Nick Agostino of Laurentian Bank Securities wants to continue the conversation on Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE), maintaining a “Buy” rating and target price of $11.00/share in an update to clients on Tuesday.

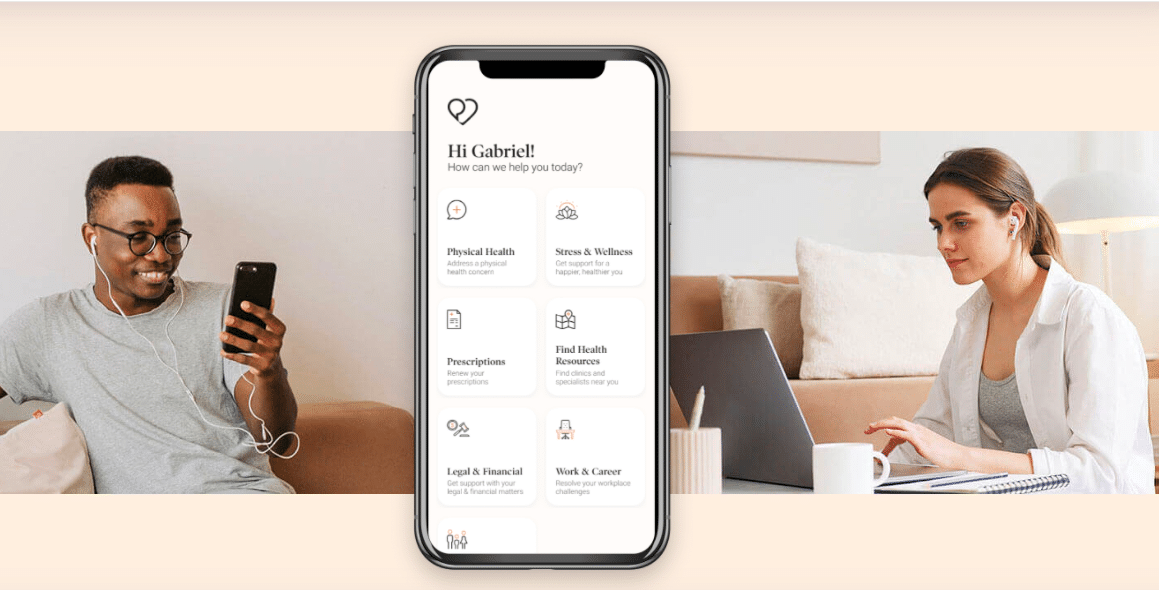

Founded in 2016 and headquartered in Montreal, Dialogue Health offers a digital healthcare and wellness platform to over 2,000 customers in Canada and Germany, providing on-demand access to medical care through its Integrated Health Platform hub focused on physical, mental and wellness issues as well as EAP and OHS services.

Agostino’s latest analysis comes after Dialogue reported its third quarter financial results which were headlined by $17.2 million in revenue in the quarter, roughly in line with the Laurentian projection of $17.3 million but falling short of the consensus projection of $18.2 million. However, despite the consensus miss, the result itself still represented year-over-year growth of 119.6 per cent, and sequential growth of 3.5 per cent.

Compared to the same point in 2020, the company’s revenue mix has become more varied, with 66.9 per cent of the revenue coming from primary care and mental health services compared to 94.8 per cent at the same point last year, with 27.7 per cent now coming from EAP (zero in Q3 2020) and the remainder from OHS.

From an EBITDA perspective, Dialogue reported a $4.9 million loss in the quarter, which was just off the $4.7 million loss projected by Laurentian Bank Securities, and further away from the consensus estimate of a $4.6 million loss.

“Adj. EBITDA loss was largely in line with our/consensus estimates, incorporating incremental personnel costs, public company costs, higher opex to support top-line growth, continued development of CARE’s IHP platform in response to customer feedback, and launch and promotion of new services,” Agostino noted.

Meanwhile, the company reported gross margin of 42.6 per cent, essentially in line with the previous 42.5 per cent estimate and ahead of the 41.5 per cent reported in the previous quarter.

“We continue to see robust demand for Dialogue’s products, which doubled our revenue and drove our pipeline of opportunities to a historical high as we entered the fourth quarter,” said Cherif Habib, Chief Executive Officer of Dialogue in the company’s November 9 press release. “These results, as well as strong momentum in a number of our key indicators as we exited the third quarter, underscore the growing need within the Canadian market for the power and convenience of our Integrated Health Platform. Our customers increasingly recognize its usefulness, not only to deliver better health and wellness outcomes for their employees, but also to attract and retain talent, especially in a competitive labour market.”

Looking ahead to the next quarter, Agostino has lowered his revenue projection to $19.2 million from $20 million, while lowering his EBITDA projection to a $4.7 million loss from the previously estimated $3.6 million loss.

Despite lowering some of his long-term metrics, Agostino still has Dialogue Health on course to nearly double from a revenue perspective, projecting $68.4 million (previously $69.2 million) in revenue for 2021 for a potential year-over-year increase of 91.1 per cent, then breaking into nine digits at a heightened projection of $104.9 million (previously $103.6 million) for 2022, a potential year-over-year increase of 53.4 per cent.

Meanwhile, as the company continues to ramp up staffing and member onboarding while developing its technology platform, Agostino continues to forecast negative EBITDA for Dialogue, projecting a loss of $20.2 million in 2021 before calming down to a projected $7.4 million loss in 2022.

On EV/Sales, Agostino projects the multiple to drop from the reported 10.3x in 2020 to a projected 5.4x in 2021, then to a projected 3.5x in 2022. All numbers compare favourably to the average of Dialogue’s peer group, which Agostino lists at 5.8x in 2021 and 4.6x in 2022.

Overall, Agostino continues to believe in Dialogue’s potential in its market space.

“While we and the street continue to tweak our estimates to reflect seasonality and delayed EBITDA positivity, we nevertheless point to CARE’s continued strong organic growth, solid revenue visibility reflected in the ARR, and are also encouraged by the growing adoption/attach rates,” “As we believe multiples in the telehealth space may be reaching a trough, a story like CARE offers an attractive entry point at current levels.”

Dialogue Health’s stock price is down 49.2 per cent since it began trading on the Toronto Stock Exchange on March 30, though it has rebounded since dropping to a low point of $5.85/share on November 1.

At the time of publication, Agostino’s $11.00 target represented a projected return of 52.8 per cent

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment