Some key differences separate Loop Media (Loop Media Stock Quote, Charts, News, Analysts, Financials NYSE:LPTV) from the rest of the digital advertising space, according to analyst Darren Aftahi of Roth Capital Partners, who provided a company update on Loop on Tuesday where he reiterated a “Buy” rating on the stock.

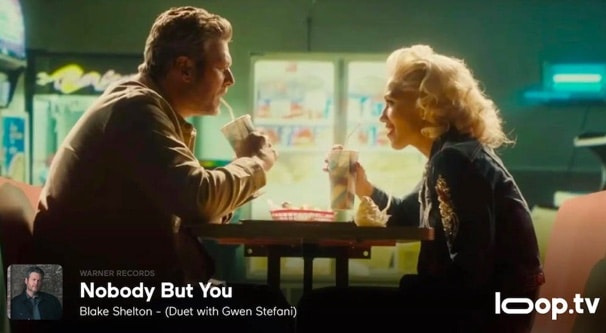

Loop Media is a multichannel streaming platform offering music video and branded entertainment channels for businesses and consumers. Loop connects digital advertising and business’ content providers to engage customers and monetize audiences.

Loop uplisted to the NYSE in late October and has since seen its share price jump from around $4.00 to the $6.00 range. Aftahi sees more upside from current levels, however, and has reiterated a $6.50 12-month target, which at press time represented a projected one-year return of about nine per cent. (All figures in US dollars.)

Roth Capital recently hosted Loop management at Roth’s 11th annual Deer Valley Conference, with Aftahi coming away confident in his thesis, even in the current downturn in the ad market.

Aftahi said Loop has a simple plug-and-play mechanism and that the company’s exposure to Retail Media should have legs going into 2023, with Loop’s Partner business set to expand in the new year and potentially feature better unit economics.

“We remain positive on LPTV’s prospects as it may be a positive light in a sea of poor performing digital advertising names. Its exposure to CTV ad dollars and the fact it represents a newer medium for reaching one-to-many keep us positive. In short, we believe this sector is a game of scale and that LPTV is currently in ramp mode of its O&O and partner businesses,” Aftahi wrote.

Loop reported its fiscal fourth quarter 2022 financials earlier this month, featuring revenue of $12.2 million compared to $2.4 million a year ago, with a net loss of $14.6 million compared to a loss of $13.1 million for the Q4 2021. For Loop’s fiscal 2022, revenue rose to $30.8 million compared to $5.1 million for 2021.

On the quarterly results, Aftahi said investors should note that LPTV’s cost structure is “significantly lower” than its fiscal fourth quarter 2023 run rate currently, as the company had to deal with one-time costs related to its uplisting as well as one-time stock and cash bonuses for management related to the uplisting.

Aftahi said there’s a fair amount of operating leverage to Loop’s business model. The analyst thinks Loop will generate full fiscal 2023 revenue of $67.6 million and EBITDA of negative $11.4 million, rising to 2024 revenue of $102.7 million and EBITDA of $0.6 million.

“We take what we believe to be a conservative approach to estimates, and should it outperform on sales, and as such GP dollars, then we tend to believe that a path to breakeven could occur in-line with management’s articulation of 2HFY23,” Aftahi wrote.

Share

Share Tweet

Tweet Share

Share

Comment