A “clear opportunity” awaits investors with med tech name OpSens (Opsens Stock Quote, Chart, News, Analysts, Financials TSX:OPS), according to Raymond James analyst Rahul Sarugaser who maintained his “Outperform 2” rating and $6/share target price for a projected return of 167 per cent in an update to clients on Wednesday.

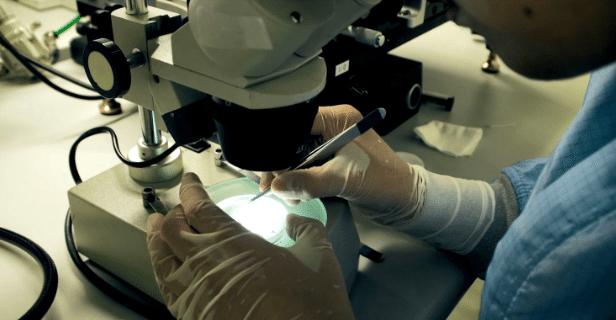

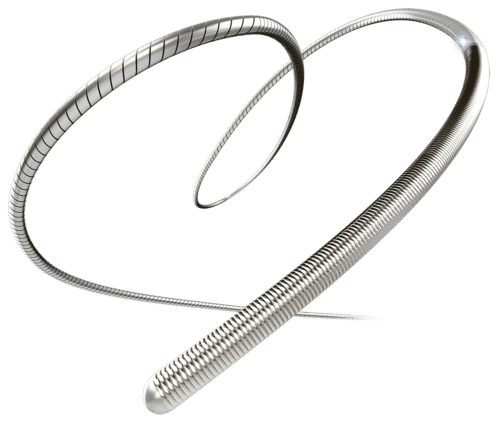

Founded in 2006 and headquartered in Quebec, Opsens Inc. develops, manufactures, installs and sells fibre optic sensors for interventional cardiology, fractional flow reserve (FFR), oil and gas and industrial applications, operating with both medical and industrial segments. The company has developed and commercialized a suite of optical devices, including the OptoWire: a fiber optic pressure guidewire used in diagnosing and treating patients with coronary artery disease.

Sarugaser’s latest update comes with a bit of remodelling for OpSens while also analyzing the company’s competitive position.

“While 2021 was a strong year for OpSens’s share price, up more than 75 per cent from Feb. 1 to Dec. 1, 2021—primarily on the strength of its TAVR program—OPS stock has since given up all of its gains, effectively flat YoY, levelling off with the UMDV (also flat),” Sarugaser said. “This, we expect, is a function of broader weakness in the small-cap biotech sector (XBI down [40 per cent] YoY) that caught up with both the UMDV and OPS, driving them down.”

In particular, Sarugaser has his eye on the company’s Transcatheter aortic valve replacement (TAVR) program, part of a market with 13 per cent year-over-year growth despite the ongoing presence of COVID-19. According to Sarugaser, since its introduction in 2012. TAVR has enabled aortic valve replacement without traditional open-heart surgery, making the procedure appropriate for intermediate-risk and low-risk aortic stenosis patients.

OpSens is working to enter that market through its SavvyWire guidewire technology in an aim to address gaps in valve placement and verification. Using its core optical sensor technology, SavvyWire is specifically designed to place valves and provide real-time pressure measurement, where typical guidewires only place the valve without knowing if it was done correctly. Typically, ensuring correct placement requires a series of secondary diagnostic tools that provide poor quality data and hinder physicians’ workflow.

Sarugaser projects 2022 to be a significant year for the OpSens TAVR program in a regulatory sense, having filed its 510(k) for approval with the U.S. Food and Drug Administration and Health Canada on December 13. Sarugaser’s timeline forecasts a decision from Health Canada late in the second quarter of 2022, followed by a decision from the FDA late in the third quarter ahead of a possible commercial launch in the first quarter of 2023.

“Today’s TAVR market is dominated by artificial valve-makers EW (66 per cent share) and MDT (29 per cent), with BSX (three per cent) and ABT (two per cent) claiming the balance. Notably, EW is the only company among these that does not make its own guidewire,” Sarugaser said. “We believe this setup may situate OPS as the go-to supplier for (and, perhaps, takeout target of) the aforementioned Med Tech heavyweights upon approval and marketing of the SavvyWire.”

OpSens most recently made news after it announced a four-year extension of its supply agreement with Abiomed to continue supplying OpSens’ Sensor Technology for Abiomed’s Impella heart pump through April 2028.

“We are pleased to continue our long-standing collaboration with Abiomed in the integration of our optical sensing technology into the Impella heart pump,” said Louis Laflamme, President and CEO of Opsens in a February 1 press release. “This partnership clearly highlights the benefits of our optical technology for cardiac applications, demonstrating the accuracy of our measurement technology as well as the quality of our manufacturing capabilities.”

After completing the 2021 fiscal year with $34 million in revenue, Sarugaser projects an increase to $40 million in 2022 (previously $41 million), implying year-over-year growth of 17.6 per cent. From there, Sarugaser forecasts another jump to $49 million, bringing about a potential year-over-year increase of 22.5 per cent.

Meanwhile, after being $2 million positive for a 5.9 per cent margin in 2021, Sarugaser projects the company to post a $2 million EBITDA loss in 2022 (previously projected at zero), then bounce back in 2023 at $5 million (previously $7 million) for a 10.2 per cent margin.

The majority of Sarugaser’s revisions come to his valuation projections, lowering his EV/Revenue projections for 2021 from 7.9x to 6.3x, his 2022 projections from 6.7x to 5.5x, and his 2023 projection from 5.5x to 4.4x.

Sarugaser also provided modified EV/EBITDA projections of 108.8x for 2021 (previously 135.3x), (122.3)x for 2022 (previously -597.7x), and 46.4x for 2023 (previously 37.7x).

“OPS’s revenue foundation comprises its steadily growing FFR business and its medical OEM business (with anchor customer ABMD), furnishing the company with long-term revenue stability. We see the non-fundamentals-driven weakness in OPS’s stock during 2022 YTD as a clear opportunity for our clients to continue adding positions, capturing more of OPS’ true upside: entry into the large and growing TAVR market: $5.1 billion WW market in 2021, est. $10 billion in 2028,” Sarugaser wrote.

OpSens has produced a return of 7.2 per cent over the last 12 months, but it has dropped off by 29 per cent since the year began, part of a descent that began when the stock hit a 52-week high of $3.56/share on November 25.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment