Raymond James analyst Rahul Sarugaser remains positive about the potential of Profound Medical (Profound Medical Stock Quote, Chart, News NASDAQ:PROF) as he maintained a “Strong Buy 1” rating, though he did lower his target price to $30.00/share from $36.00/share for a projected return of 108 per cent in an update to clients on Tuesday. (All figures in US dollars.)

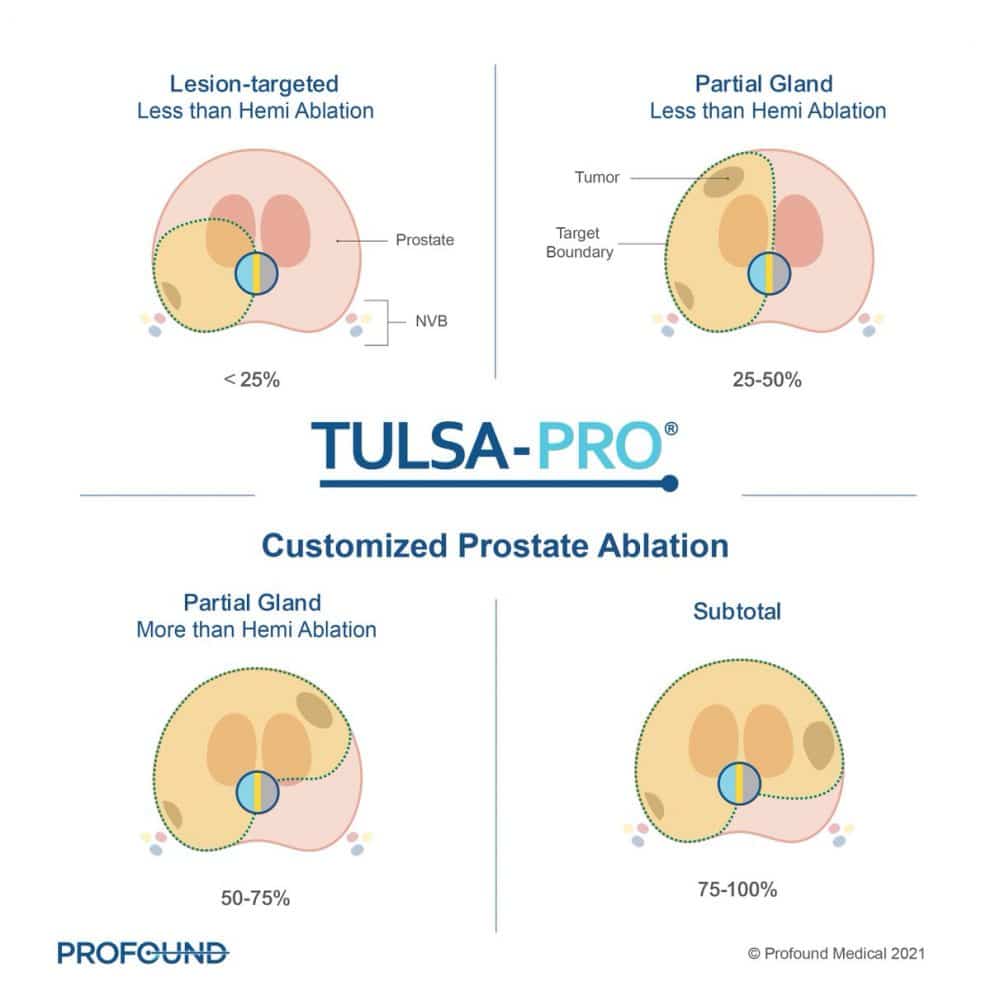

With its headquarters in Mississauga, Ont., Profound Medical is a medical technology company focused on a therapeutics platform that provides the precision of real-time Magnetic Resonance Imaging combined with the safety and ablation power of directional and focused ultrasound technology for the incision-free ablation of diseased tissue.

Sarugaser’s latest analysis comes as a ripple effect of a generally softer quarter in the medical technology sector, with Profound expected to release its third quarter financial results on November 4.

“While PROF’s installation pipeline—that yielded strong 2Q21 results—remains deep, we estimate that TULSA installations continued to be stymied by CV-Delta-driven hospital capacity constraints, so we are projecting relatively flat QoQ Rev., and expect some of this weakness to filter over into 4Q,” Sarugaser said.

However, despite the softer overall quarter and fewer unit installations, Sarugaser’s gaze is forward-looking, as his future analysis will have a keen eye on utilization rate of the existing installed base, where there was a 20 per cent sequential increase between the first and second quarters of 2021, and noting that the first quarter of 2022 should be an inflection point for the company as it drives installations from its deep signed-contract pipeline with increased access to hospitals.

Sarugaser’s interest is further aroused by the company’s soon to be initiated Level 1 CAPTAIN trial, which will directly compare Profound Medical’s TULSA-PRO image-guided therapeutic technology, which combines real-time magnetic resonance imaging with transurethral, robotically-driven therapeutic ultrasound and closed-loop thermal feedback control, to the standard robotic radical prostatectomy in 201 randomized patients, assigned to TULSA or RP in a 2:1 ratio.

Sarugaser notes that the trial’s primary outcome measures include urinary continence and erectile potency at 12 months, and, proportion of patients free from progression to additional treatment at 36 months, though he does expect other data to come from the company at 12 and 24 months, as well.

In recent studies, both the rates of incontinence and erectile dysfunction were significantly lower in focal ablation (HIFU) compared to radical prostatectomy in intermediate-risk prostate cancer patients, which Sarugaser notes as a significant development in TULSA-PRO’s quest to become a new standard operating procedure.

“We cannot overstate how important this study is, as it is very likely to engender broad awareness of TULSA throughout the urologist community, driving shorter-term adoption,” Sarugaser said. “More importantly, should TULSA show superiority to RP—which, given a recent AUA presentation showing significant superiority of HIFU over RP, combined with our analysis that TULSA is objectively superior to HIFU—we have very high confidence TULSA will show superiority over RP, which in turn will redefine TULSA as the standard of care in prostate cancer.”

Sarugaser also noted, based on guidance from Profound Medical CEO Dr. Arun Menawat, that the company should be ready to file an application for a permanent Category 1 CPT Code, and that the company should have a ruling from the American Medical Association for reimbursement before 2022 comes to an end.

The softer sector has prompted Sarugaser to revise some of his financial projections, as he now projects revenue of $10 million for 2021 (previously $15 million) for a potential year-over-year growth of 42.9 per cent, followed by a tripling to a projected $30.4 million in 2022 instead of the previous $35 million estimate. Accordingly, Sarugaser’s EV/Revenue multiple projections have risen slightly, as he now forecasts a drop from 30.3x in 2020 (previously 26.8x) to a projected 21.2x (previously 13.5x) in 2021, then to a projected 7.1x (previously 5.5x) in 2022.

Meanwhile, Sarugaser continues to forecast EBITDA losses, with loss projections of $22 million in both 2021 and 2022 (previously $20 million in each year) after reporting a $14 million loss in 2020. Consequently, the EV/EBITDA multiple projections continue to be negative, moving from a reported -15.5x (previously -13.7x) in 2020 to a projected -10x (previously -9.4x) in 2021, remaining there in an unchanged 2022 projection.

Despite the target price drop, Sarugaser’s conviction in the company’s overall fortunes remains unchanged.

“PROF’s team continues to execute extremely well, even through CV-Delta hospital capacity restrictions, so, with our strong visibility on ‘22 Rev., combined with important upcoming catalysts—the CAPTAIN level-1 study, and PROF’s CPT reimbursement application—we maintain our Strong Buy (1) rating,” Sarugaser said.

Overall, Profound Medical’s stock price has dropped 41.4 per cent over the course of 2021, steadily dropping after reaching a high point of $35.63/share on February 5.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment