Slightly slower market expansion from LexaGene Holdings (LexaGene Stock Quote, Charts, News, Analysts, Financials TSXV:LXG) has iA Capital Markets analyst Chelsea Stellick paring down her expectations for the stock. Stellick lowered her rating on LXG in a Tuesday report from “Buy” to “Speculative Buy” and also took her target price from C$0.75 to C$0.50 per share, saying the company still has a lot of room to grow in the diagnostics space.

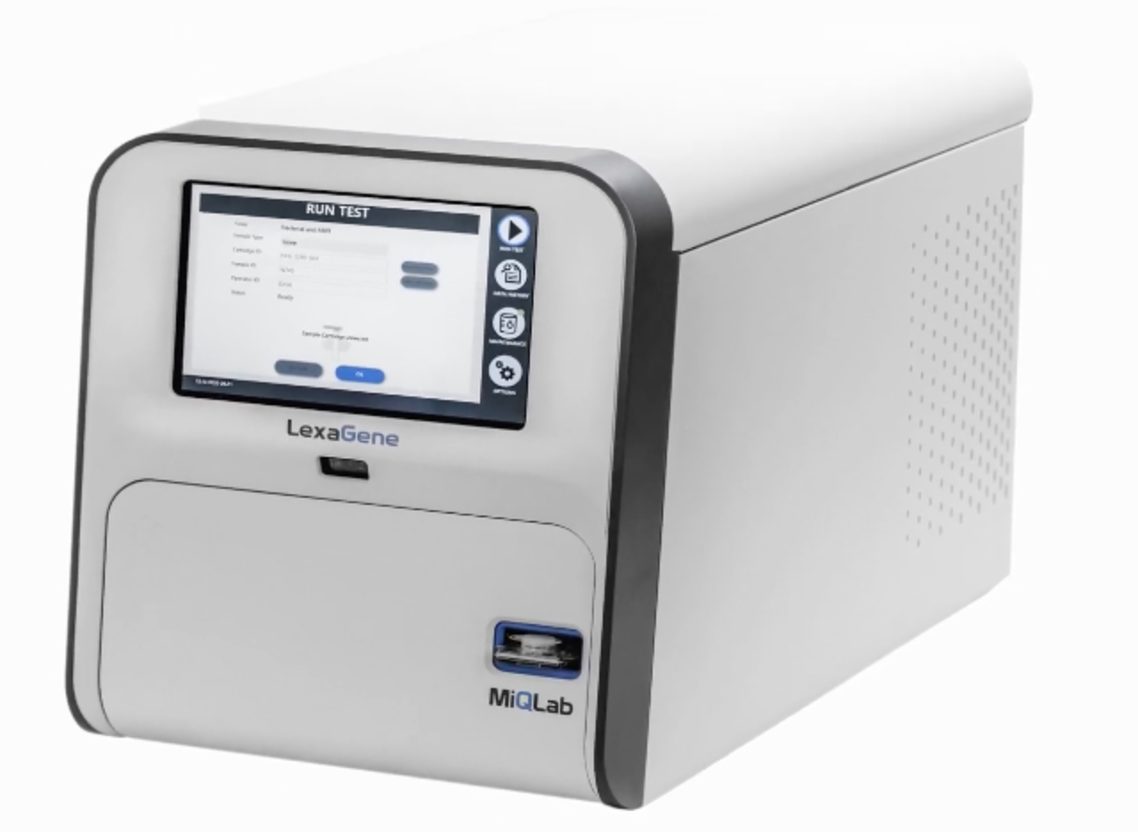

Beverly, Massachusetts-based LexaGene is a molecular diagnostics and medical device company which is currently commercializing the MiQLab System for automated PCR-based syndrome testing in veterinary clinics. The company’s other markets include human diagnostics, water quality monitoring and aquaculture pathogen surveillance.

The company reported on Monday after market close its audited financials for the fiscal year ended February 28, 2022, showing net product revenue of $75.3 million versus $58.1 million a year earlier. Net loss was $10.6 million compared to a loss of $9.9 million a year earlier, while net loss per share was $0.09 compared to a loss of $0.10 a year ago. (All figures in US dollars except where noted otherwise.)

Lexagene’s financial results were delayed, and management had secured a cease trade order on June 30, 2022, before fixing a filing requirement.

Looking at the numbers, Stellick noted that the company’s cash burn dropped 23 per cent sequentially to $1.8 million for the fourth quarter fiscal 2021, taking the Q4 net loss to $0.02 per share. Stellick said sales of the MiQLab unit were negatively impacted by a reversal of previously recognized revenue, leading to sales of four instruments in fiscal 2021, a double of the previous year but five less than the analyst had forecasted.

Still, Stellick said that with seven unit sales announced by less than halfway through fiscal 2022, Lexagene is on track for more than doubling instrument sales this year.

Stellick added that Lexagene had $4.7 million in cash on hand as of the fiscal year’s end and $1.4 million in inventory, which is enough to provide a runway until late into the calendar 2022 year, although financing will be required for the company to reach profitability.

Based on 56 per cent slower than expected MiQLab unit sales over the fiscal 2021, Stellick has pulled back her forecast for fiscal 2022 by 56 per cent to 16 units, which then brings her multiples down in turn.

Stellick wrote, “Although LXG doubled unit sales in F2022, the Company is not moving as quickly as we expected to penetrate the veterinary and CDMO markets and we have adjusted our forecasts accordingly. We revise our target price to $0.50/share (previously $0.75/share) based on the new forecast using the average of P/B, EV/EBITDA, and DCF valuation models.”

“Although our belief in the strength of the underlying technology and the large unmet need is unchanged, we revise our recommendation to a Speculative Buy (previously Buy) until LexaGene can build out a larger install base, which will solidify its place and unlock the large upside available as a disruptor in the diagnostics market,” she said.

Stellick now has LexaGene hitting fiscal 2022 veterinary sales of $990,000, rising to $2.6 million in fiscal 2023 and $5.9 million in fiscal 2023.

LexaGene’s share price has tumbled over the past year and a half, dropping from a high of around C$1.25 in February, 2021, to now C$0.13 per share. At the time of publication, Stellick’s new C$0.50 target represented a projected one-year return of 257.1 per cent.

Share

Share Tweet

Tweet Share

Share

Comment