Gone are the days when you could throw a dart and hit something bound to go up, and while there are no sure bets in the current market climate, one stock that should be on your wish list is Polaris Renewable (Polaris Renewable Stock Quote, Charts, News, Analysts, Financials TSX:PIF). That’s according to portfolio manager Alex Ruus, who thinks Polaris is a no-brainer in the independent power producer space.

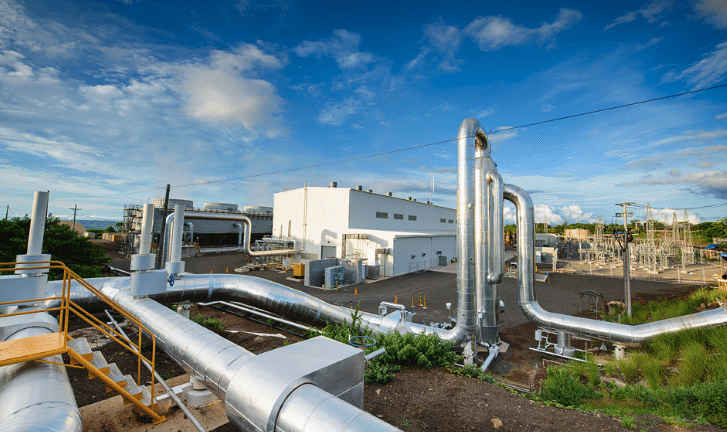

“They are producers of electricity entirely from geothermal, wind, solar and hydro projects and they produce in five Latin American countries. This is just a great green business,” said Ruus, of Arrow Capital Management, who profiled Polaris Renewable on a BNN Bloomberg segment on Wednesday.

Polaris, formerly called Polaris Infrastructure, is a Toronto-headquartered acquirer, operator and developer of renewable energy projects which of late has been concentrating on growing its portfolio of operations.

Last month, the company closed on its third acquisition in 2022 in the form of a 6.0 MW hydro project in Ecuador. Polaris is paying $16.3 million in cash for 83 per cent of outstanding shares of Hidroelectric San Jose de Minas S.A., with the intent of acquiring the remaining shares over the next 12 months. That comes after having earlier this year acquired two construction-ready solar projects in Panama and an operational solar project in the Dominican Republic.

As part of the San Jose de Minas announcement, Polaris said it also formalized a development framework agreement with the selling shareholder of the hydro project to jointly pursue other hydro projects in the Ecuadorian market, targeting an upcoming renewable energy tender from the Ecuadorian government for 500 MW, to take place in the fourth quarter 2022.

“We are very pleased to have closed this transaction as anticipated,” said Polaris CEO, Marc Murnaghan, in a press release. “Combined with the recently closed acquisitions in Panama and the Dominican Republic, we are now in five countries in the region. These acquisitions place us on the path of building a regional platform focused on renewable energy and set the stage for the next phase of our growth.”

Polaris has been building its energy capacity for a while now, going from 571,000 MWh of consolidated power in 2019 to 663,000 MWh in 2020 to 644,000 MWh in 2021. Its most recent quarter, the company’s Q2 delivered in August, generated 163,000 MWh compared to 151,000 a year earlier.

On the financials, Polaris’ second quarter 2022 featured revenue of $15.2 million compared to $14.2 million a year earlier and a net loss of $1.5 million compared to net income of $159,000 a year earlier. Earnings per share were a loss of $0.08 compared to positive $0.01 per share for last year’s Q2.

Ruus says that not only is Polaris trading at an inexpensive price compared to its peers, the company looks to be a prime takeout target.

“It’s slow and steady grower. Through a combination of organic and acquisition growth, they continue to grow the company, and it trades at about half the valuation of other independent power producers,” Ruus said.

“To me, it’s a table-pounding buy here. It’s just really, really cheap and it’s just a matter of time before it’ll either go up or it’ll get bought by one of the big boys at a serious premium,” he said.

It’s not easy being a fan of renewable energy stocks these days. With the sector seeing a huge run-up in 2020, things started going downhill almost as fast, beginning in February of 2021. The iShares Global Clean Energy ETF (iShares Global Clean Energy ETF Stock Quote, Charts, News, Analysts, Financials NASDAQ:ICLN), for example, went from about $12 per share at the start of 2020 to as high as $32 by early 2021, only to fall back to now the $18 range.

It’s been somewhat of a similar journey for Polaris, which hit a high of $24.33 in early February, 2021, before heading back down to $15 by early 2022. The stock then climbed again over this past summer but has come back down to now close to $16.

With a market capitalization of $310 million, PIF also comes with a substantial dividend, currently at a 4.9 per cent yield.

On the company’s recent rebranding under Polaris Renewable Energy, management said the new name reflects their focus on being a contributor to the current energy transition to renewables.

“Our recent and prospective acquisitions are catalysts towards the achievement of our long-term vision, which is to become a leading developer, investor, and operator in the renewable energy industry, contributing to a greener future, driven by our values,” said Board Chair Jaime Guillen in a July press release.

Share

Share Tweet

Tweet Share

Share

Comment