Investors can expect an organic growth bump in third quarter earnings from Savaria Corp (Savaria Corp Stock Quote, Charts, News, Analysts, Financials TSX:SIS), according to Laurentian Bank Securities analyst Nick Agostino, who delivered an earnings preview on Wednesday where he maintained a “Buy” rating and $20.00 target on the stock.

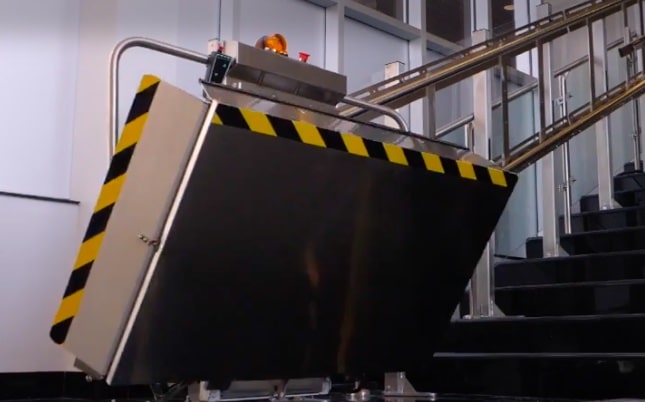

Savaria, a Laval, Quebec-based maker of accessibility solutions for the commercial and residential markets worldwide, is set to report third quarter results on November 2 after market close. The company saw topline growth of 7.5 per cent year-over-year in its Q2 to $192.1 million, with adjusted EBITDA up 14.9 per cent to $31.5 million. Savaria said the revenue uptick was driven by organic growth in its Accessibility and Patient Care segments.

“The end of our second quarter marks 16 months since the acquisition of Handicare in March 2021. I am proud to say that the collaboration of our worldwide teams has yielded effective strategies to increase revenue and gain synergies for our profitability,” said Marcel Bourassa, President and CEO in the second quarter press release.

For the Q3, Agostino is expecting sales of $199.1 million, which he said is slightly above the consensus call and would represent year-over-year organic growth of 10.1 per cent, a potential improvement over the 9.7 per cent organic growth in its second quarter. On EBITDA, he is modelling $34.5 million for a 17.4 per cent margin. The analyst said Savaria’s Q3 will be aided by seasonality, a favourable comp, reduced component shipment delays, the full impact of pass-through pricing and pent-up demand in residential and commercial markets.

Breaking down the revenue forecast, Agostino is calling for Savaria to have sales of $142.1 million in its Accessibility segment, up 4.7 per cent year-over-year and buoyed by solid demand for residential lifts, normalizing commercial demand and incremental growth from new addition Handicare. In Patient Handling, sales are expected to be up 28.6 per cent to $44.7 million, with the easing of pandemic restrictions allowing for better facilities access and pent-up demand. And in Adapted Vehicles, sales are expected to rise 19.2 per cent to $12.3 million.

Savaria’s share price had a fall to a little under half its value between September, 2021, and May of this year, after which the stock has been treading water around the $14.00 mark. At press time, Agostino’s $20.00 target represented a projected one-year return including dividend of 46.9 per cent.

“SIS currently trades at 9.1x NTM EV/EBITDA, toward the low end of the normalized trading range of 8x-16x over the last 8.5 years, and versus peers at 9.8x (excluding outliers),” Agostino wrote.

Share

Share Tweet

Tweet Share

Share

Comment