Work management platform Asana (Asana Stock Quote, Charts, News, Analysts, Financials NYSE:ASAN) posted huge gains over its first year as a public company, but portfolio manager Kim Bolton thinks the stock will go higher.

Bolton is calling for the stock to double over the next 12 months, saying,

“Asana came out about a year ago and they did a direct listing. [The stock] just sort of sat there down around $20, and thankfully we got into it,” says Bolton, president of Black Swan Dexteritas, speaking on BNN Bloomberg on Wednesday. “Our target was $90 and we actually let it go at $88 and here it is at about $125.”

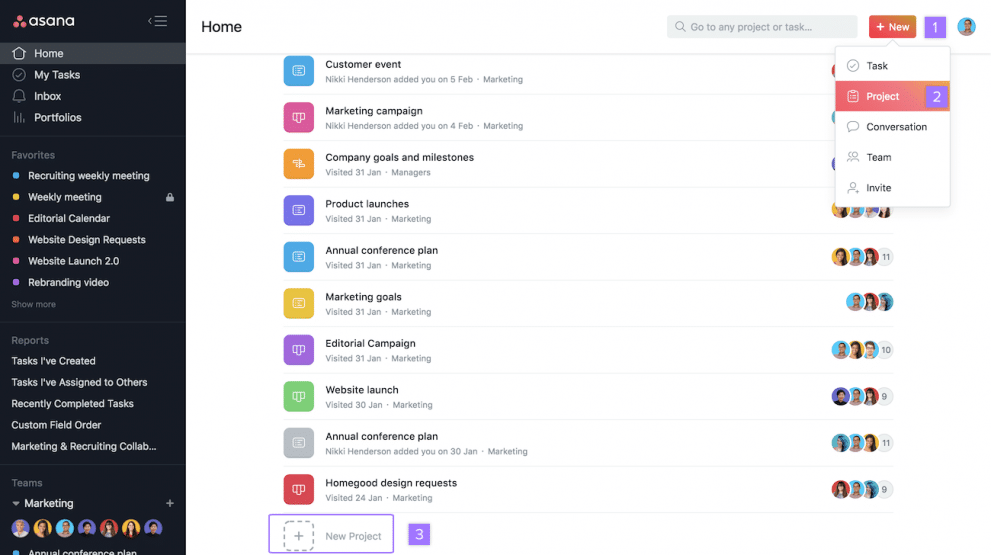

Launched a decade ago by Facebook co-founder Dustin Moskovitz and Facebook engineer Justin Rosenstein, Asana has built up its presence slowly, arriving as an Android app in 2015 and then developing an integration with Microsoft products in 2017 and gaining its reputation as one of the best collaboration platforms available.

Asana registered over 107,000 paying customers as of its latest reported quarter, the company’s Q2 delivered last month. Asana posted strong revenue growth of 72 per cent year-over-year for the quarter, hitting $89.5 million, while still sporting a considerable net loss of $68.4 million or $0.40 per share compared to a loss of $41.1 million or $0.54 per share a year earlier. For the third quarter, management forecasted revenue between $93 and $94 million with a net loss of between $0.27 and $0.26 per share. (All figures in US dollars.)

“In the second quarter we accelerated total revenue growth, continued to report strong customer growth and increased dollar-based net retention rates across the board,” said Moskovitz in a September 30 press release. “Customers are adopting Asana everywhere: across our major geographies and across all sizes of teams. We saw particular strength in the enterprise, with the number of customers spending over $50,000 up 111 percent. Stay tuned for more enterprise announcements in October.”

For Bolton, Asana has lots going for it, including what he sees to be a mistaken view of its growth rate.

“Asana is a phenomenal company. It plays in that whole work collaboration, work management space, the same as a Slack or Atlassian or a Monday.com. Three reasons why you should own it are, first, the growth rates are phenomenal. The valuation is based on growing at about 30 per cent per year [but] I think it’s probably going to actually grow at greater than 40 per cent. And then, thirdly, the reason that we really like it is that the company’s co-founders are Dustin Moskovitz and Justin Rosenstein, who were other founders over at Facebook.”

“Asana jumped nine per cent [on Tuesday] and the reason for that their chief product officer whom we’ve actually met, Alex Hood, was being featured on the popular podcast Inspired Execution and he was highlighting the disruptive potential of Asana and its voice recognition natural language processing systems,” Bolton said.

“But he also mentioned that this is the company that eats its own dog food — in other words, Asana’s collaboration and project management means are actually met by its own software,” Bolton said. “So, I would recommend you could even buy it here at $125 or leave some space and maybe pick up down at $100 and at best maybe $75. We have a 12 month price target of $260.”

This week, Asana announced a suite of new features under the Enterprise Work Graph moniker, aiming to help companies align their workplace goals across teams and timezones.

“Enterprises today are organized functionally but the reality is that work happens cross-functionally,” said Anne Raimondi, Chief Operating Officer, in an October 20 press release. “The misalignment between how teams are organized and how work actually gets done is fueling work about work across organizations. With the Enterprise Work Graph, Asana is solving the universal challenges of cross-team coordination by providing the clarity teams need to stay connected, no matter where they are in the world.”

“In today’swork from everywhere environment, the best leaders macromanage, not micromanage, their teams. By setting clear objectives connected to the work and the tools that bring them to life, enterprises can align effort and impact to achieve amazing results and increase employee happiness,” she said.

Asana, which debuted as a public company on September 30, 2020, at $27.00 per share, is currently up about 330 per cent year-to-date. By contrast, Slack Technologies, which was bought by Salesforce a few months ago, returned 88 per cent in 2020 its first calendar year of trading. Australian workplace software company Atlassian returned 89 per cent in 2020 and is up about 75 per cent so far in 2021.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment