Colin Healey of Haywood Capital Markets remains charged up about EXRO Technologies (Exro Technologies Stock Quote, Chart, News, Analysts, Financials TSXV:EXRO), maintaining a “Buy” rating and target price of $8.00/share for a projected return of 158.9 per cent in an update to clients on Wednesday.

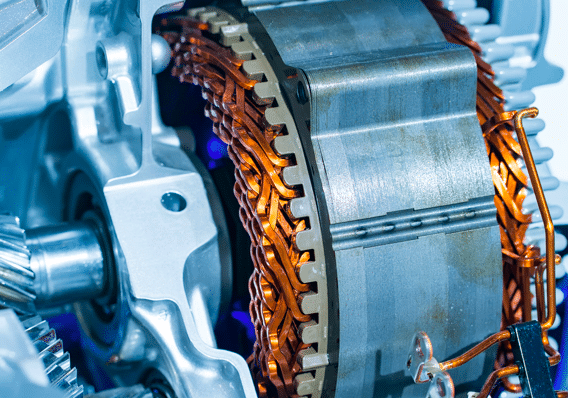

Incorporated in 2014 and headquartered in Calgary, Exro Technologies focuses on developing and commercializing patented coil driver technology and proprietary system architecture for power electronics. In particular, the company is focused on its patented Coil Driver technology, which could dramatically reduce the cost and complexity associated with deploying electric vehicle infrastructure at scale.

Healey’s latest analysis comes after EXRO announced that it had launched a new service arm for the company, with the aim of helping more automakers integrate electrification into its operations.

“According to the company, its new Vehicle Systems division will build on Exro’s suite of existing product offerings with Coil Driver and Battery Control System and focus on complete powertrain designs that integrate Exro’s core technology with vehicle powertrains including embedded software, Vehicle Control Units and batteries,” Healey said.

The Vehicle Systems division will be led by Brian Van Batavia, formerly the Technical Director and AVL Chief Engineer of Electrification at Bollinger Motors, who Healey mentioned has a number of articles and papers related to energy management to his name as well holding several patents related to hybrid and electric vehicles and powertrains.

Van Batavia won’t be joining Exro alone, however, as Healey noted that Van Batavia will also bring his team of engineers aboard, headed by Justin Goeglein, who brings over ten years of experience in integration of automotive vehicle platforms with a specialty in software solutions to the table, as the division’s Director of Engineering.

AVL has been involved with Exro previously, having performed a series of tests on an electric motor dynamometer with the Coil Driver to demonstrate its ability to coil switch, similar to how a gearbox changes the gears for a combustion vehicle, at various speeds and under different conditions.

According to Healey, the company is also planning to open a new facility in Detroit next year, with an aim toward better capitalization on service opportunities for top automakers in the region and within the EV industry.

Overall, the aim is for the new division to introduce automakers to Exro’s independently tested technology in the early design stages to create lower cost yet higher performing electric vehicles at scale, which Healey notes is the key to accelerating EV adoption.

“I’m continuously energized by the growth our team has achieved this year, and I’m thrilled to welcome Brian and Justin to Exro,” said Sue Ozdemir, CEO of Exro Technologies in the company’s November 3 press release. “The addition of this new arm enables us to better support our customers and fast-growing pipeline with holistic solutions that complement our core technologies for automakers pursuing electrification, while facilitating a new path to accelerate our business growth.”

“I’ve been keeping a pulse on Exro since I first learned about the company’s ability to bring a more cost-effective electric vehicle to market,” Van Batavia added. “I’m excited to join the incredible group at Exro and use my expertise in systems engineering for electrified vehicles to drive new organic growth by delivering new optimal powertrain solutions to the electric mobility industry.”

Healey projects significant growth for Exro in his financial projections, beginning with a $2.4 million revenue forecast in 2021 before getting a boost to a projected $26.3 million in 2022, a near tenfold potential year-over-year increase. He then projects another shot upward to a projected $55.5 million in 2023, good for a potential year-over-year increase of 110 per cent.

Based on a consistent gross margin of 40 per cent, Healey also projects the company’s gross profit to grow from a forecasted $900,000 in 2021 to $10.5 million in 2022, then to a projected $22.2 million in 2023.

Meanwhile, Healey projects the company’s EBITDA to turn positive in 2023 at $8 million, following projected losses of $8 million and $300,000 in 2021 and 2022, respectively.

Overall, Healey views the announcement positively, with an expectation for Exro to take a step forward, and he has retained his Top Pick for 2021 status for EXRO.

“Today’s news is important as it adds a potential new revenue channel and positions the Company to serve as a one-stop-shop for vehicle manufacturers,” Healey said. “Additionally, the on-boarding of Mr. Van Batavia and his team provide Exro with extensive expertise, positioning the Company as a valuable part of the EV supply chain. We continue to like Exro and expect further news flow to incrementally move the stock higher and recommend adding to positions as the Company progresses towards formal commercialization of multiple technologies.”

Overall, Exro’s stock price is down 20.5 per cent over the course of the year, reaching an early high point of $7.17/share on February 16.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment