After a ton of success over the past year and a half the share price for Converge Technology Solutions (Converge Technology Solutions Stock Quote, Charts, News, Analysts, Financials TSX:CTS) has been about even for a number of months now. But with industry tailwinds and good expansion prospects, the IT solutions company should be heading north again, according to Paradigm Capital analyst Daniel Rosenberg, who delivered an update to clients on CTS on Friday.

A leading North American provider of software-enabled IT and cloud solutions, Converge delivered its third quarter 2021 financials on Wednesday, showing revenue up 93 per cent year-over-year to $367.3 million and adjusted EBITDA up 29 per cent to $18.9 million.

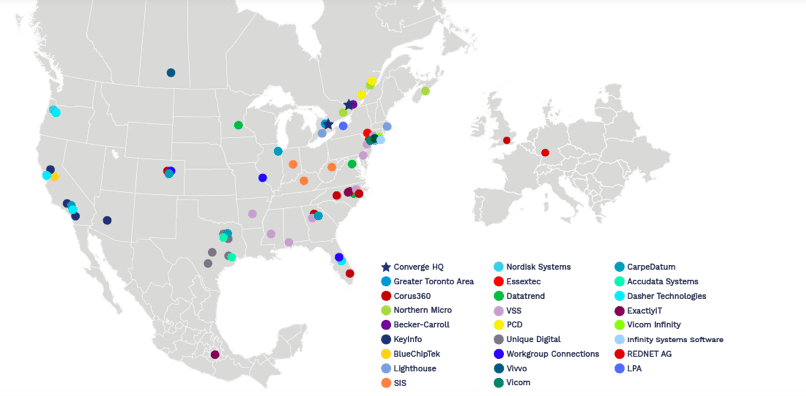

Converge is a consolidator in the IT solutions space, having acquired a number of smaller value-added resellers (VARs) over the past few years, including in August Rednet AG, headquartered in Mainz, Germany, CTS’s first move into Europe.

“Converge continues to execute on all aspects of its strategy and we are extremely enthusiastic to have closed our platform acquisition in Europe. The Company continues to invest in talent and expand its service capabilities to its customers across North America and Europe, as reflected in our very impressive recurring revenue managed services growth,” said Converge CEO Shaun Maine in the company’s third quarter press release.

“Additionally, the Company ended the quarter with $210 million of cash on-hand driven by extremely strong free cash generation from our business, with $190 million in available capacity under our ABL credit facility,” he said.

Also over the quarter, Converge closed on acquisitions of Vicom Infinity and Infinity Systems Software, while since the end of the Q3 the company closed on the acquisition of LPA Software Solutions. In September, CTS closed on a bought deal offering for gross proceeds of $259 million including over-allotment.

Looking at the quarterly numbers, Rosenberg said they were generally in-line with expectations but profitability was weaker than expected. Rosenberg pointed out that revenue growth came from higher hardware sales to the Canadian government along with inorganic growth through M&A.

“The quarterly revenue mix was a drag on gross margin, but the product mix is expected to improve as the company cross-sells managed services to hardware heavy entities. The outlook for 2021 is strong with strength in cloud spending, digital transformation and cybersecurity, driving organic growth. Management is on track to hit targets of $2.0 billion+ pro-forma revenue run rate and $100–$200 million adjusted EBITDA run rate in 2021,” Rosenberg wrote.

Rosenberg said the IT services industry has been hit by supply chain issues but the outlook for CTS’ fourth quarter is strong, with management expecting high demand from customers for its software, while for 2022 management says spending in cybersecurity, artificial intelligence and digital transformation will help drive organic growth for the company.

Rosenberg said Converge is now well cashed up for more M&A activity.

“Recall, historically the company had been targeting 4–6 transactions per year in North America. During the quarter, Converge completed the acquisition of LPA Software Solutions for $11.3 million that expands its capabilities in advanced analytics and further strengthens its ties with IBM. Converge is now adding a European M&A program and we expect it to be meaningfully additive to the current M&A opportunity,” he said.

Rosenberg said Converge has been adept so far at executing to its three-phased strategic plan as laid out in 2018 with the next phase involving a $2-billion revenue target for 2022 and $5 billion by 2025 via acquiring three to five companies in North America annually and three to five in Europe and with an end goal of $500 million in EBITDA by 2025.

“Converge is rapidly growing by consolidating regional IT service providers to create a national service offerings in North America and Europe. CTS’s strategy is aligned with IT spending trends in cloud, and COVID-19 has been a catalyst for further investment in the area,” Rosenberg wrote.

“CTS has strong strategic partnerships with cloud technology leaders, including VMware, Red Hat, Microsoft Azure, Amazon Web Services and Google, which highlight its capabilities in serving complex IT networks. These relationships support high-margin managed service revenue. In addition to strong organic growth, the company is executing a disciplined M&A model. With eyes set on international expansion, CTS offers investors a strong growth profile, proven execution, and an attractive valuation,” he said.

With the update, Rosenberg provided a revised forecast for CTS, with revenue and adjusted EBITDA estimates down from his previous forecast at $1,500.7 million for revenue (previously $1,667.1 million) and $86.4 million for EBITDA (previously $108.2 million). For 2022 revenue is expected to be $2,300.7 million and EBITDA at $189.3 million.

Rosenberg reiterated his “Buy” rating but slightly dipped his 12-month target from $13.75 to $13.50 per share, representing at press time a projected return of 22.0 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment