With a healthy cash position and improving numbers, Raymond James analyst Rahul Sarugaser says he’s still very bullish on Opsens (Opsens Stock Quote, Chart, News, Analysts, Financials (TSX:OPS).

With a healthy cash position and improving numbers, Raymond James analyst Rahul Sarugaser says he’s still very bullish on Opsens (Opsens Stock Quote, Chart, News, Analysts, Financials (TSX:OPS).

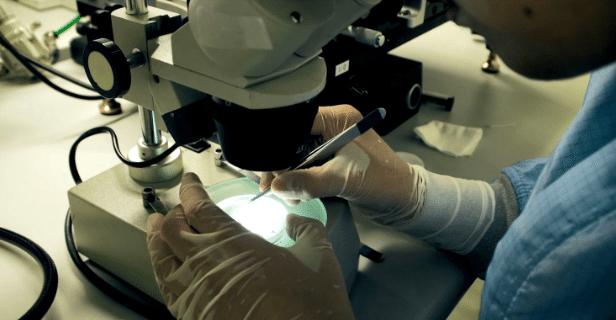

On July 14, Opsens reported its Q3, 2022 results. The company lost $2.9-million on consolidated sales of $10.1-million, up from the $9.2-million topline the company posted in the same period a year prior.

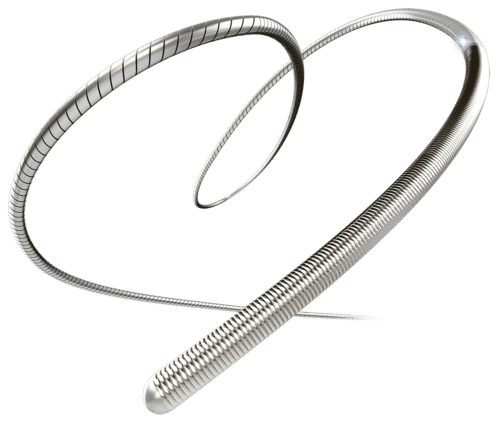

“I am pleased with the financial performance of the third quarter, as we achieved record revenues surpassing $10-million with a number of significant milestones that include Health Canada approval of our Savvywire, as well as the first successful procedures and revenues for the Savvywire, as part of the controlled commercial launch in Canada,” said CEO Louis Laflamme. “We continue to make meaningful progress in our initial launch sites, which will support the full commercialization of the Savvywire in Canada. During the third quarter, Dr. Josep Rodes-Cabau and Dr. Reda Ibrahim successfully performed the first commercial TAVR procedures using the Savvywire in Canada. The medical teams at both hospitals were very enthusiastic with the Savvywire’s operational results and improved workflow. Outside of Canada, our 510(K) submissions with the FDA [Food and Drug Administration] for regulatory clearance in the U.S. and for CE [European Conformity] Mark approval in Europe are currently under review for Savvywire. While we work to secure regulatory clearance, we are investing to support successful global commercial product launch upon approval.”

Sarugaser, who has maintained his “Strong Buy” rating and one-year price target of $6.00, says OPS is built to weather the current headwinds.

As we see it, while macro headwinds continue to impact the med-tech sector, OPS’s imminent opportunity in TAVR (FDA clearance ~late 3Q22), combined with its rejuvenated—and insulated by ABMD—sales of its legacy optical medical products, all supported by its relatively strong cash position of $28 mln (with Q/Q burn of ~ $2.5 mln) frame our view that OPS as very well positioned relative to the broader med-tech universe,” he said.

Sarugaser thinks Opsens will post EBITDA of negative $8-million in fiscal 2022 on revenue of $35-million. He expects the company will generate EBITDA of negative $9-million on a topline of $43-million the following year.

The analyst’s target price implied a return of 165 per cent at the time of publication.

Share

Share Tweet

Tweet Share

Share

Comment