Leede Jones Gable launched coverage on Monday of Canadian blockchain company TAAL Distributed Information Technologies (TAAL Distributed Stock Quote, Charts, News, Analysts, Financials CSE:TAAL), with analyst Greg McLeish calling TAAL’s targeted markets immense in areas such as data integrity, traceability, smart contracts and compliance.

Toronto-headquartered TAAL is a vertically integrated blockchain infrastructure company which hosts blockchain computing equipment with third-party hosting providers totalling about 450 PH/s of custom modified blockchain computing power. The company focuses on building the next generation of global data commerce, which through the blockchain’s distributed ledger allows for data and digital resources to be owned and to remain unalterable, forged or destroyed. The technology has numerous applications, with fintech and financial services being a key sector.

McLeish said TAAL is positioning itself to deliver in the disruptive, data-driven, transactional economy where its Blockchain-as-a-Service solutions will serve Web 3.0’s decentralized applications globally. For investors, McLeish said TAAL offers a way to take part in the cryptocurrency space without resorting to buying coins.

“According to [TAAL], for blockchain to become mainstream, it must be built in such a way that it can handle a high volume of transactions per second without jeopardizing the network’s effectiveness or security. This means that as use cases and adoption increase, the performance of the blockchain will not suffer,” McLeish wrote.

“Management’s strategy is to use its profitable mining revenues to fund the R&D and product development of a trusted foundational layer service, delivered through its Metanet Solutions platform, that is required to enable the next generation of internet services and data monetization,” he said. “For clients who are not interested in investing directly in individual cryptocurrencies, TAAL is an excellent investment vehicle that provides direct exposure to the blockchain transaction economy.”

McLeish said that after first dismissing out-of-hand the crypto hype, he has come to recognize the potential of Bitcoin and other cryptocurrencies. The analyst said part of the reason for his shift stems from the observation that government spending has gotten out of hand and central banks are printing money at an inordinate pace, whereas by contrast the supply of bitcoin is capped at 21 million, creating a situation of scarcity for this store of value that can help control the inflation resulting from central bankers’ unlimited supply.

As well, McLeish said not only have cryptocurrencies continued to gain traction with major financial institutions but the decentralization endemic to bitcoin and blockchain put them beyond control by any central authority and, by that measure, they represent “a good hedge against bad government policies,” he said.

That backdrop has set TAAL up well to succeed, McLeish argues.

“Along with its traditional digital asset hashing operations, the company has positioned itself as a leader in the transition and evolution from digital asset subsidy mining to cloud-based transaction processing, enabling subscription service packages for value-added products and services. TAAL’s business model is designed to drive revenue through two distinct business units: blockchain operations in which block subsidy rewards currently make up the majority of revenue and, secondly, through service fees generated from customer use of its blockchain infrastructure and related added value services,” he wrote.

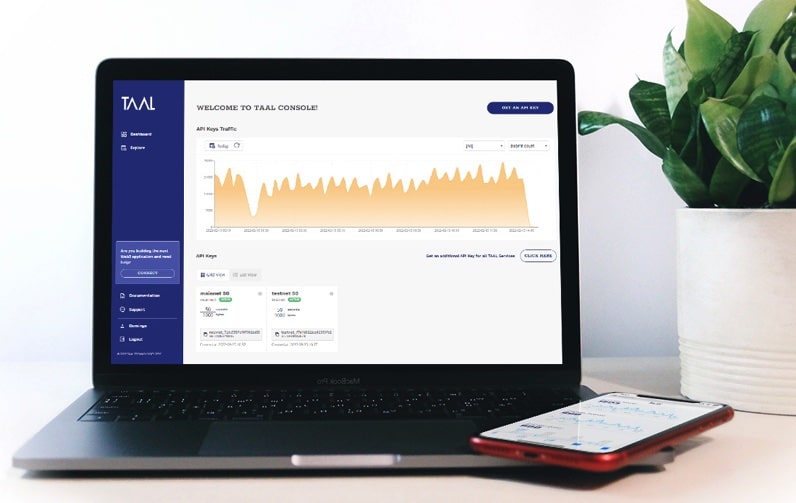

Through digital asset hashing (the verification of transactions on the blockchain), TAAL hosts computing equipment with third-party providers in North America and Russia. The company’s transaction processing solutions — such as TAAL Orchestrator, TAAL Console, WhatsOnChain and STAS — are enterprise-grade and are suited to help businesses develop blockchain applications, with management saying it has first-mover advantage in the space which will enable it to grow market share in the new Blockchain-as-a-Service field. Moreover, McLeish said TAAL’s blockchain cloud computing data centre in Grand Falls, New Brunswick, will serve as its source for 50 MW of clean energy, which will be enough to power up to 1.4 EH/s of bitcoin mining.

“The company provides value-added services such as tokenization management, data storage solutions, private/public key management, micropayment services, analytics, and reporting based on the company’s software development and priced in fiat metered usage fees to customers,” McLeish wrote.

“Management’s strategy is to use its profitable mining revenues fund the R&D and product development of blockchain infrastructure and Metanet packaged solutions that will meet the growing enterprise demand in a disruptive data driven, transactional economy,” he said.

On its financials, McLeish sees TAAL’s 2022 revenue reaching $27.4 million, while for 2023 he presents three scenarios: a low forecast at $38.6 million, a base forecast at $42.1 million and a high forecast at $45.3 million. For 2024, the three scenarios are, respectively, $84.0 million, $93.3 million and $99.5 million. On earnings, the analyst has TAAL’s base forecast EBITDA going from negative $20.2 million in 2022 to negative $4.4 million in 2023 to positive $20.3 million in 2024.

With the coverage launch, McLeish has started TAAL off with a “Buy” rating and $3.00 target price, which is based on a 10x multiple of his 2024 EV/EBITDA forecasts. At press time, the $3.00 target represented a projected one-year return of 233 per cent.

Share

Share Tweet

Tweet Share

Share

Comment