Analyst Douglas Loe and Leede Jones Gable have launched coverage on ProMIS Neurosciences (Promis Neurosciences Stock Quote, Chart TSX:PMN), initiating with a “Speculative Buy” rating on May 11 and a $0.50/share target price for a projected return of 355 per cent.

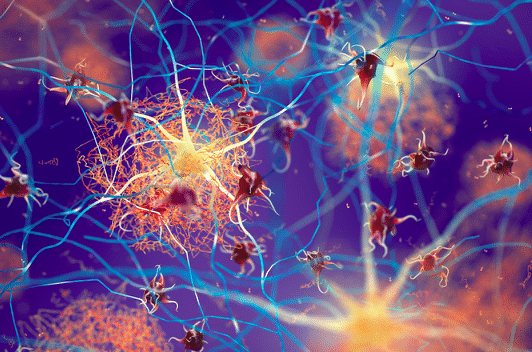

Based in Massachusetts, ProMIS Neurosciences is a CNS-focused antibody-based drug developer, led by its primary offering, the preclinical PMN310, a humanized monoclonal antibody (mAb) drug that selectively targets conformational epitopes within misfolded toxic amyloid-beta oligomers, which can be an indicator for the pathophysiology of Alzheimer’s Disease.

Loe’s financial modelling assumes the company will be able to get PMN310 to formal Phase I clinical testing by the first quarter of its 2023 fiscal year, with the ability to provide seminal safety/PK data by the third quarter of 2023 fiscal, with the expectation of initiating equally seminal Phase II testing in mild-to-moderately symptomatic Alzheimer’s disease patients by the first quarter of its 2024 fiscal year.

“ProMIS’ core competency lies in its expertise in generating mAbs that target conformational epitopes that are expressed either predominantly or exclusively on misfolded or aggregated proteins that in being misfolded/aggregated contribute to disease,” Loe said. “This expertise has been applied to a suite of mAb therapies and not just PMN310.”

According to Loe, the Alzheimer’s Disease landscape is full of clinical stage therapies, though he also notes there are very few that specifically target toxic amyloid oligomers the way the PMN310 offering is purported to do.

“We believe that PMN310 rises above its peers in not only targeting this intermediate aggregation form of beta-amyloid but also from being specifically designed to do so and thus to manifest fewer off-target side effects,” Loe said. “This is in contrast to other therapies, including other beta-amyloid-targeted mAbs that simultaneously bind to beta-amyloid monomers or fibrils that we believe are less relevant to Alzheimer’s disease progression.”

In addition to the PMN310 testing, ProMIS also has engaged in further preclinical testing for the alpha-synuclein targeted mAb PMN442 and TDP-43-targeted PMN267, which are intended to be relevant to Parkinson’s Disease and other motor neuron disorders, along with the orphan CNS disorder ALS, better known as Lou Gehrig’s Disease.

Alpha-synuclein also appears to be a target for major pharmaceutical companies in developing a Parkinson’s Disease treatment, as Novartis signed a US$1.5B deal with private Belgian pharmaceutical giant UCB to co-develop two distinct alpha-synuclein-targeted therapeutics.

“The role of alpha-synuclein in Parkinson’s disease etiology is well-documented in the medical literature and a few drug developers are already exploiting the protein as a target for experimental therapies,” Loe said. “The attention that this Parkinson’s-associated protein is garnering is becoming both intense and lucrative in ways that are relevant to our PMN investment thesis.”

Subsequent to Loe’s coverage initiation, ProMIS released its first quarter financial results for the 2022 fiscal year on May 13, headlined by a net loss of $3.1 million to come out ahead of the $7.6 million loss reported in the same quarter of 2021, with the difference representing royalties received on the company’s assays and interest income received on the company’s cash balances.

Meanwhile, ProMIS also spent $2.6 million in research and development in the quarter, a significant increase from the $193,000 spent in the same quarter of 2021 to reflect an overall increase in availability of capital resources during the respective periods, allowing the Company to engage additional personnel and more aggressively progress its core programs, particularly the PMN310 AD program.

“In Q1 of 2022 we have continued the significant progress of late 2021, advancing and expanding our portfolio of differentiated therapeutic product candidates in diseases such as Alzheimer’s disease (AD), ALS, and schizophrenia,” said Gene Williams, ProMIS’ Chairman and CEO. “Our lead program PMN310 for Alzheimer’s continues rapid progress to an IND filing and clinical trials. Our unique technology platform also enables us to make therapeutic vaccine “versions” of our antibody therapies, and we announced excellent progress toward an anti-amyloid therapeutic vaccine for Alzheimer’s at a major international conference.”

“While biotechnology markets and specific disease sectors within biotechnology have cyclical ups and downs, we are well positioned to continue making substantive progress in our programs that could allow us to capitalize when markets rebound, as we believe they will,” Williams added.

In terms of financial projections, Loe doesn’t forecast any royalty revenue coming in until 2028 at a projected $46.4 million, with over 90 per cent projected to come from its PMN310 offering. With the Parkinson’s and Lou Gehrig’s Disease indications becoming more prominent in later years, Loe forecasts the company’s royalty revenue to reach $731 million by 2023, with 74 per cent ($541 million) projected to come from the PMN310 offering, and the Parkinson’s disease indicator accounting for another 19.8 per cent ($144.7 million) of the projection.

Meanwhile, after continued investment throughout the majority of the 2020s, Loe forecasts the company’s EBITDA to also turn positive in 2028 at $37.6 million for an estimated margin of 81 per cent, with a projected widening of the margin to 98.2 per cent ($717.7 million) by the 2033 fiscal year.

Share

Share Tweet

Tweet Share

Share

Comment