Nick Agostino of Laurentian Bank Securities has more to say about Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE), maintaining a “Buy” rating and raising his target price from $11/share to $11.50/share for a projected return of 112.2 per cent in an update to clients on Wednesday.

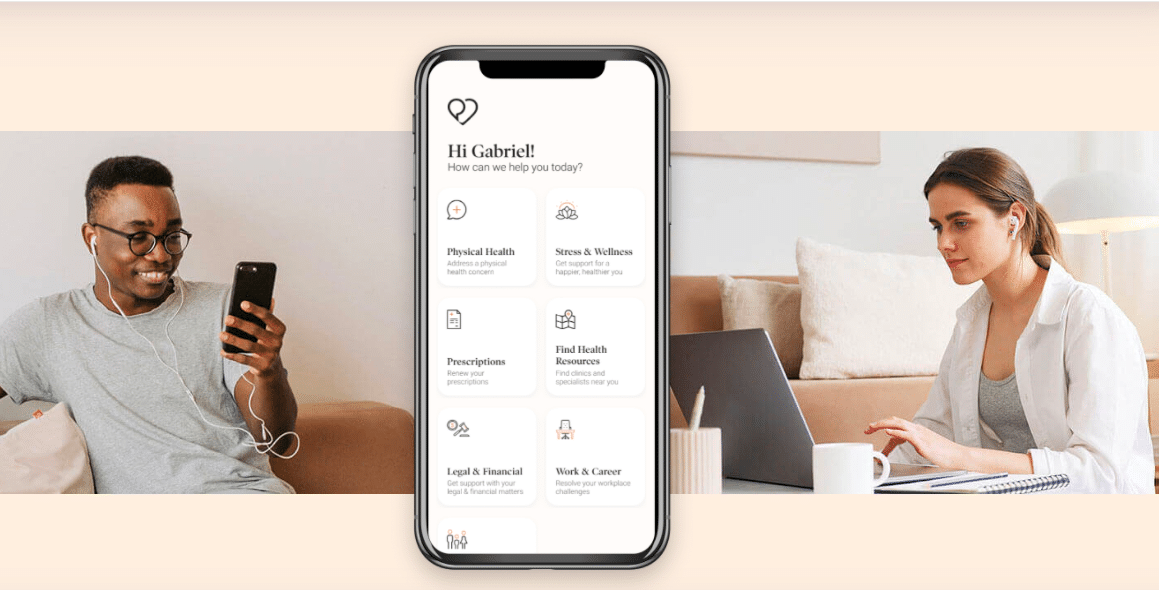

Founded in 2016 and headquartered in Montreal, Dialogue Health offers a digital healthcare and wellness platform to over 2,000 customers in Canada and Germany, providing on-demand access to medical care through its Integrated Health Platform hub focused on physical, mental and wellness issues, as well as EAP and OHS services.

Agostino’s latest analysis comes after Dialogue announced an agreement to acquire Tictrac Ltd., a London, U.K.-based provider of a global health and wellness platform used in 11 countries across Europe, Asia and the United States.

“The addition of a high-margin, SaaS-based digital health and wellness offering provides a unique opportunity to accelerate the development of CARE’s IHP, with notable immediate advantages such as extending its continuum of care, expanding TAM and enhancing CARE’s financial profile,” Agostino said.

The acquisition comes with a price tag that could reach as high as $56 million, consisting of $24 million paid in cash upon closing and the remainder payable upon certain revenue milestones being hit by 2023, which would be paid out as 54 per cent cash and 46 per cent stock, at a value equal to or greater than $8.43/share.

According to Agostino, the acquisition should prove to be immediately accretive to Dialogue, as it would be paying 5.3x ARR for Tictract if no earnouts were to be met. However, on a forward basis, assuming that the ARR exceeds $14.5M at the end of the March 2023 earn-out period, Dialogue would forecast to pay 3.9x.

“We’re thrilled to add Tictrac’s innovative technology, deep expertise, and proven methodology to Dialogue,” said Cherif Habib, Chief Executive Officer of Dialogue in the company’s April 13 press release. “This acquisition is our largest to date and contributes directly to the ambitious growth objectives we laid out in our IPO plan a year ago. Tictrac allows us to strengthen our Integrated Health Platform with a highly engaging new service, while also gaining exposure to attractive international markets with strong health and wellness potential.”

With a new revenue stream in play for the company, Agostino has revised his financial projections for the company. While his 2022 estimates for the other streams remain the same ($65.7 million in Primary Care and Mental Health, $24.5 million in EAP and $4.5 million in OHS), Agostino forecasts the Wellness stream to add $6 million to push his overall projection to nine figures at $100.8 million compared to the previous $94.8 million estimate.

Agostino sees a more significant change in 2022, as he forecasts the Wellness stream to add $24.3 million in revenue to bring the new overall estimate from $124.6 million to $148.9 million, with all other revenue stream forecasts remaining unchanged ($90.5 million in Primary Care and Mental Health, $28.2 million in EAP, $5.9 million in OHS).

The updated sales projections also raise Agostino’s gross margin estimates to 47.1 per cent in 2022 (previously 44.5 per cent) and 52.4 per cent in 2023 (previously 45.1 per cent).

From a valuation perspective, Agostino forecasts the company’s EV/Sales multiple to drop from the reported 4.3x in 2021 to 2.9x in 2022, then to a projected 2x in 2023.

Meanwhile, Agostino forecasts a slight change in Dialogue’s EBITDA projection, as he now estimates a $12.5 million loss for 2022 compared to his previous estimate of an $11.1 million loss. However, he raised his positive expectation for 2023 from $882,000 and a 0.7 per cent margin to a projected $6.6 million and a 4.4 per cent margin. Agostino’s initial EV/EBITDA multiple also comes in 2023, at an estimate of 44.3x.

“Tictrac ticks all the right boxes by adding a new service, sizeable global clients and entrance into new geographies, giving us comfort around sales synergies going forward as CARE cross-sells and upsells its IHP, including iCBT,” Agostino said. “We increase our estimates on the back of this deal, leaving room for upside from hitting the top end of guidance or from selling of iCBT into Tictrac’s channels, which we believe is not captured in the guidance.”

Dialogue’s stock price rose nine per cent on Wednesday alone, though it is down 21.4 per cent since the start of 2022 overall. The company began 2022 trading at $7.24/share on January 4, though it dropped as low as $4.92/share on March 7.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment