates on Tuesday on two healthcare stocks — Diagnos Inc (Diagnos Stock Quote, Charts, News, Analysts, Financials TSXV:ADK) and Quipt Home Medical (Quipt Home Medical Stock Quote, Charts, News, Analysts, Financials TSXV:QIPT) — both of which kept their Top Pick status with the analyst for the first quarter 2023.

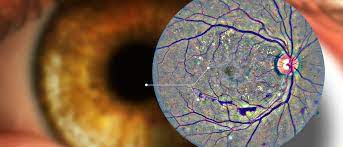

Montreal-based Diagnos is an artificial intelligence company addressing the problem of diabetic retinopathy, the leading cause of blindness, and is currently commercializing its image enhancement and AI analysis platform, which is rolling out across Quebec through New Look Vision as well as in various medical locations in Central America. Diagnos also has an MOU with EssilorLuxottica, the world’s largest eye care company.

Quenneville said he views the EssilorLuxottica MOU as well as the New Look Vision deal as validation of Diagnos’ technology and he said that the platform is gaining acceptance and recognitions as a next-gen commercial diagnostic tool.

“As such, ADK appears poised to secure agreements with an increasing number of optical retailers, networks of healthcare facilities, private and public payors, and strategic partners. While the platform’s roll-out to New Look locations in Quebec has been slower than expected, the technology has been installed in ~20 locations to date, with the goal of rolling out to five stores per week starting in January 2023,” Quenneville wrote.

Quenneville maintained a “Speculative Buy” rating on Diagnos as well as a 12-month target of $1.00, which at the time of publication represented a projected return of 257 per cent.

On in-home monitoring and chronic disease management services company Quipt Home Medical, Quenneville said he’s staying bullish on the home care-focused durable medical equipment (DME) industry, which he said has solid long-term organic tailwinds. Quenneville also likes last week’s acquisition by Quipt of Great Elm Healthcare, a transformation deal for QIPT, wrote Quenneville.

“With this acquisition, Quipt has achieved a regional scale and has developed insurance relationships that will improve margins in the near term and catalyze the growth of its commercial network in the medium- to long-term. Meanwhile, it remains in the M&A sweet spot as an attractive target for one of the handful of larger national players, while the fragmented DME market provides ample opportunity for accretive acquisitions,” Quenneville wrote.

The analyst said Quipt represents a compelling opportunity for investors as it currently trades at 5.3x his EV/EBITDA 2023 estimates versus its broader North American peers at a median valuation of 9.0x.

Quenneville maintained a “Buy” rating on Quipt and C$11.75 target price, which at the time of publication represented a projected return of 86 per cent.

Share

Share Tweet

Tweet Share

Share

Comment