The stock fell hard over the last stretch of 2021 but Scott McAuley of Paradigm Capital Markets is staying optimistic on OpSens Inc. (OpSens Stock Quote, Chart, News, Analysts, Financials TSX:OPS). McAuley maintained a “Buy” rating in his latest analysis on Thursday, though he did lower his target price from $4.10/share to $3.75/share for a projected return of 93 per cent.

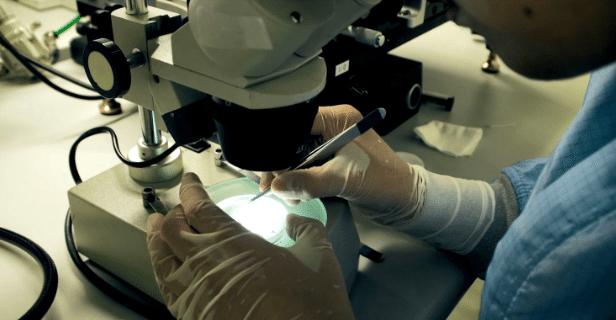

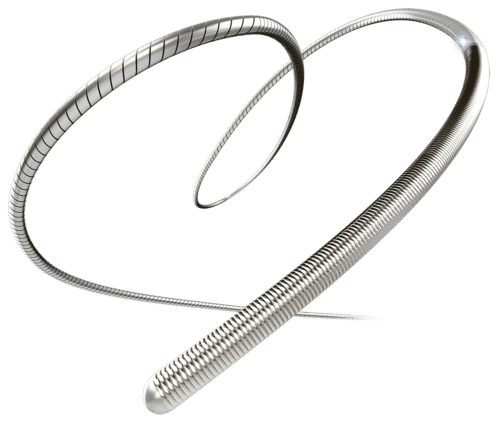

Quebec City-based OpSens focuses mainly on physiological measurements, such as FFR and dPR in interventional cardiology, with its primary offering being the OptoWire, a fiber optic pressure guidewire designed to provide the lowest drift in the industry and excellent lesions access. The OptoWire has been used in the diagnosis and treatment of over 150,000 patients in more than 30 countries and is approved for sale in the US, the European Union, Japan and Canada.

McAuley’s updated analysis comes after the company reported its second quarter results for the 2022 fiscal year, which were headlined by $8.1 million in revenue, in line with the Paradigm Capital expectation. However, the figure was a slight miss on the consensus expectation of $8.3 million as well as being down from the $8.8 million figure reported in the same quarter of 2021 and being flat sequentially.

Breaking down the topline, OpSens saw a six per cent sequential drop and 24 per cent year-over-year decrease in its coronary artery disease product sales, including its OptoWire offering, though it did establish a consistent revenue base for the future after reaching a four-year contract extension with Abiomed, providing secure revenue through 2028.

“Revenue was impacted by Omicron and the associated decline in procedure volumes in North America as well as a supply chain issue that affected Japanese sales,” McAuley said. “Both issues are seeing improvement through fiscal Q3, with procedure volumes approaching pre-Omicron levels and the supply issue resolved.”

Meanwhile, the company’s margin stats were relatively in line with expectations, namely, with $4.6 million in gross profit (Paradigm estimate was $4.5 million) along with an EBITDA loss of $1.4 million compared to the Paradigm projection of a $1.5 million loss.

Going forward, McAuley believes the company’s financial future is flexible with $30.9 million in cash on hand compared to $5.8 million in debt and lease liabilities and a $1 million cash burn, with a $10 million credit facility also available if needed by August 31.

“The recent challenges from COVID, including supply chain disruptions and a decrease in hospital procedure volumes, continued to impact the business in the second quarter. However, with the Omicron variant subsiding in North America, we have seen an increase in procedural volume and are expecting an increase in revenue in the third quarter compared to the most recent second quarter,” said Louis Laflamme, President and Chief Executive Officer of OpSens in the company’s April 13 press release.

“We have been diligent with managing our field resources to align with the pandemic restricted access to cathlabs and hospitals. As access has become more available, we have accelerated our sales rep hiring in the U.S. We believe that the impact of increased access and number of representatives will contribute to the achievement of our sales objectives,” Laflamme said.

The financial results prompted McAuley to revise some of his financial projections, setting a revenue target of $37.9 million for 2022 after previously listing it as n/c, which would represent a year-over-year increase of 9.9 per cent while coming in ahead of the consensus estimate of $37.1 million. Looking ahead to 2023, McAuley lowered his revenue projection from $63.4 million to $58 million, which would still produce a year-over-year increase of 53 per cent and beat the consensus expectation of $56.2 million.

Meanwhile, McAuley flags an even bigger EBITDA loss projection for 2022 at $4.1 million compared to his previous estimate of a $2.3 million loss, while expecting a positive return in 2023 at $1.7 million (previously $4.7 million), well off from the consensus estimate of $5.7 million in EBITDA.

After producing a return of 130 per cent in 2021, sell-offs in health stocks have seen OpSens’ stock price fall off by 30.4 per cent to start 2022. The stock has dropped off since starting the year trading at $2.93/share, though it has rebounded slightly from its 2022 low point of $1.75/share from April 11.

However, McAuley continues to believe OpSens presents a sensible investment opportunity with expectations surrounding the SavvyWire.

“We believe the recent pullback has resulted in the market heavily discounting the near-term value of OptoWire and not including any future opportunity from SavvyWire,” McAuley said. “With a growing sales force and new GPO contracts set to improve OptoWire’s market share and the expected approval of SavvyWire in the late summer or early fall, we believe there continues to be significant opportunities for investors.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment