Clinical-stage biotech company Antibe Therapeutics (Antibe Therapeutics Stock Quote, Charts, News, Analysts, Financials TSX:ATE) has fallen a long way over the past year, but Paradigm Capital analyst Scott McAuley is still bullish on the stock, saying in a Monday report to clients that the market isn’t taking full account of the opportunity presented by its lead candidate otenaproxesul, an inflammation-targeting drug with a safer profile than both opioids and NSAIDS for post-operative pain.

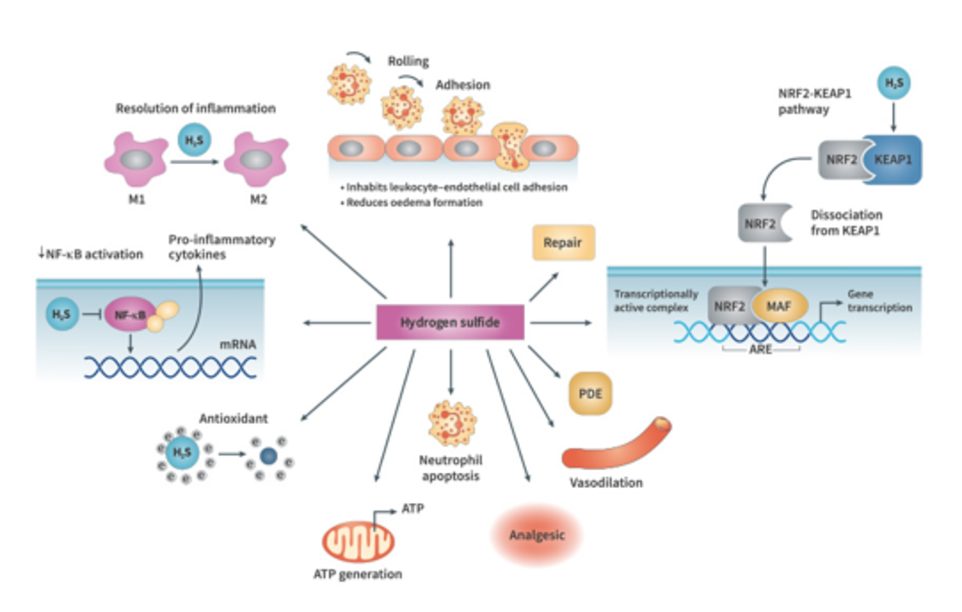

Antibe Therapeutics saw its share price tank last year after clinical trial results came out for otenaproxesul, which at the time was being billed as a potential upgrade in the multi-billion dollar pain relief category. Antibe’s proprietary hydrogen sulfide-releasing drug platform is a chemical analog of naproxen, one of a number of widely-used non-steroidal anti-inflammatory drugs (NSAIDs). Whereas NSAIDs come with the potential for gastrointestinal (GI) damage on repeated use, that had not been found in the case of otenaproxesul.

But last year, chronic pain trials for arthritis patients turned up liver toxicity events in an absorption, metabolism and excretion (AME) study, which prompted Antibe to switch gears with otenaproxesul, with the focus now on the acute, post-operative market.

“Since its launch last fall, we’ve been encouraged by the results of otenaproxesul’s acute pain program, and it remains very much on track,” said Dan Legault, Antibe’s CEO, in the company’s fiscal year 2022 (ended March 31) press release, delivered on June 30.

“Our data suggest that the drug can deliver the onset of action and pain relief required for commercial success in acute pain indications – an exciting prospect in a massive market that’s seen minimal innovation over the last 20 years. To further de-risk the dose selection for the planned bunionectomy trial, we’ve added a short molar extraction study to the Phase 2 program – with no impact on cashflow. With a balance sheet that funds us well into 2024, we’re continuing to focus our efforts and expenditures on creating value for our shareholders,” Legault wrote.

Over the fiscal fourth quarter, Antibe completed two pharmacokinetic/pharmacodynamic (PK/PD) studies, with the loading dose study suggesting viable onset for acute pain relief.

Antibe said there’s a Phase 2 molar extraction study scheduled for initiation in the early calendar fourth quarter with top-line results expected in three months and a follow-up Phase 2 bunionectomy (foot bone surgery) study.

The company said it’s also continuing to investigate alternative treatment regimens for chronic indications and is evaluating two promising molecules for inflammatory bowel disease as well as having filed a patent for a specialized pain indication for ATB-352, Antibe’s second pipeline drug.

Looking at the fiscal fourth quarter numbers, McAuley said ATE’s cash burn was in line with expectations at $3.8 million compared to his forecast of $3.6 million, leaving the company with cash and equivalents at the fiscal year’s end of $54.8 million.

“The current $58.6 million in cash and equivalents will easily take the company through its two upcoming Phase 2 studies (est. cost ~$15 million) and through most of its three concurrent Phase 3 studies (est. cost ~$40 million). There is the potential to reduce the number of Phase 3 studies needed for approval and related costs if the FDA accepts either ATE’s prior GI safety and/or its upcoming Phase 2 bunionectomy pain relief studies as pivotal trials,” McAuley wrote.

McAuley said otenaproxesul has the potential to be the only NSAID without a GI FDA black box warning label, which would be a significant clinical improvement and market opportunity.

“Antibe Therapeutics (ATE) is trading below cash while preparing for mid-stage trials of a new, gastrointestinal safe, hydrogen sulfide-releasing (H2S) analog of the widely used nonsteroidal anti-inflammatory drug (NSAID) naproxen for post-operative pain relief,” McAuley wrote. “A finding of possible liver toxicity in patients treated for more than 14 days led to a switch from chronic osteoarthritis treatment to acute post-surgical pain relief as the lead indication and a significant drop in market value. However, there are extensive safety and efficacy data from patients treated for less than 14 days that we believe the market is heavily discounting.”

With the update, McAuley has rejigged his financial forecasts, calling for zero revenue in fiscal 2023 and 2024 and for EBITDA of negative $22.8 million in fiscal 2023 (previously negative $18.8 million) and negative $32.0 million in fiscal 2024 (no change).

The analyst has maintained his “Speculative Buy” rating on the stock while lowering his target price from $1.70 to $1.60 per share, which at the time of publication represented a projected one-year return of 162 per cent.

“We value ATE as the sum of our rNPV for otenaproxesul in post-operative pain and its cash. The sale of its Citagenix subsidiary, a slight increase in our clinical trial cost assumptions and the cash burn over the past year results in our updated target price of $1.60 (was $1.70),” McAuley wrote.

“We expect that returning to the clinic in Q4 will help re-ignite interest in the opportunity for otenaproxesul; however, we note that investors will need to wait until H2/CY23 for a readout of the placebo-controlled trail in bunionectomy patients,” he said.

Share

Share Tweet

Tweet Share

Share

Comment