Beacon Securities analyst Gabriel Leung believes Kraken Robotics (Kraken Robotics Stock Quote, Chart, News TSXV:PNG) has provided plenty of reasons for optimism, maintaining his “Buy” rating and target price of $1.00/share with a potential return of 156 per cent in an update to clients on Monday.

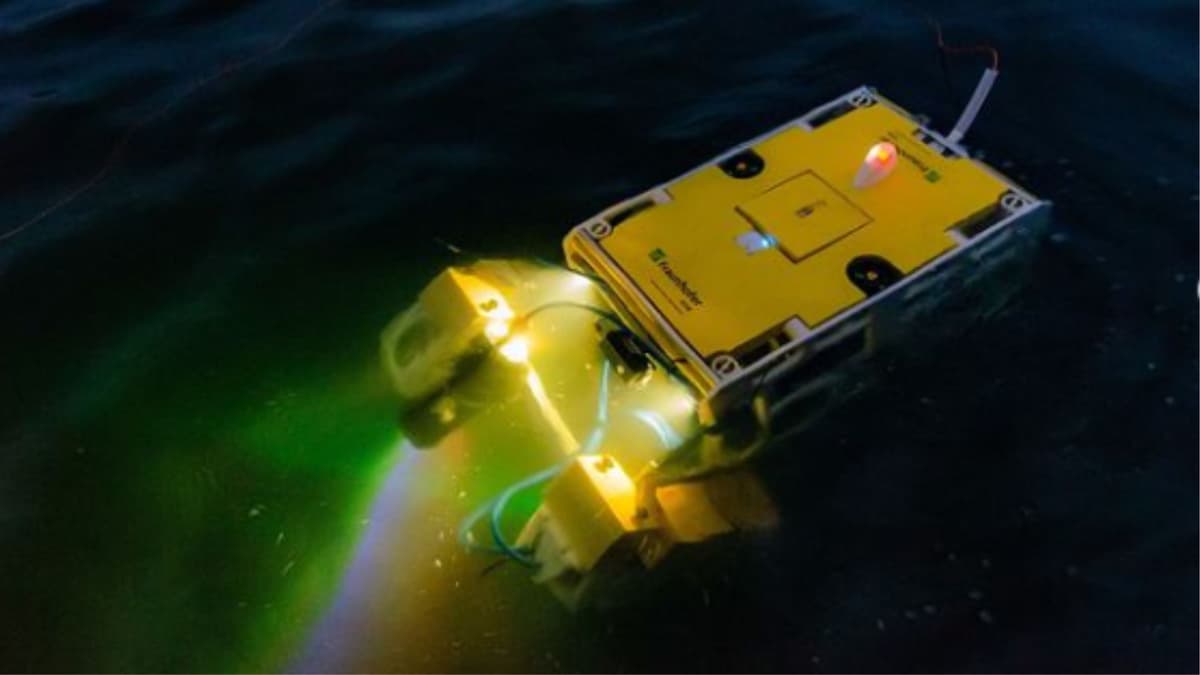

Based in Newfoundland, Kraken Robotics is a marine technology company providing ultra-high resolution, software centric-sensors and underwater robotic systems.

Leung’s latest analysis comes after the company provided updates on some of its ongoing projects in its Robotics as a Service (RaaS) operations, with the company noting that the integration of recent acquisition PanGeo was going well, with PanGeo’s engineering team now moved into Kraken’s Newfoundland facilities and both teams also now working on several large projects, with an aim toward having all Newfoundland employees integrated in Kraken’s Mount Pearl facilities by the first quarter of 2022.

“Recall that Kraken’s RaaS business, which was recently augmented by the acquisition of PanGeo, is expected to accelerate Kraken’s recurring revenues and diversify its revenue streams more significantly into the offshore renewable energy market,” Leung said.

PanGeo is experiencing strong offshore utilization in Kraken’s fourth quarter, with six ROV-mounted Sub-Bottom Imagers (SBI), two shallow water mounts (GeoLink and GeoArm) and the remotely-operated SeaKite unit performing sub-seabed imaging in locations in Europe and Asia Pacific.

In regards to the rest of the RaaS operation, Leung notes that the company recently completed its first commercial RaaS campaign using its KATFISH towed underwater vehicle, undertaking a subsea cable inspection campaign in the Strait of Bell Isle. Meanwhile, the company noted that its SeaVision laser scanning services have experienced strong interest from the offshore oil and gas and renewable energy markets (including large global providers) for critical subsea asset inspection, with paid demonstrations in place in North America, Europe, Africa, and Brazil through the fourth quarter of 2021 and first quarter of 2022.

“Kraken’s RaaS is a cloud-based robotics rental / licensing business model that enables customers to incorporate the robotic capabilities they need when they need them, upgrade or downgrade systems as requirements change and deploy robotics without the necessary costs required by more traditional robotics implementations,” said Karl Kenny, Kraken’s President and CEO in the company’s October 25 press release.

“RaaS works by utilizing Kraken’s internally developed IP including our subsea sensors and robotics hardware, artificial intelligence algorithms and cloud-based data analytics. This allows customers to rapidly spool up and deploy operations, significantly reduce upfront capital equipment and operational expenditures and adjust survey and inspection capabilities on the fly,” Kenny said.

“For customers trying to improve productivity and reduce risk but have thought robots were out of their price range, Kraken’s RaaS offers a very compelling alternative for both underwater defence and commercial applications,” Kenny added.

The news only got better for Kraken on Monday, as the company also announced it had secured a $500,000 RaaS contract with the Canadian government for testing of Kraken’s ultra-high resolution survey equipment with the Royal Canadian Navy (RCN) at its Fleet Diving Unit – Atlantic in Halifax, which will be funded under the Canadian government’s Innovative Solutions Canada program.

“Kraken is excited to be able to offer RaaS to the RCN as an “Early Adopter” to augment existing RCN Route Survey with a Service offering based on the latest SAS technology available,” Kenny said in a separate press release. “Kraken seeks to offer our Robotics as a Service globally, in particular to other NATO allies, and this contract for the RCN’s evaluation will serve as an excellent reference. The RCN’s objective comparison of the data from our RaaS offering against legacy sonar data will provide demonstrative evidence of the superior image resolution and accuracy of Kraken survey data.”

Leung’s financial forecasts remain unchanged from his previous analysis, as he has Kraken reaching $28.1 million in revenue for 2021, which would be a potential 128 per cent year-over-year increase, before climbing to a projected $37 million in 2022, a potential 31.7 per cent year-over-year increase.

In addition, after reporting a $2.7 million loss in 2020, Leung projects the adjusted EBITDA will swing positive for the first time in 2021 at $3.9 million for a 13.9 per cent margin, then rising to a projected $4.7 million, though the margin would drop to 12.8 per cent.

Leung’s valuation data puts Kraken in a good light, as he projects the EV/Sales multiple to drop from 5.9x in 2020 to a projected 2.6x in 2021, then dropping to a projected 2x in 2022. With EBITDA projected to turn positive in 2021, Leung’s EV/EBITDA multiple projections begin there at a revised rate of 18.7x (previously 21.2x), then dropping to a projected 15.3x (previously 17.4x) for 2022.

Overall, the share price for Kraken Robotics has dropped by 29 per cent for the year to date, hitting a peak price of $0.99/share on February 18 before bottoming out at $0.38/share on October 21.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment