Look for key clinical data to be arriving soon from immuno-oncology company Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Charts, News, Analysts, Financials TSX:MDNA), according to Research Capital Corporation analyst André Uddin, who delivered an update to clients on the company on Friday. Uddin said a licensing deal for Medicenna’s lead orphan drug candidate MDNA55 would be a key catalyst for the stock.

Medicenna is a clinical stage cancer company developing novel interleukin (IL)-based treatments, with MDNA55 in development for glioblastoma. The company reported second quarter fiscal 2023 results on Friday for the three-month period ended September 30, showing $0.0 in revenue and a quarterly net loss of $0.9 million.

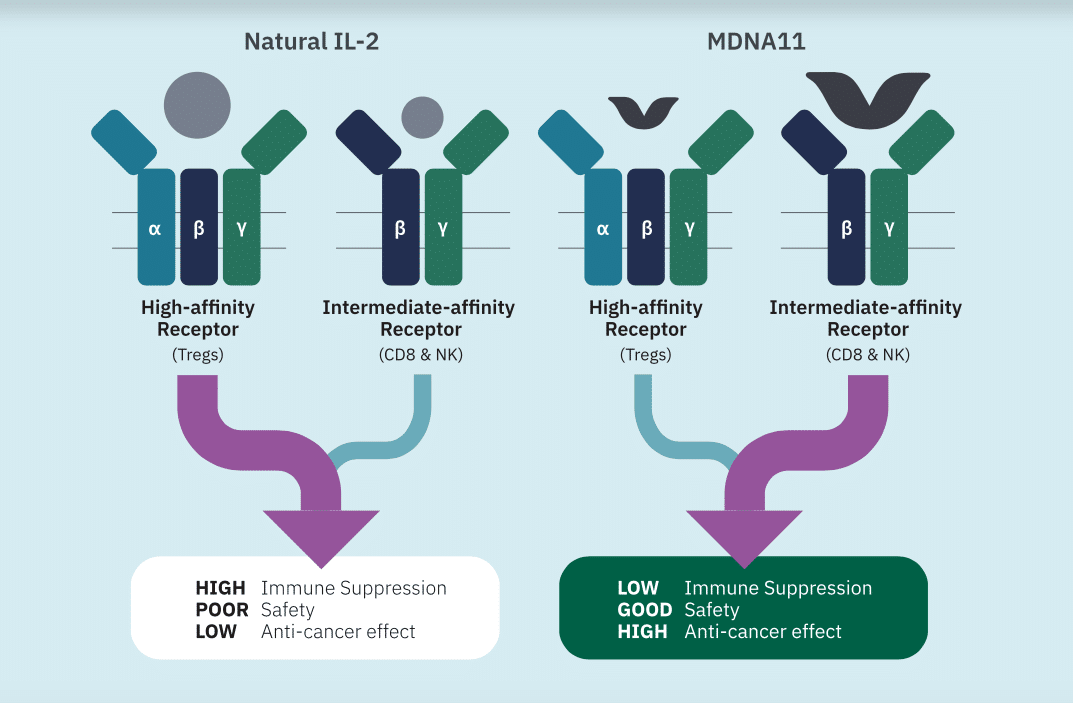

On advancements in its program, Medicenna reported in September new anti-tumour activity data from a Phase 1/2 ABILITY study on MDNA11, which the company said supported the drug’s potential in advanced solid tumours that are unresponsive to standard treatments. Further data from that trial is expected in the fourth quarter of this calendar year and in 2023. Meanwhile, Medicenna is planning on out-licensing MDNA55 before a Phase 3 trial is initiated.

“Achievements this quarter have substantively bolstered our clinical dataset and balance sheet, providing support for MDNA11’s best-in-class potential and runway through completion of the ABILITY study,” said Fahar Merchant, PhD, President and CEO of Medicenna, in a November 4 press release. “We are particularly encouraged with promising signs of MDNA11’s monotherapy activity in multiple patients with aggressive cancers that are typically resistant to immunotherapy.”

On the fiscal Q2 financials, Uddin said the zero dollars in revenue was expected, while the net loss of $0.9 million or negative $0.01 per share was better than expected, with Research Capital’s estimate being at negative $5.0 million or negative $0.07 per share and the consensus call being at negative $4.8 million or negative $0.07 per share. The smaller loss was chalked up to a number of factors: a foreign exchange gain of $1.9 million on the company’s USD cash balance, a non-cash gain of $1.8 million related to the change in valuation of a non-cash warrant liability associated with the company’s recent financing and a rduction in R&D expenses. Uddin noted that Medicenna finished the quarter with $40 million in cash and had completed a $20 million equity raise in August.

With a market cap of $61 million, MDNA has fallen a long way over the past two years, going from a high of around $6.00 at the end of 2020 to now below $1.00 per share. But Uddin sees upside to the name and with the update reiterated a “Speculative Buy” rating and $2.00 target price on the stock, implying at press time a one-year return of 117 per cent.

“MDNA’s stock has underperformed in 2022 for several reasons,” Uddin wrote. “Investors have been expecting an out-licensing deal for MDNA55 since Q4 CY2020 – an equity financing often (but not always) implies a partnership is not imminent; on October 28 Sanofi took a US $1.6 billion impairment charge for delays on SAR444245 (IL-2) which had a clinical setback (Sanofi acquired Synthorx for its IL-2 program on Jan 23, 2020 – a US$2.5 billion acquisition), Nektar’s IL-2, a competitor to MDNA-11, reported weak efficacy IL-2 data and Moderna dropped their IL-2 candidate; the biotech sector has been weak; and MDNA just completed a US$20 million financing with five-year warrants.”

Share

Share Tweet

Tweet Share

Share

Comment