It’s been a rough stretch over the pandemic for Canadian simulation tech company CAE Inc (CAE Inc Stock Quote, Charts, News, Analysts, Financials TSX:CAE), but the skies will clear soon enough, says portfolio manager Ryan Bushell, who thinks investors will want to buy this stock for the long term.

“The reason I really like CAE and own it for our clients is their exposure to business jets,” says Bushell, president of Newhaven Asset Management, who spoke about CAE on a BNN Bloomberg session on Wednesday. “The business jet market, I think, is poised to continue to be strong with the high wealth levels of the population that are interested in business jets. There continue to be travel restrictions making it harder to fly, let’s just say, first class versus business jet travel.”

“So, I like that area of their business, combined with the fact that pilot training for new aircraft and the retirement of pilots that’s happened over the past couple of years not only due to the pandemic but just due to demographics — older pilots, retiring and new pilots — they need to be trained up and I think that creates a really strong cycle for CAE that will endure for quite some time,” he said.

“I’m positive on the company and think it probably revisits those highs at some point in the near future,” he said.

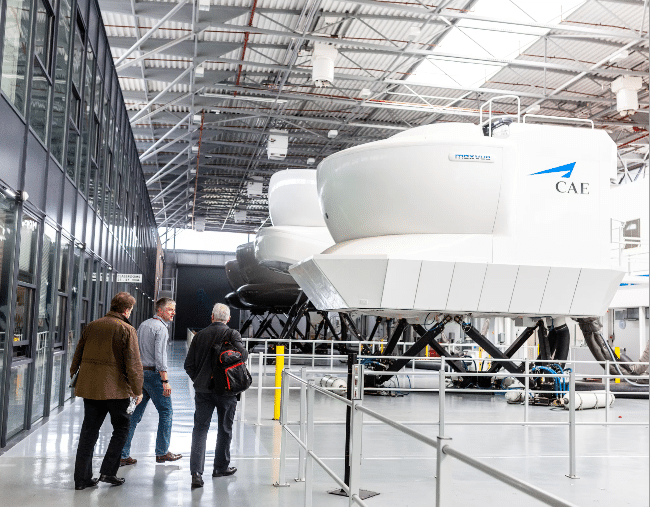

Just prior to COVID, CAE’s share price had reached the $40 mark, having climbed steadily over the previous few years and with the stock paying a nice dividend, as well. That all changed, of course, in early 2020 where stocks connected to the airlines like CAE — which makes flight simulators among other training hardware and services for fields like defence and healthcare — plummeted.

In CAE’s case, the stock bottomed out at $15 and took its time getting back to the high-$30s range before dropping again more recently down to now between $30 and $32 per share.

The company reported second quarter fiscal 2022 earnings in mid-November, with the results underwhelming the market which was expecting better results from its pilot training centres as air travel has begun to open up again.

Revenue for the fiscal Q2 was $814.9 million compared to the more COVID-impacted quarter one year earlier at $704.7 million while net income was $14.0 million or $0.04 per share compared to a loss of $5.2 million or negative $0.02 per share a year earlier.

“Our year-over-year growth in the second quarter was driven by the strengthening of our Civil training business, the continued ramp up of structural cost saving initiatives, and the integration of the L3 Harris Military Training business in our Defence results,” said Marc Parent, CAE’s President and CEO, in a press release. “Overall, we delivered 16 per cent year-over-year revenue growth and $0.17 of adjusted earnings per share. We also booked $871 million in orders for a book-to sales ratio of 1.07 times and concluded the quarter with an $8.8 billion backlog.”

Headquartered in Montreal, the $9.8-billion market cap CAE showed just how impactful the COVID pandemic could be when in April of 2020 the company laid off about a quarter of its staff, cut executive salaries in half and suspended its dividend and share buyback program.

On the dividend, Bushell said CAE is probably doing the right thing by taking care of debt first before reinstating the dividend.

“I think what they are doing is more prudent which is paying down the debt from those recent acquisitions with what free cash flow they have — and free cash flow is also poised to move upwards especially as we move through, hopefully, post-Omicron wave we’re another step closer to things normalizing, and their business continues to improve fundamentally,” Bushell said.

“I think the dividend could come back in. I’m not sure if it’ll be 2022 or not. I think another year of paying down debt and integrating those acquisitions is probably wise, to take it slow,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment