It’s clear that growth stocks have gone out of fashion over the past few months, and while that may not play out too well for a number of tech names, investors looking for quality over growth still have options in the space. One would be Japanese automation components company Keyence Corporation (Keyence Stock Quote, Charts, News, Analysts, Financials TYO:6861), which portfolio manager David Fingold says should reward investors over the long term.

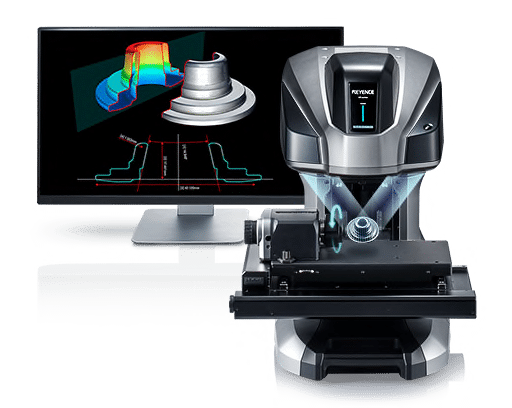

Trading on the Tokyo Stock Exchange, Osaka-based Keyence designs sensors and measuring instruments for automation processing and robotics. The stock has been an amazing performer over the years, rewarding shareholders with a return of over 1400 per cent for the past decade and over 200 per cent for the past five years.

Keyence has traded down more recently, and Fingold, who had picked Keyence as one of his best ideas a year ago, says market sentiment shifting towards cyclical names might be part of the reason.

“I’m disappointed with how Keyence has traded. We’ve been out of that security for some time. It’s still a great company. I think its long term prospects are really strong. They are experts in machine vision — they’re really one of three companies that have a global presence in machine vision,” said Fingold, vice president and senior portfolio manager at Dynamic Funds, who spoke on BNN Bloomberg on Monday.

“The issue I think that it has faced is that it’s perhaps too high quality. I think that people have had more of a desire to own more deeply cyclical businesses,” he said.

“The other thing is you need very strong investment cycles in smartphones and in autos to drive their results. They’re more diversified than that but without a very strong smartphone or auto modernization cycle I don’t see what the catalysts are right now. But as a long term hold, that’s an amazing company,” Fingold said.

Founded in 1974, Keyence has grown to be an international force with over 300,000 customers across 110 countries. Business has taken a hit over the pandemic, however, with workforce disruptions worldwide and economic slowdowns. For the company’s fiscal year ended March 30, 2021, sales at $4.9 billion were down just over two per cent compared to the previous year and net income at $1.8 billion was flat. (All figures in US dollars.)

“Although the global economy remained in a dire situation during this consolidated fiscal year due to the novel coronavirus, there were some signs of increasing consumption and production in the United States,” said Keyence President Yu Nakata in the company’s 2021 annual report.

“As economic recovery continued in some Asian regions, the re-emergence of infections in Europe has curbed economic activity and weakened consumption. Despite signs of weakening personal consumption in Japan, production and capital investment also showed signs of improvement,” he said.

But the automation sector should do well going forward as manufacturing companies look to create better efficiencies and up their game on the tech side to overcome supply chain hurdles.

One Canadian company benefitting in this capacity is ATS Automation (ATS Automation Stock Quote, Charts, News, Analysts, Financials TSX:ATA), whose share price more than doubled last year.

Last month, portfolio manager Jennifer Radman of Caldwell Investment Management named ATS Automation as one of her top picks for the upcoming year, saying the company is gaining more traction.

“The global supply chain disruptions that we keep talking about are a positive tailwind for [ATS Automation], higher labor costs are a positive tailwind and then another secular driver for them is electric vehicles where they have pretty good expertise in the battery assembly pack,” said Radman, speaking on BNN Bloomberg in December.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment