With Canadian tech stocks like Shopify and Lightspeed Commerce getting torched these days, investors might be casting their gaze more fondly on legacy names in technology, a case in point being BlackBerry (BlackBerry Stock Quote, Charts, News, Analysts, Financials TSX:BB), which is now trying to make a name for itself in software and security as opposed to push button smartphones.

But before you let the warm fuzzies of BlackBerry’s halcyon days take over, portfolio manager Christine Poole says even now years into its remake the company still needs to prove that its business model is a solid one.

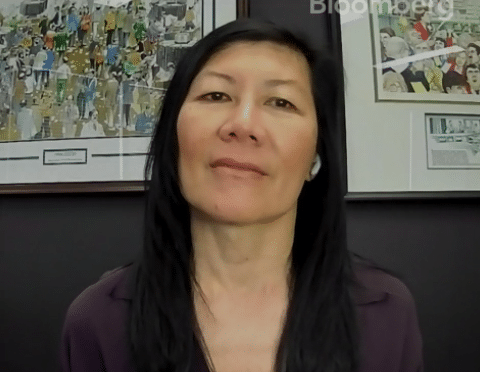

“BlackBerry has gone and is going through a multi-year transition. When [CEO] John Chen came over many years ago it has really gotten totally out of the hardware business now and is focusing on software. And for myself, we’re not interested in the name,” said Poole, CEO and managing director at GlobeInvest Capital Management, who spoke on BNN Bloomberg on Tuesday.

“I still don’t have a lot of visibility as to where their revenue and earnings growth is going to come from,” she said.

BlackBerry made news recently by announcing an agreement to sell its non-core patents to a Baltimore-based company set up to acquire the IP in a US$600-million deal. While the deal with have to meet with regulatory approval, BlackBerry, which has had legacy licensing revenue for years, said the move won’t impact its main operations in cybersecurity and connected tech.

“Patents that are essential to BlackBerry’s current core business operations are excluded from the transaction. BlackBerry will receive a license back to the patents being sold, which relate primarily to mobile devices, messaging and wireless networking. This transaction will not impact customers’ use of any of BlackBerry’s products, solutions or services,” BlackBerry said in a press release.

The divorce from its cellphone past seems more real, with BlackBerry announcing early in January that it was pulling the plug on its service and software for its classic smartphones, apparently still in use by some diehards. In more related news, the company that had in the past been named by BlackBerry to take up the reins in creating a new phone with some version of the iconic keyboard, OnwardMobility, has reportedly bowed out, leaving the return of the BlackBerry phone even more in doubt.

But for the Waterloo, Ontario-based BlackBerry, this has been the chosen path for years, starting when Chen was brought on back in 2013 to resurrect the company which had lost its smartphone market to the likes of Apple and Samsung. It took a while for investors to return to BlackBerry, but the company started establishing itself with its QNX operating system that had found a market in connected tech within the auto sector and, leaning on its reputation as the maker of more secure mobile devices, BlackBerry was also setting up shop in the cybersecurity sector, punctuated by the US$1.4-billion acquisition of California-based Cylance in 2020.

Those developments made for some good press on the company, enough, it seems, for the retail “meme stock” crowd to take an interest in BB. Last January, the stock went through the roof on practically no company news and spiked again in June before starting a long descent back to reality. BlackBerry still finished 2021 up a huge 40 per cent, although the stock is down about 24 per cent so far this year.

For Poole, the still-in-the-future promise of BlackBerry 2.0 is apparently not enough for her to hang her investor hat on.

“I think they’re going to have to make acquisitions to fund their growth. I just can’t model their growth and so it’s very hard to determine what an attractive entry point would be for the stock,” Poole said.

“It’s not a name in which we’re interested in the technology sector,” she said.

Set to report its fourth quarter fiscal 2022 results in March, BlackBerry’s third quarter saw revenue fall to $184 million versus $218 million a year earlier while net income improved to $76 million versus a loss of $128 million a year earlier. By segment, BlackBerry’s Cybersecurity revenue was flat at $128 million compared to $130 million a year earlier, its IoT revenue was up to $43 million compared to $32 million a year earlier and the company had revenue of $13 million in Licensing and Other compared to $56 million a year earlier.

“In IoT our QNX business achieved a quarterly record for design-related revenues, performing stronger than expected despite ongoing industry supply chain headwinds,” said Chen in a press release. “On the Cybersecurity front we saw further traction for our recent unified endpoint security product launches with additional head-to-head wins against other next-gen players. I am excited about how the current organization is executing to take advantage of the market opportunities.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment