iA Capital Markets analyst Chelsea Stellick likes the progress being made by clinical-stage biopharm company NervGen Pharma (NervGen Pharma Stock Quote, Charts, News, Analysts, Financials TSXV:NGEN), giving the stock a reiterated “Speculative Buy” rating in a report on Monday. Stellick said NervGen is in a solid financial position and is looking towards Phase 2 trials in 2023 for its first-in-class neurological therapeutic NVG-291.

Vancouver-based NervGen released its third quarter financials on Monday, showing a cash burn of $4.8 million, up 30 per cent sequentially. The company completed dosing of the last cohort in its Phase 1 trial, which is nearing completion, while the FDA recently amended a partial clinical hold it had on the trial, allowing for expanded patient cohorts.

“Completing the dosing of the final cohort of postmenopausal females in the MAD portion of the Phase 1 clinical trial is an important accomplishment,” stated Bill Radvak, NervGen’s Executive Chairman & Interim CEO, in a press release. “Coupled with the FDA’s authorization to proceed with enrollment of male and premenopausal female bridging cohorts, we look forward to completing the Phase 1 study.”

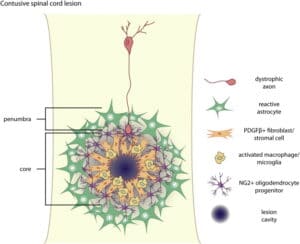

NervGen is planning on running three Phase 1b/2a trials on NVG-291, beginning with Spinal Cord Injury (SCI), then Alzheimer’s Disease (AD) and finally Multiple Sclerosis (MS).

In her comments, Stellick wrote, “We continue to see NVG-291 as potentially useful in several nervous system diseases, but we are pleased to see the newfound focus on SCI since the management change as SCI is the indication with by far the most supportive preclinical data and the highest probability of approval. Moreover, we believe SCI trials will be shorter and require fewer patients, allowing more rapid progression toward approval than AD or MS.”

Stellick said after recently securing up to US$1.5 million in non-dilutive funding from the US Department of Defense Military Operational Medicine Research Program to conduct preclinical studies to evaluate NVG-291 as a restorative therapeutic for treating peripheral nerve injury, NGEN is now in a good cash position at about $27.7 million, leaving it plenty of dry powder to advance its clinical development through to the end of 2023 without needing further financing.

“NervGen continues to make progress clinically while recruiting a new CEO ahead of expanding into Phase 2 trials in 2023,” Stellick wrote. “We look forward to the completion of Phase 1 bridging cohorts and likely removal of the partial clinical hold ahead of initiation of a Phase 1b/2a SCI trial in H1/23. We continue to emphasize the unparalleled preclinical data backing NVG-291 and maintain our Speculative Buy rating and $6.00/share target price, using the average of a discounted cash flow (DCF) and an EV/EBITDA valuation.”

At press time, Stellick’s $6.00 target represented a projected one-year return of 265.9 per cent.

Share

Share Tweet

Tweet Share

Share

Comment