Last year was a rough one for healthcare stocks and 2022 hasn’t started out much better, with healthcare tech names in particular continuing their slide. But for investors interested in the sector, Desjardins Capital Markets has lined up a set of picks from the Canadian market, all with Buy recommendations.

Desjardins analyst David Newman delivered a Diversified Industries report to clients on Wednesday where he gave a fourth quarter earnings preview as well as some thoughts on where the healthcare tech sector is headed.

Year-to-date through to February 15, Newman says his six healthcare picks have delivered a market cap-weighted return of negative 6.0 per cent compared to the S&P/TSX SmallCap Index which has generated a plus 3.3 per cent return. Newman pointed to three factors in the mix, saying that interest rate hikes are creating a headwind for tech and growth stocks, that there’s been a shift toward other sectors and large-cap names as potential safe havens and reopening plays and that investors perhaps have been less inclined to jump into healthcare with the easing of the COVID-19 pandemic, even if the sector has prevailing tailwinds that are set to continue post-pandemic.

“We believe consolidation is inevitable as the market moves toward integrated health offerings, with one-off solutions likely to capitulate, eg., MindBeacon by CloudMD and Wello by Maple acquisitions,” Newman wrote.

“Investors should value companies with: (1) the ability to execute, with expanding margins or a clear path to profitability, and strong cash flows; (2) resilient demand with strong visibility into revenue (eg., SaaS-driven with a skew to B2B/B2G, one-to-three-year contracts, high retention); (3) a strong moat around their offerings; and (4) proven organic growth and M&A strategies,” he said.

CareRx (CareRx Stock Quote, Charts, News, Analysts, Financials TSX:CRRX)

- Rating: Buy – Average Risk

- Target: $9.50 (unchanged)

- Projected 12-month return: 89 per cent

Specialty Pharmacy services company CareRx should see margin improvement over 2022, according to Newman, while the company has started work on its first “mega-site” in Burlington, Ontario, with completion set for the spring of 2022. Five fulfillment centres are looking to be rolled into the one site, and CareRx has plans for two others, one in the eastern GTA and one in Vancouver.

Newman labelled CareRx as well-equipped to navigate the per-province regulatory landscape, noting that management has commented that regulatory changes over the past five years have levelled the playing field for specialty pharmacies.

Newman added that CareRx is looking to continue consolidating in the industry.

“Being the only active strategic buyer in the space, CRRX is increasingly setting the price and multiple paid for these tuck-ins. After taking out MPGL and Rexall, the company is facing significantly less competition than in the past (MediSystem remains the only large national competitor but is not active in M&A). In Ontario, where competition is strongest, management believes the market will eventually shake out to CRRX, MediSystem and a few large provincial players, with the small pharmacies either exiting the business or being acquired,” Newman wrote.

Newman is calling for CareRx to generate fourth quarter revenue of $91.2 million and adjusted EBITDA of $8.0 million.

Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Charts, News, Analysts, Financials TSX:CARE)

- Rating: Buy – Above Average Risk

- Target: $10.00 (previously $14.50)

- Projected 12-month return: 79 per cent

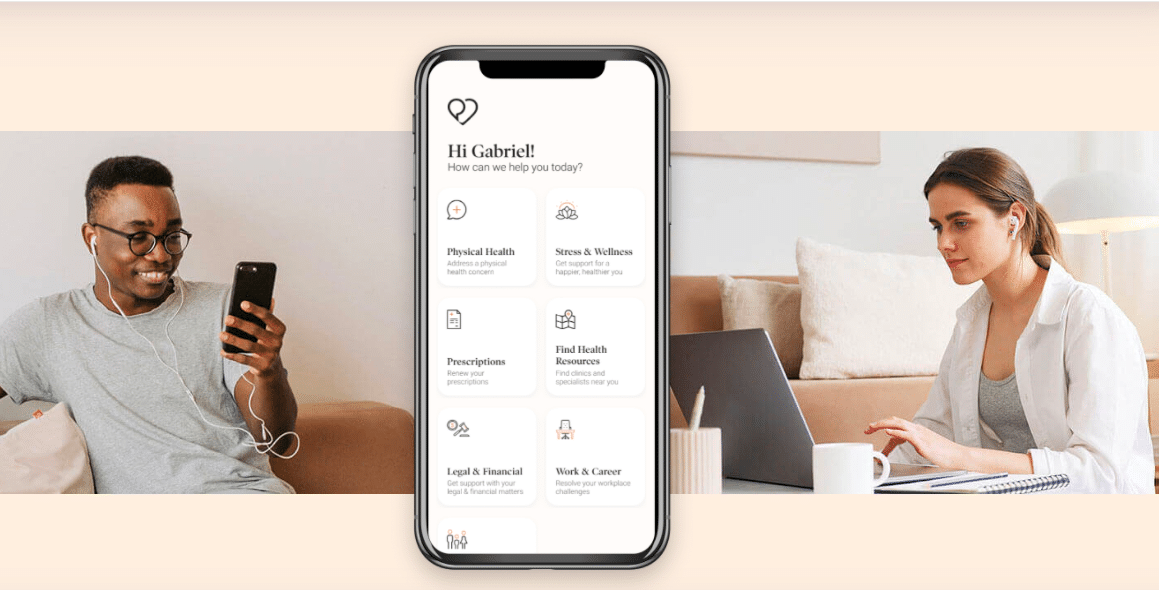

Montreal-based virtual healthcare company Dialogue continues to grow its member base, hitting almost 1.85 million in the fourth quarter and an additional 100,000 over the first week of the new year.

Newman said the ongoing labour shortage has employers (Dialogue’s customers) facing difficulties in finding replacements for position vacancies and in filling new positions.

“We believe this directly impacts member count for CARE given its PMPM model but does not reflect the merits of the company’s IHP, which continues to gain traction. Demand should continue to build, especially as companies are facing pressure to improve mental health (MH) benefits, evidenced by the increase in MH claims with large insurance providers such as Canada Life and Sun Life,” Newman wrote.

The analyst said CARE has been concentrating on top-line growth and that could push out profitability, with Newman now expecting breakeven EBITDA in 2023. Newman is calling for Dialogue to hit Q4 revenue of $18.8 million and an adjusted EBITDA loss of $5.3 million.

Greenbrook TMS (Greenbrook TMS Stock Quote, Charts, News, Analysts, Financials TSX:GTMS)

- Rating: Buy – Above Average Risk

- Target: $10.00 (previously $18.50)

- Projected 12-month return: 122 per cent

Greenbrook TMS has clinics in the United States providing Transcranial Magnetic Stimulation therapy, which is an FDA-cleared treatment for major depressive disorder and other mental health disorders. Newman said the pandemic and Omicron most recently had an impact on Greenbrook’s treatment volumes and the company has also been dealing with staffing challenges. Management has said it expects the first quarter 2022 to be significantly impacted by the pandemic followed by a strong rebound in Q2 and normalization for Q3 and Q4.

We are reducing our 4Q revenue estimates to US$12.0 million (from US$15.0 million) vs consensus of US$14.3 million. While established regions have effectively navigated the pandemic over the past two years, especially given the increase in mental health issues, there has been a lag in ramping revenue at regions that were established right before the start of COVID-19, such as Michigan, Ohio and Texas,” Newman wrote.

“Typically, new regions take ~2.5 years to ramp to ~US$800,000 revenue/centre from ~US$400,000 revenue/centre at a ~30 per cent operating margin. However, as of 3Q21, GTMS’s average run-rate revenue/centre stood at only ~US$420,000, short of expectations,” he said.

Newman said while slower on-boarding of new treatment centres and slower top-line growth have been disappointing he likes management’s shift in focus towards profitability especially in the current market climate. On the fourth quarter, Newman is calling for revenue of $50.2 million and an adjusted EBITDA loss of $13.6 million.

LifeSpeak Inc (LifeSpeak Inc Stock Quote, Charts, News, Analysts, Financials TSX:LSPK)

- Rating: Buy – Above Average Risk

- Target: $13.00 (unchanged)

- Projected 12-month return: 65 per cent

A SaaS provider of mental health and wellbeing education for employers, LifeSpeak is making news with its acquisition of Wellbeats, a Minnesota-based B2B physical wellbeing platform, a move which Newman has called a positive for its strategic alignment with LifeSpeak’s offerings.

LifeSpeak pre-released its 2021 revenue which implied a Q4 revenue of $7.0 million.

“We estimate ARR of $35.7 million. LSPK expects ARR from Wellbeats of $19.2 million (midpoint of $18.4–20.0 million), which brings its pro forma ARR to $54.4 million in 2021. For 2022, LSPK expects ARR of C$75–85 million vs our estimate of C$80.9 million, implying organic growth of ~47 per cent, excluding the tremendous upside from cross-selling. In terms of official guidance, management expects 2022 revenue growth of 180–200 per cent yoy vs our forecast of $66.0m for 182 per cent yoy growth. Wellbeats is expected to dilute adjusted EBITDA margin to 30–40 per cent in 2022 (vs our previous estimate of 43.8 per cent). We expect 2022 EBITDA of $23.5 million for a 35.6 per cent EBITDA margin,” Newman wrote.

Think Research (Think Research Stock Quote, Charts, News, Analysts, Financials TSX:THNK)

- Rating: Buy – Above Average Risk

- Target: $3.00 (unchanged)

- Projected 12-month return: 173 per cent

Digital healthcare tech provider Think Research, which has data-driven services and solutions for enterprise clients, hospitals, health regions and governments, is on the cusp of positive EBITDA, according to Newman, who projects the company will reach the mark in the first quarter 2022.

Newman said the Omicron wave negatively impacted revenue for a number of Think’s businesses including Healthcare Plus (digital-first in-person primary care) and Clinic 360 (elective surgery) and clinical studies at BioPharma. Newman is calling for Q4 2021 revenue of $18.6 million and an adjusted EBITDA loss of $0.8 million.

“We believe THNK may look to reduce its debt balance (~$21 million at the end of 3Q21) given a rising interest rate environment before considering acquisitions, which could imply some financing is needed (however, at the current stock price, an equity raise is unlikely). Its cash burn should decline to ~$1 million in 4Q21 (vs ~ $4.0 million in 3Q21) and turn positive for 2022 (we estimate FCF of $5.2 million for the year).

WELL Health Technologies (WELL Health Technologies Stock Quote, Charts, News, Analysts, Financials TSX:WELL)

- Rating: Buy – Above average risk

- Target: $8.50 (previously $11.00)

- Projected 12-month return: 87 per cent

Newman has raised his fourth quarter estimates on omni-channel digital health company WELL Health, which has a number of segments including an Electronic Medical Records (EMR) business, primary and executive health clinics, telehealth services and gastroenterology services.

Newman is estimating Q4 revenue of $301 million and adjusted operating EBITDA of $58 million.

“The stock has gained some ground since the announcement of the share buyback (+19 per cent as of February 15, 2022 vs $3.83 per share on January 19, 2022, prior to the announcement). However, we are trimming our target price to $8.50 (from $11.00) based on our DCF and 4.5x our 2022 revenue estimate (was 5.5x), which reflects current general healthcare and healthcare technology valuations, as highlighted earlier,” Newman wrote.

“We remain constructive on WELL given its unique value proposition, EBITDA profitability (~20 per cent EBITDA margin and ~10 per cent organic growth, consistent with the Rule of 30) and strong expected FCF generation. In Canada, it is the largest digital health and healthcare system provider with the country’s only end-to-end care and delivery model across provincial boundaries,” he said.

Disclosure: Nick Waddell and Jayson MacLean owns shares of WELL Health Technologies and WELL Health is an annual sponsor of Cantech Letter.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment