They had to scale back their initial public offering this week but online learning company D2L (D2L Stock Quote, Charts, News, Analysts, Financials TSX:DTOL) should be a winner, says Stephen Takacsy, who thinks the stock is starting off at a substantial discount to its peer group.

Another in a rash of Canadian tech IPO’s this year, D2L had originally priced its offering at between $19 and $21 per share early in October but settled last week for an offering of about 8.8 million shares at $17 per share for gross proceeds of $150 million.

“This is an exciting milestone — it will mark the end of the beginning and the start of our next chapter of enabling the future of work and learning,” said John Baker, President and Chief Executive Officer of D2L. “I want to thank all of our employees, customers, and partners for their support. Together, we are committed to building the innovations that make it easier to learn — and helping people to achieve more than they dreamed possible.”

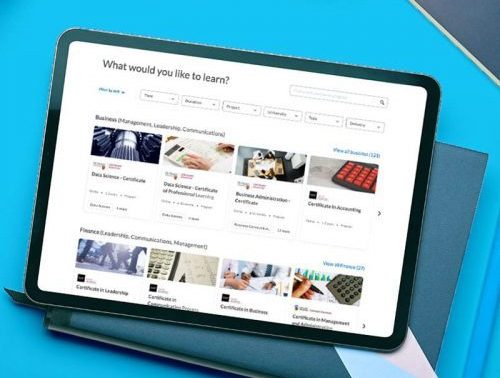

The Kitchener, Ontario-based D2L, formerly named Desire2Learn, was founded in 1999 and offers online learning products with key products Brightspace and D2L Wave and with a client base that includes a number of post-secondary institutions.

“It’s a world leader in cloud-based learning platforms that helps deliver online education and training for schools, universities and corporations,” said Takacsy, president and CEO of Lester Asset Management, who spoke on BNN Bloomberg on Tuesday where he named D2L one of his top picks for the next 12 months.

“They have about 1,000 clients with 15 million users and in 40 countries and the platform helps deliver a combination of in class at home and mobile learning experiences that can be personalized and integrated with other technologies,” he said. “We don’t normally buy IPOs but we really, really like this one.”

Takacsy says the online learning space has blossomed during COVID-19 and its lockdowns and virtual rather than in-class learning environments, with D2L seeing plenty of runway left for growth.

“The pandemic isn’t just a boost for online learning but it’s really a massive wakeup call for institutions and corporations to upgrade their legacy on-premise based systems,” he said. “So, the company has long-term, three to five year contracts which gives them great revenue visibility. The company has 90 per cent of its revenues in high-margin SaaS revenues and they’re growing at over 20 per cent a year with an annualized revenue run rate of $144 million US right now.”

One name investors may already be familiar with in the online learning space is Canadian firm Docebo (Docebo Stock Quote, Charts, News, Analysts, Financials TSX:DCBO), which has seen massive share price appreciation since the start of the pandemic. The stock went from about $16 in early 2020 to as high as $117 in September 2021. DCBO has pulled back since to the mid-$90s, still a huge return for the past two years.

Takacsy says D2L gives investors a chance to get in on a newly public tech company with legitimate growth prospects which comes cheap by comparison to its industry peers.

“D2L wanted to go public but they wanted the stock placed with long-term institutional investors not hot money and not flippers, and they wanted it priced at a decent discount, so it was placed in good hands,” Takacsy said.

“The stock is only trading at 3.7x forward sales versus Infrastructure and Power School which are US comparables trading at 8x-9x and, of course, a TSX darling called Docebo trading at 15x sales,” he said. “So, you’re getting a really high quality fast growing world leader in e-learning at a very discounted price.”

“In fact, the stock is trading just below $17, which was the IPO price, so for those who don’t have the opportunity to participate in many of the IPOs in Canada, this is a great buying opportunity. And we think this company is going to do really well over the next few years,” Takacsy said.

D2L has racked up a number of new clients in recent months including Amsterdam University of Applied Sciences, University of Guelph, McMaster University and University of Manitoba.

The company’s D2L Wave product is a so-called upskilling platform which gives educators and institutional employees an online catalogue of resources for professional development.

“D2L is passionate about transforming the way the world learns and partnering with innovative leaders to help learners achieve more than they dreamed possible,” said Baker in an August 23 press release.

“The University of Guelph has shared our mission since the start and helped connect learners with educational opportunities that exceed their needs and goals. I’m so proud to build on our work together through D2L Wave and bring forward a new era for professional development in workplaces,” Baker said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment