She still has lots of faith in the company but Chelsea Stellick of iA Capital Markets is being a little more conservative on Canadian digital health company Carebook Technologies (Carebook Technologies Stock Quote, Chart, News, Analysts, Financials TSXV:CRBK), maintaining a “Buy” rating but reducing her target price from $1/share to $0.70/share in an update to clients on Tuesday.

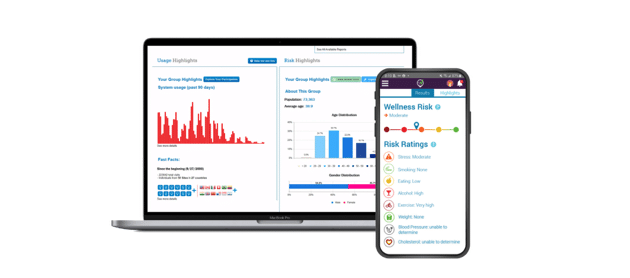

Founded in 2018 and headquartered in Vancouver, Carebook Technologies is engaged in the development and commercialization of a mobile health management system for individuals, their families, pharmacies, insurers, employers and clinics.

Stellick’s latest analysis comes after Carebook Technologies expanded its contract with Air Canada by adding its CoreHealth offering to the pre-existing Wellness Checkpoint assessment tool. Stellick notes the deal offers Carebook momentum and confirmation of successful integration for its offerings onto a single platform to drive sales from large corporate customers, though it does not push things forward by itself.

“This large contract win validates the revenue synergies promised with the CoreHealth acquisition,” Stellick said. “This contract renewal and expansion also boosts CBRK’s relationship with a prominent Canadian company employing 20K workers, which constitutes a large user base.”

The announcement comes in the wake of a corporate restructure at Carebook, which saw the company’s new management cut headcount by 34 per cent in November to save $5 million in annual costs to right-size the company’s financial path after poor sales. Since the restructure, the company has brought in $3.5 million worth of contracts, along with ARR totalling $800,000.

Over the same time period, Carebook also announced a rights offering to common shareholders to raise $4.5 million through the issuance of 30 million shares at $0.15/share, with the full value guaranteed due to stand-by commitments by significant shareholders like UIL Ltd. and SAYKL Investments Ltd.

The rights and the common shares issuable upon exercise of the Rights will be listed on the TSX Venture Exchange from now through May 12 at noon EST. According to Stellick, the company plans to use the $4.5 million for debt repayment, working capital, and general corporate purposes.

“This contract with Air Canada, one of this country’s most important and well-respected corporations, represents a major turning point for Carebook,” said Michael Peters, CEO of Carebook in the company’s April 25 press release. “Our comprehensive offering of digital health solutions is the product of the successful integration of Wellness Checkpoint and CoreHealth, both acquired in 2021, and the expansion of our partnership with Air Canada further validates that our comprehensive suite of assessment and wellness solutions are well positioned to serve Canada’s top employers.”

Paired with news of the new contract, Stellick has also made revisions to her financial projections, lowering her revenue target for 2021 from $6.5 million to $5.7 million for a year-over-year increase of 62.9 per cent. She also lowered her projections for 2022 from $13.4 million to $8.8 million for a year-over-year increase of 54.4 per cent, while her 2023 revenue forecast is now set at $10.4 million instead of $15.9 million for a potential jump of 18.2 per cent.

From a valuation perspective, Stellick forecasts the company’s EV/Revenue multiple to drop from the reported 2.5x in 2021 to a projected 1.6x in 2022 to 1.4x in 2023, which Stellick said is favourable in reference to the comparable group average of 1.9x.

Stellick also made slight changes to her adjusted EBITDA forecasts after the company reported a $6.2 million loss in 2021 (Stellick had previously forecasted a $5.9 million loss). For 2022, the analyst now forecasts a $1.9 million loss in adjusted EBITDA after previously expecting zero, though she forecasts a positive turn in 2023 at $0.9 million (previously $1.6 million) for an implied margin of 8.7 per cent.

In terms of valuation, Stellick introduces an EV/adjusted EBITDA multiple of 15.1x for 2023, which comes in slightly ahead of the comparable average of 19.3x.

Overall, Stellick acknowledges the bold moves made by company management in the name of paying down debt and reducing operational costs, though the moves did come with the effect of further share dilution.

“The Air Canada relationship expansion signifies 2021 acquisitions bearing fruit and the leaner, sales-focused organization is exactly what CRBK needs to become profitable and unlock a re-rating of the stock,” Stellick said. “Continued support from institutional investors remains a bright spot, showing confidence in CRBK’s potential. After accounting for share dilution, our target price still represents significant upside as we wait for Carebook to continue its momentum with its B2B suite offering.”

Carebook’s share price has cratered to a 51.4 per cent loss since the start of 2022, consistently falling since starting the year at $0.36/share, dropping as low as $0.14/share on April 12. At press time, Stellick’s new target of $0.70 per share represented a one-year projected return of 367 per cent.

Share

Share Tweet

Tweet Share

Share

Comment