Want a sign of how tough it is to predict where the markets are heading? Since November, stocks in the fintech and payments space have tumbled — in the case of PayPal (PayPal Stock Quote, Charts, News, Analysts, Financials NASDAQ:PYPL) it’s been an incredible 70 per cent decline.

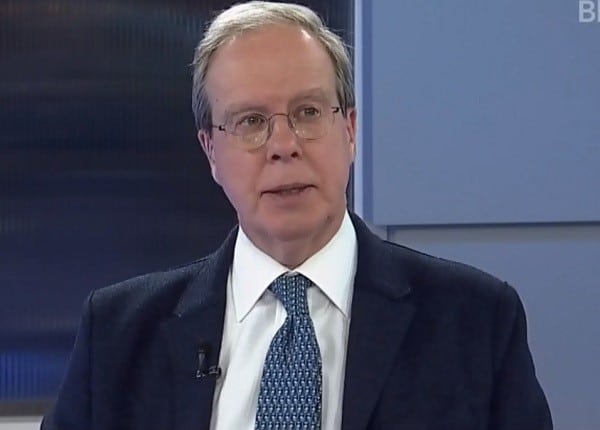

And while reason might suggest that these names are now on sale, that’s not necessarily the case, says David Fingold of Dynamic Funds, who sees a flaw in PayPal’s business model.

“I am watching the whole payment space very carefully,” said Fingold, vice president and senior portfolio manager at Dynamic, who spoke on BNN Bloomberg on Monday. “PayPal was really well positioned for COVID.”

“I don’t think it was deliberate but because PayPal is inherently an online business and really has not been able to get their business model to work in land-based stores, they were really well positioned for the shift of shopping dollars to online,” he said. “In the current environment where people are going into stores more, where people are purchasing services more on the margin, they’re not well-positioned. In the long term, they will have to solve these questions.”

Digital payments company PayPal has been on a rough ride the past half-year, going from about $300 per share in November to now just below $90. The drop is in part due to the wider market rotation away from growth-oriented stocks like those in the tech sector and towards value and more defensive plays, a trend which took off in earnest in November and has yet to let up.

But PayPal has its own issues that have accelerated the downturn, most noticeably a more muted outlook from management on the company’s growth prospects this year. In its fourth quarter 2021 and year-end financial report in February, PayPal forecasted first quarter 2022 earnings of $0.87 per share compared to the $1.16 per share called for by analysts, saying a dip in consumer spending along with the internal issue of former owner eBay setting up a separate payments platform will drag on revenue growth for the first half of the year.

PayPal saw its total payment volume (TPV) grow by 33 per cent last year to $1.25 trillion and revenue grew by 17 per cent to $25.4 billion, both hefty and respectable numbers for a company growing within the still-evolving fintech space. But the market seemingly didn’t like the company’s guidance for 2022, which called for TPV to grow by a smaller 19-22 per cent and revenue to improve by 15-17 per cent. On average, analysts had been estimating 2022 revenue growth of 17.9 per cent. PayPal’s troubles also include a concern over user growth, which has been impacted by “illegitimate” accounts on its platform, to the tune of 4.5 million last quarter.

Explaining why the company is taking a more conservative stance towards 2022, Chief Financial Officer John Rainey said inflation and its impact on consumer spending were a big factor.

“When we laid out our medium-term outlook one year ago, underlying the assumptions was a more normalized steady-state expectation for overall economic activity and consumer demand. Our medium-term targets simply did not contemplate inflation at a 40-year high and supply chain issues not seen in my lifetime,” Rainey said in the fourth quarter 2021 conference call.

PayPal also said it will be transitioning from a focus on growing user numbers to increasing revenue per user, intoning a message of “sustainable growth and driving engagement,” according to Rainey.

But that shift won’t come right away nor is its outcome a certainty. Speaking on CNBC after the first quarter release, Ritholtz Wealth Management CEO Josh Brown said moving to a revenue per user approach will come with growing pains for PayPal. Brown pointed to how the company has said much of the new users added over the past couple of years haven’t been that productive, revenue-wise, and so now ARPU is the aim.

“That’s a very different story and you saw Wall Street react,” said Brown, on a CNBC segment on February 3, “and even if they ended up being right on that new strategy and it turns out that focusing on ARPU was a superior idea versus just growing and having unprofitable customers. It would still take multiple quarters for them to prove that that new strategy is even going to work,” he said.

Fintech in general has been underperforming. Looking at the Global X Fintech ETF (Global X Stock Quote, Charts, News, Analysts, Financials NASDAQ:FINX), whose holdings include names in the financial tech, payments and cryptocurrency spaces, the stock returned almost 54 per cent in 2020 and followed that with a good-looking 2021 until the bottom started falling out, again, in November. FINX dropped from about $52 per share in early November to now $28.

“The whole payment space to be blunt has not really done very well,” said Fingold. “And I’m not sure what the problem is. You hear a lot of controversy around the potential of a central bank digital currency disrupting payments, you hear a lot of controversy about alternative peer-to-peer payment methods and to some extent the banks are also competitors in this space.”

“I would stay on the sidelines and I would observe and I would wait for a better backdrop but we’re just not there right now,” he said.

Share

Share Tweet

Tweet Share

Share

Comment