mCloud Technologies has target cut in half by ATB

After third quarter financials and a major pivot announced by mCloud Technologies (mCloud Technologies Stock Quote, Charts, News, Analysts, Financials), analyst Martin Toner of ATB Capital Markets is keeping a “Speculative Buy” rating on the stock on Wednesday while dropping his target price from $6.00 to $3.00 per share, saying a recent share offering is cause for the target decrease.

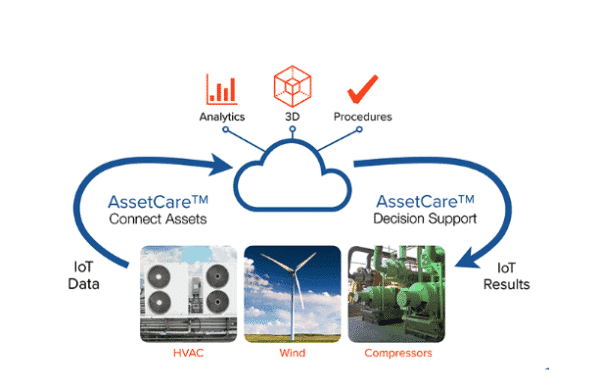

mCloud released its third quarter 2022 financials on Tuesday, reporting $2.9 million in revenue, down from $7.4 million a year earlier and operating EBITDA of negative $7.7 million compared to negative $2.8 million a year earlier. Much of the change related to the company’s decision to phase out its legacy infrastructure and migrated its AssetCare platform to Google Cloud, integrating its business operations in order to improve the company’s cost structure. mCloud is exiting its low-margin Technical Project Services business and retiring contracts related to its legacy connected assets and workers.

“The rationalization of the business has included divesting low-value customer engagements and orderly exit from the Technical Project Services business. The revenue and cost reduction impacts we see in Q3 2022 were the direct result of our move to be materially out of this business by the end of September 2022,” said mCloud President and CEO Russ McMeekin in a press release.

“Today, mCloud possesses a stable of relationships in Western Canada that are enabling the pursuit of new AssetCare opportunities in partnership with Google Cloud,” he said. “As we make progress in Q4 2022, we are already working side-by-side with Google Cloud teams globally. We have a multitude of go-to-market activities underway to take advantage of the reach and scale Google Cloud uniquely affords. Based on our current trajectory, we anticipate our integrated activities with Google Cloud will have us ramping up to full velocity by mid-2023.”

Commenting on the move, Toner said the decline in AssetCare Solutions revenue (formerly Overtime) began in the fourth quarter of 2021 when a number of customers in Alberta paused their subscriptions due to COVID-19 and other issues but haven’t returned to the product. The new arrangement will see mCloud work with Google Cloud Platform (GCP) to assist existing GCP customers in the energy industry with their cost and carbon footprint reduction efforts.

“The Company’s partnership with Google holds significant potential, including enabling the Company to reduce operating costs and lower the breakeven gross profit level,” Toner wrote. “While the timing and likelihood of significant revenues is uncertain, we believe rapidly scaling revenues and profits is more likely with the partnership. Given the lack of visibility, we are conservative with our forecast, and we have reduced estimates.”

“Our target price has been reduced to $3.00 (from $6.00) due to the impact of a dilutive equity raise,” he said.

Toner’s new estimates have mCloud finishing 2022 with revenue of $15.9 million (previously $26.0 million) and adjusted EBITDA of negative $38.6 million (previously negative $32.6 million). For 2023, he is calling for revenue of $33.0 million (previously $56.7 million) and adjusted EBITDA of negative $18.9 million (previously negative 8.5 million.

At the time of publication, Toner’s $3.00 target represented a projected one-year return of 122.2 per cent.