Even with a shake-up at the helm, it’s still full steam ahead for Canadian biopharmaceutical company NervGen Pharma (NervGen Pharma Stock Quote, Charts, News, Analysts, Financials TSX:NGEN), according to Paradigm Capital analyst Scott McAuley, who in a recent client report reiterated a “Speculative Buy” rating on the stock due to its promise in the neurodegenerative field.

Shares of NervGen rose in late July on promising news showing that the company’s NVG-291 lead candidate promotes functional recovery in mice after ischemic stroke and indicating improvements in memory and spatial learning, with the potential application in areas such as Alzheimer’s and multiple sclerosis.

Vancouver-based NervGen announced last Thursday that President and CEO Paul Brennan would be stepping down immediately while remaining on as a strategic advisor during the transition to a new CEO. Brennan was President and CEO for three years, while Executive Chairman Bill Radvak will now take over as interim CEO until a replacement is found.

“With a Phase 1 safety study actively enrolling patients, multiple Phase 2 clinical trials in development with anticipated readouts beginning in 2024 and a cash balance of $25 million, the largest in the company’s history, [Brennan] has helped position NervGen to become a leading player in the emerging central nervous system repair field,” said Radvak in a press release. “We look forward to working with him during this transition period and wish him the best in his future endeavours.”

Commenting on the news, McAuley said he’s expecting the search for a new CEO to take between three and six months but that in speaking with Brennan and members of the Board he was told that the announcement doesn’t signal any changes to the strategic direction for NervGen or related to the opportunity its has in front of it.

“The departing Mr. Brennan has a long career of management and business development across Arbutus Biopharma, Aspreva Pharma, AnorMED and more, but the board believes the company needs new leadership as it evolves into a mid-stage biotechnology company with an eye on U.S. capital markets and a large mid-stage clinical program,” McAuley wrote in his September 22 report.

NGEN shares have been up and down since IPO-ing in March of 2019 with an issuing of ten million shares at $1.00 per share. The stock has stayed mostly between $1 and $3 over that time period, with a current year-to-date return of about negative 38 per cent.

But McAuley sees a lot of potential for the stock and company, pairing his “Buy” with a maintained target price of $4.50, representing at the time of publication a projected one-year return of 143 per cent.

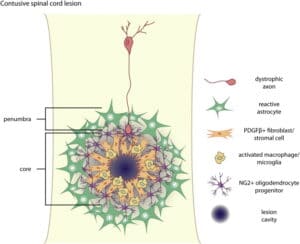

“NGEN could revolutionize the treatment of neurodegenerative diseases by enabling the central nervous system (CNS) to repair itself through a novel mechanism discovered at Case Western Reserve University,” McAuley wrote. “Pre-clinical studies have demonstrated the potential for its lead candidate, NVG-291, to improve outcomes in multiple sclerosis, Alzheimer’s, spinal cord injury and stroke.”

Up ahead, McAuley said potential milestones for NGEN could come when the company removes the partial FDA clinical hold, when its Phase 1 study is completed (sometime by the end of the year), with the launch of its next program of Phase 1b/2 studies over the first half of 2023 and also through a potential uplisting to the Nasdaq, which McAuley said could come once a new CEO is in place in 2023.

“All of these events will increase the profile of the company among investors, physicians and patient groups,” he said.

As far as its resources go, McAuley said NervGen’s balance sheet remains strong, having reported $11.6 million in cash as of its last quarter and having since added US$15 million in a July financing round. But there will be a need for additional capital, the analyst said, related to the Alzheimer’s Phase 1b/2a trial (expected to cost about $20 million), a spinal cord injury trial at Phase 1b/2 (about $10 million) and a multiple sclerosis Phase 2 study (about $20 million).

“Any changes to senior leadership introduces additional uncertainty and risk; however, we note that NGEN has recently attracted strong leadership across both management and the board,” McAuley said.

“[W]hile there may be short-term weakness during the transition, we continue to see significant opportunity for NVG-291 to transform the lives of patients with neurodegenerative diseases and provide significant returns for shareholders,” he said.

On NGEN’s financials, the analyst has the company posting no revenue for 2022 or 2023, with negative EBITDA of $20.5 million in 2022 and negative $57.4 million in 2023.

Share

Share Tweet

Tweet Share

Share

Comment