Nick Agostino of Laurentian Bank Securities is still talking about Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE), maintaining a “Buy” rating and target price of $11/share for a projected return of 103.7 per cent in an update to clients on Wednesday.

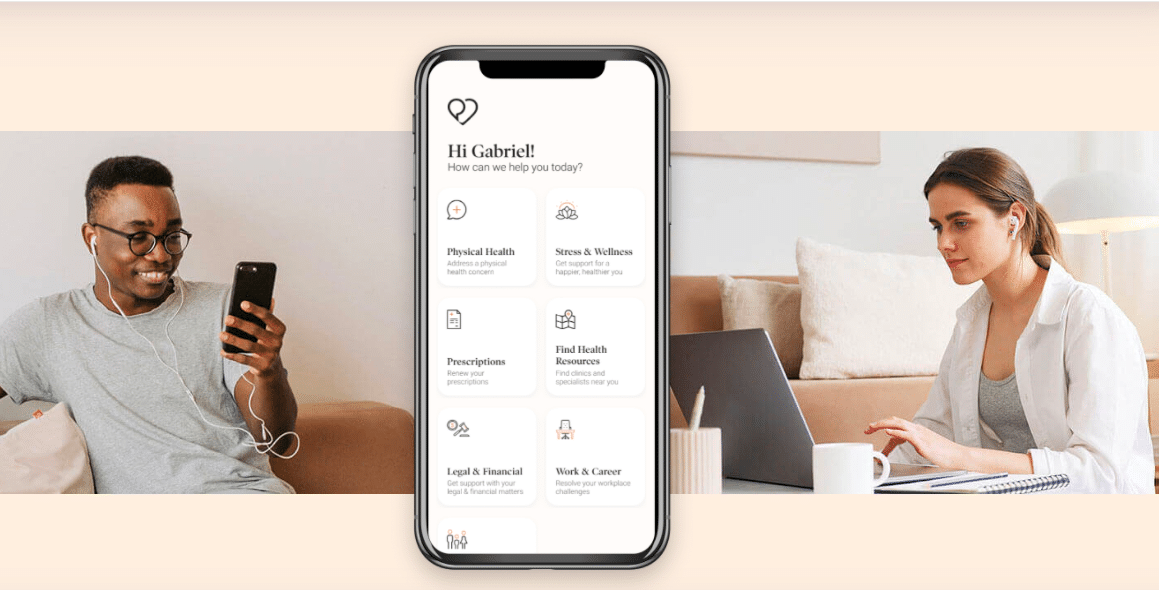

Founded in 2016 and headquartered in Montreal, Dialogue Health offers a digital healthcare and wellness platform to over 2,000 customers in Canada and Germany, providing on-demand access to medical care through its Integrated Health Platform hub focused on physical, mental and wellness issues as well as EAP and OHS services.

Agostino’s latest analysis comes after Dialogue reported its fourth quarter financial results, which Agostino noted to be in line with expectations.

Dialogue’s financial quarter was headlined by revenue of $18.9 million, which was right in the ballpark with the consensus projection of $19 million and the Laurentian Bank Securities estimate of $19.2 million while producing 9.8 per cent sequential growth and a 40.6 per cent year-over-year increase.

All three of its revenue sectors, Primary Care and Mental Health, EAP, and OHS, were essentially on the mark in comparison to the Laurentian Bank securities projections.

Meanwhile, the company’s gross margin produced a beat for the quarter at 43.5 per cent, coming in ahead of the Laurentian Bank Securities projection of 40.8 per cent while also being up sequentially from the 42.6 per cent margin produced in the previous quarter, and the 34.8 per cent year-over-year margin. Agostino attributed the beat to realized efficiencies in operations, mainly due to the continued scaling of the company’s Mental Health and EAP services, as well as the continued migration of Optima customers to a PMPM model.

On the other side, the quarter yielded an EBITDA loss of $5.7 million for the company, which came in behind the Laurentian Bank expectation of a $4.7 million loss and the consensus expectation of a $4.6 million loss. Agostino attributed the slight miss to continued growth investments and wage inflation, higher opex to launch and promote new services, developing its technology platform and sustaining the company’s public company structure.

“2021 was a pivotal year for Dialogue as we made our entry on the Toronto Stock Exchange. Even more notably, we delivered strong growth, launched our Integrated Health PlatformTM, strengthened our offering with the addition of internet-based cognitive behavioural therapy, and expanded our largest partnerships,” said Cherif Habib, Chief Executive Officer of Dialogue in the company’s March 23 press release. “As we enter 2022, we are excited about the opportunity to take advantage of our growing scale, competitive moats, and market awareness to establish Dialogue as the leading, fully-integrated virtual health and wellness platform in Canada and beyond.”

Dialogue’s overall 2021 revenue came in at $68 million to produce a year-over-year increase of 89.9 per cent. Looking ahead to 2022, Agostino forecasts that number to grow to $94.8 million, which is down from his previous estimate of $104.9 million, though it would still produce a year-over-year increase of 39.3 per cent. Agostino then forecasts revenue to break into nine figures in 2023 at a projected $124.6 million, good for a 31.5 per cent year-over-year increase.

From a valuation standpoint, Agostino forecasts the company’s EV/Sales multiple to drop from the reported 3.8x in 2021 to a projected 2.7x in 2022, then to a projected 2.1x in 2023.

Meanwhile, the fourth quarter results meant Dialogue locked in an EBITDA loss of $21.2 million for 2021, with Agostino forecasting a further loss of $11.1 million in 2022. However, Agostino expects a positive turn in 2023 at $900,000, accompanied by an EV/EBITDA multiple of 290.3x.

Agostino also forecasts minimal growth in the company’s gross margin going forward, with a slight expansion to 44.5 per cent in play for 2022 before moving to a projected 45.1 per cent for 2023.

“CARE’s focus continues to remain on boosting revenue growth at the expense of profitability in the near-term, and we believe growth in KPIs such as ARR, MSU and attach rates is justifying its strategy,” Agostino said. “We are particularly impressed with the latter and look for it to move higher as CARE introduces more services to new / existing customers overtime. As well, we look for M&A to augment growth plans as well as drive eventual expansion into the lucrative U.S. market.”

Dialogue Health’s stock price has dropped off by 63 per cent in the last 12 months and by 27.2 per cent since the start of 2022. The company was riding at a 52-week high of $19.49/share on April 6 of last year, though it has been consistently descending since, hitting a 52-week low of $4.92/share on March 7.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment