Eight Capital analyst Christian Sgro is increasingly optimistic about kneat.com (kneat.com Stock Quote, Chart, News TSXV:KSI), maintaining his “Buy” rating while raising his target price to $5.40/share from $4.75/share, leading to a projected return of 34 per cent in an update to clients on Wednesday.

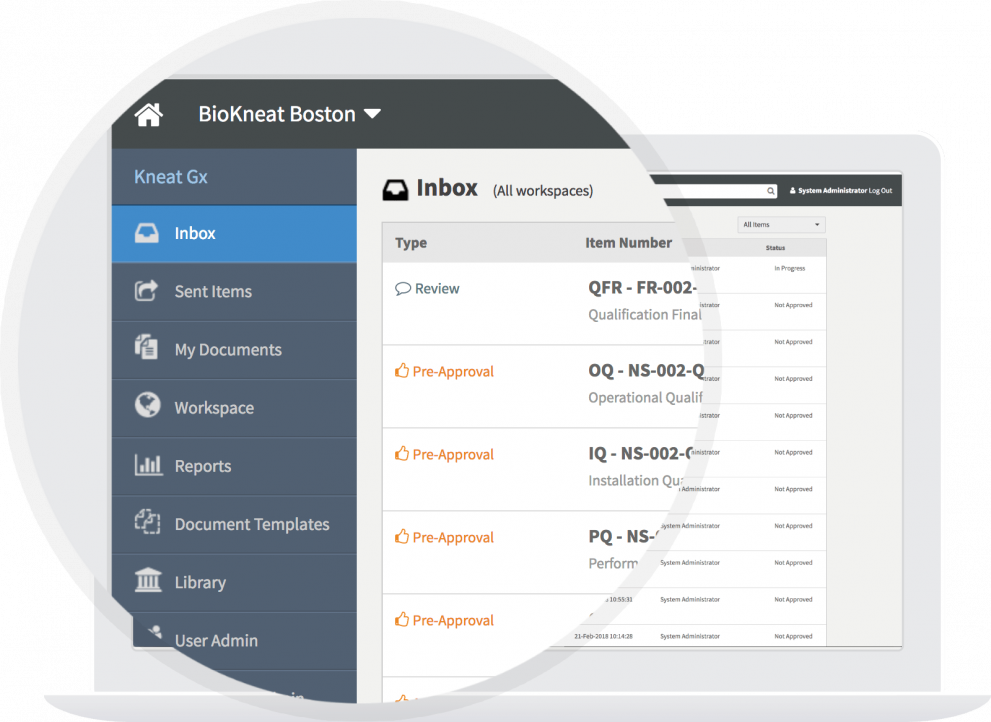

Headquartered in Ireland, kneat.com designs, develops and supplies software for data and document management through its kneat Gx platform, an application focused on validation lifecycle management and testing for the biotechnology, pharmaceutical and medical device manufacturing industries.

Sgro’s latest company analysis comes after kneat released its third quarter financial results, which Sgro noted to be more impressive than its previous quarter despite muted reaction.

“Similar to last quarter, we expect momentum to continue as kneat scales, uplists to the TSX, and delivers on plan,” Sgro said. “The company has proven product-market fit, with a land and expand strategy that we believe remains in the early innings.”

The company’s results were headlined by $3.7 million in revenue to produce year-over-year growth of 91 per cent, with a substantial increase in SaaS revenue ($2.6 million, 276 per cent increase) driving that figure forward. kneat’s gross margin percentage remained relatively steady at 54.3 per cent, while adjusted EBITDA came in at a loss of $1.1 million.

Sgro had a number of takeaways from the company’s conference call to discuss the reports, including the fact that none of its customers have fully scaled their operations yet, meaning this kind of quarter is repeatable through continued R&D investment and step-function expansion.

In addition, Sgro noted that kneat has started getting referrals from customers to their supply chain partners, which in turn has led to more opportunities to strengthen its overall market; he also noted that some of the company’s partners are shouldering bigger responsibilities in the development process, which should prove beneficial for kneat in the long term as it relates to its gross margin.

“New customer acquisition and the expansion of existing customers continue to drive our growth,” said Eddie Ryan, Chief Executive Officer of kneat in the company’s November 9 press release. “As customers scale their use of kneat, our technology is becoming an integral part of their operations. While our growth trajectory continues upward, these large scaling events are somewhat unpredictable in their timing and given the early growth stage of the company, they can result in period-to-period variability in ARR growth rates.”

“I’m very proud of our dedicated employees as they continue to execute across all functions, ensuring ongoing growth and value creation for our shareholders,” Ryan added.

The newest results have encouraged Sgro to alter some of his financial projections for kneat, raising his fourth quarter revenue projection to $4.6 million from $3.9 million to mark a 55.7 per cent year-over-year increase, with the lion’s share of the difference coming from SaaS license fees.

Consequently, Sgro’s 2021 overall revenue projection is now $13.8 million, an upgrade from the previous $13 million estimate, and representing a potential year-over-year increase of 86.6 per cent. The 2022 revenue projection also enjoys a bump up, as Sgro now forecasts $23.9 million for a 72.8 per cent potential year-over-year increase compared to the original estimate of $21.1 million. The revised numbers all come in ahead of the consensus estimates of $4 million in the fourth quarter, $13 million in 2021 and $21.3 million in 2022.

Meanwhile, Sgro has added further adjusted EBITDA losses to his projections for kneat, forecasting a loss of $800,000 in the fourth quarter (in line with the consensus estimate) compared to the previous estimate of a $300,000 loss, leading to a modified projection of a $3 million overall loss in 2021 compared to the original $1.8 million estimate, which puts it below the consensus estimate of a $2.6 million loss.

In addition, Sgro has included another year of negative adjusted EBITDA as he has revised his 2022 projection to a $1.4 million loss compared to the initial thought of going positive at $600,000, all while remaining below the consensus projection of a $300,000 loss.

With the negative adjusted EBITDA values present, the only valuation multiple Sgro looks at for kneat is the EV/Revenue multiple, which he projects to drop from the reported 38.9x in 2020 to a projected 20.8x in 2021, then again to a projected 12.1x in 2022, all of which compare favourably to the averages in Sgro’s high-growth B2B SaaS peer groups in Canada (15.1x in 2022) and the United States (20.5x in 2022).

Overall, kneat.com’s stock price is up 44.3 per cent for the year to date, maintaining its momentum after beginning its upswing in late July that eventually reached a peak of $4.64/share on September 13.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment