Flight simulation and training company CAE Inc. (CAE Stock Quote, Charts, News, Analysts, Financials TSX:CAE) has been in a tailspin over the past few weeks, losing about a quarter of the stock’s value, but portfolio manager Ryan Bushell remains confident in the name, saying investors will benefit once the company brings back its dividend, even though it’s taking CAE longer than hoped to reinstate it.

“CAE was a lot better a couple of weeks ago before they released their quarter,” said Bushell, president at Newhaven Asset Management, who spoke on BNN Bloomberg on Tuesday. “They did pay a dividend previous to the pandemic. They suspended it early on in the pandemic.”

“Part of my reason for buying the company was I believed that they would reinstate that dividend when things normalize,” he said. “They’ve done two acquisitions in 2021 that have prevented them from doing that.”

“But I do ultimately think this is a cash generative business that will reinstate a dividend someday. I’d like to see that before more acquisitions but I still like the setup for the company as things normalize and especially given the real secret, I think, of this company which is their exposure to business jets. I think this is going to be a big area of growth for them,” he said.

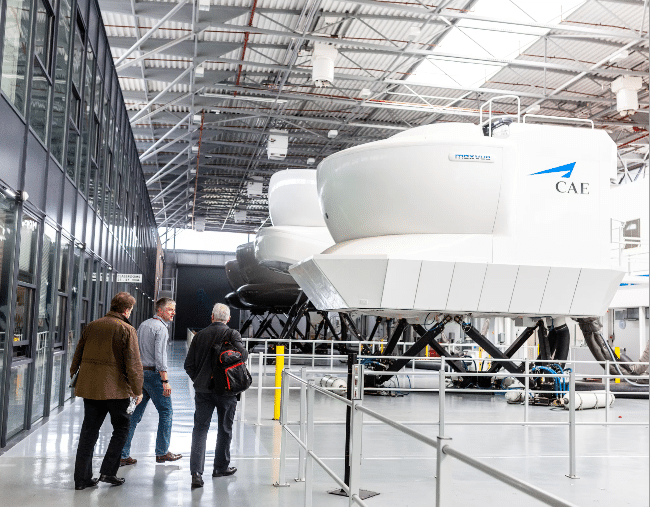

Montreal-headquartered CAE, which makes simulation tech and offers training services for the airline, defence and healthcare industries, was hit hard in the early days of COVID-19 in terms of both its share price and operations. For the company’s fiscal 2021, which ran from April 2020 to April 2021, CAE saw revenue fall from $3.6 billion to $3.0 billion with a net loss for the year of $47.5 million compared to net income of $318.9 million for the previous year. (All figures in Canadian dollars except where noted otherwise.)

But the company was turning things around more recently and saw revenue climb 16 per cent year-over-year in its fiscal second quarter 2022, delivered on November 11, posting a profit of $14 million and an EPS of positive $0.04 per share compared to negative $0.02 a year earlier.

CEO Marc Parent said CAE “continues to play offence” during the currently disruptive period for the aviation business and pointed to the company’s nine acquisitions since the start of the pandemic and including more recently the announced proposed acquisition of yada from Sabre Corp, a software and tech company for the global travel industry, announced in October. That deal was priced at US$392.5 million.

“While COVID-related impacts continue to affect all of our business units, we increasingly see a clearer path to recovery and a larger, more resilient, and more profitable CAE in the future,” said Parent in CAE’s second quarter press release.

“Specifically, we are currently targeting to reach a consolidated adjusted segment operating margin of approximately 17 per cent by the time our markets are generally recovered, with steady room for further improvement thereafter. We expect to reach this level of profitability on a significantly larger base of business with a post-pandemic capital structure that will allow us to sustain ample flexibility to further invest in our future,” he said.

Yet the market evidently soured on CAE despite the rise in revenue and earnings. The company’s reported poorer performance than expected from its Defence segment, as pandemic-related delays in orders and program execution made for lower organic growth. Also in Healthcare, management reported COVID-related headwinds for its Florida-based operations. At the same time, CAE pointed to $871 million in new orders over the quarter and a rise in its backlog from $8.3 billion to $8.8 billion.

“Our year over year growth in the second quarter was driven by the strengthening of our Civil training business, the continued ramp up of structural cost saving initiatives, and the integration of the L3 Harris Military Training business in our Defence results,” Parent wrote.

CAE’s share price fell sharply after the Q2 release, erasing all of the gains made so far in 2021 and putting the stock now down about 12 per cent for the year. That’s in the $30-$31 range whereas CAE was up as high as $42 in early November and, by comparison, finally above its pre-pandemic high of $41.48.

But Bushell says investors should be taking a good look at CAE right now.

“The stock was down by half when I bought it at $20, so at that level, the previous dividend would have yielded over four per cent, which I think is an attractive area to buy the stock. So, even if they reinstated their previous dividend or ever got back to that level that to me is attractive,” Bushell said.

“It got up to $42 there and now now it’s pulled back to the low $30s. For new clients and clients where I’m light on positioning, I’m adding at current levels,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment