It’s been a long time coming for the return of air travel and with COVID still lingering in various forms worldwide, the truth is no one’s sure if and when people will be taking to the skies like they did pre-pandemic. And while that plus other geo-political turmoils has the market still skittish on the airlines, there are still some plays in the space worth your money, says Ryan Bushell, president of Newhaven Asset Management, who has put simulation tech company CAE Inc (CAE Inc Stock Quote, Charts, News, Analysts, Financials TSX:CAE) in his Top Pick list for the next 12 months.

“Right now, I’m looking for safety and for companies that can move forward no matter what happens next and CAE I think does fit that bill,” said Bushell, speaking on BNN Bloomberg on Thursday, where he named CAE one of his three Top Picks.

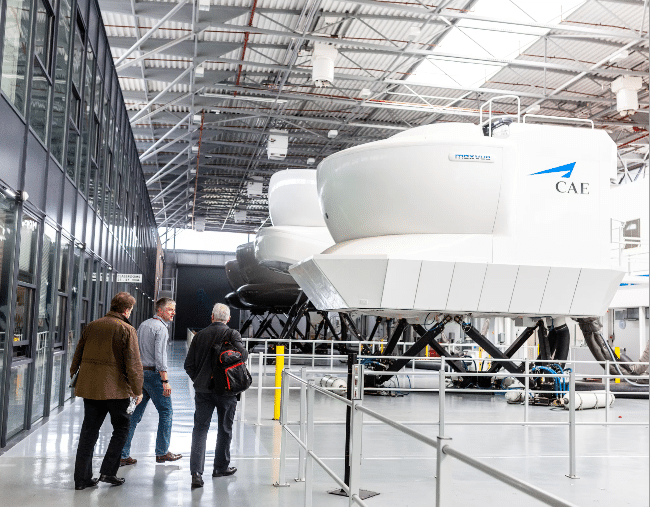

Montreal-headquartered CAE, which makes flight simulators and offers training solutions for civil aviation and defence and has education and training services for the healthcare sector as well, started the COVID era with its share price being chopped in half in early 2020 but the stock recovered very well over the subsequent year and a half, returning to pre-pandemic levels of just below $40 per share as of November, 2021.

But CAE has since pulled back, perhaps on the stalled recovery of the airline industry but also with a little help coming from its quarterly results, which for the past two quarters have seen profits drop on a year-over-year basis.

First came its fiscal second quarter 2022 financials this past November when revenue was shown to grow 16 per cent to $814.9 million while profits fell to $0.13 per share, missing analysts’ consensus estimate. The fiscal third last month had a similar theme, with revenue up two per cent year-over-year to $848.7 million while adjusted earnings were $0.19 per share compared to $0.22 per share a year earlier. Analysts had also forecasted $0.19 per share in EPS.

CAE President and CEO Marc Parent said the company is operating in a still-challenging global environment but that bookings and backlog were still developing positively and that business was still healthy with $282.1 million in free cash flow from the fiscal Q3.

“We made excellent progress on the order front with a book-to-sales ratio of 1.62 times, securing nearly $1.4 billion in orders and concluding the quarter with a $9.2 billion backlog. In Civil, we booked $753 million in orders for a 1.93 times book-to-sales ratio, including long-term training agreements with airlines and business aircraft operators, and 19 full-flight simulator sales. In Defence, we booked orders for training and mission support solutions valued at $593 million for 1.39 times book-to-sales. And in Healthcare, we continued to drive double-digit revenue growth with our reenergized organization and innovative solutions,” Parent wrote in a February 11 press release.

Yet the market has yet to reward the stock for its efforts, staying within the $30-$35 range over the past three months.

But Bushell said the dip in CAE represents a buying opportunity.

“We’re seeing very strong recovery in air travel, combined with now probably a renewed emphasis on CAE’s defence business,” he said. “The company had a bit of a soft quarter and the stock is down from the mid or low $40s to the low $30s [but] I think the future is bright.”

“Even if there is a broader market sell off, I don’t think it gets hit maybe as hard as the market does. And on the long term recovery basis I think the stock looks great,” he said. “I would like to see management revisit the dividend, though, here in the next 12 to 24 months.”

CAE made the decision in April 2020 during the first wave of the pandemic to suspend its dividend as well as its share repurchase plan, having to lay off about a quarter of its workforce to boot. But management has been optimistic in its outlook, saying in the recent Q3 report that the considerable pent-up demand for air travel will lift its sails and that performance in its Civil Aviation segment is strong, while its Defence business has been strong due to what it called “the increasing relevancy of training and simulation” in that sector.

“Defence is now more closely aligned with its defence customers’ utmost priorities and is established as the world’s leading platform agnostic, global training and simulation pure play defence business. This is expected to bring increased potential to capture business around the world, accelerated with the expanded capability and customer set the combined entity now possesses,” CAE’s press release said.

“As a waypoint along its journey to cyclical recovery and beyond, the Company is currently targeting to reach a consolidated adjusted segment operating margin of approximately 17 per cent by the time its markets are generally recovered, with steady room for further improvement thereafter. It expects to reach this level of profitability on a significantly larger base of business with a post-pandemic capital structure that will allow the Company to sustain ample flexibility to further invest in its future,” the company said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment