There’s upside to Teladoc from here, this portfolio manager says

If you can handle the volatility, investors should be thinking about Teladoc (Teladoc Health Stock Quote, Chart, News, Analysts, Financials NYSE:TDOC), says Kim Bolton, who likes this leader in the medical technology space despite the recent downturn.

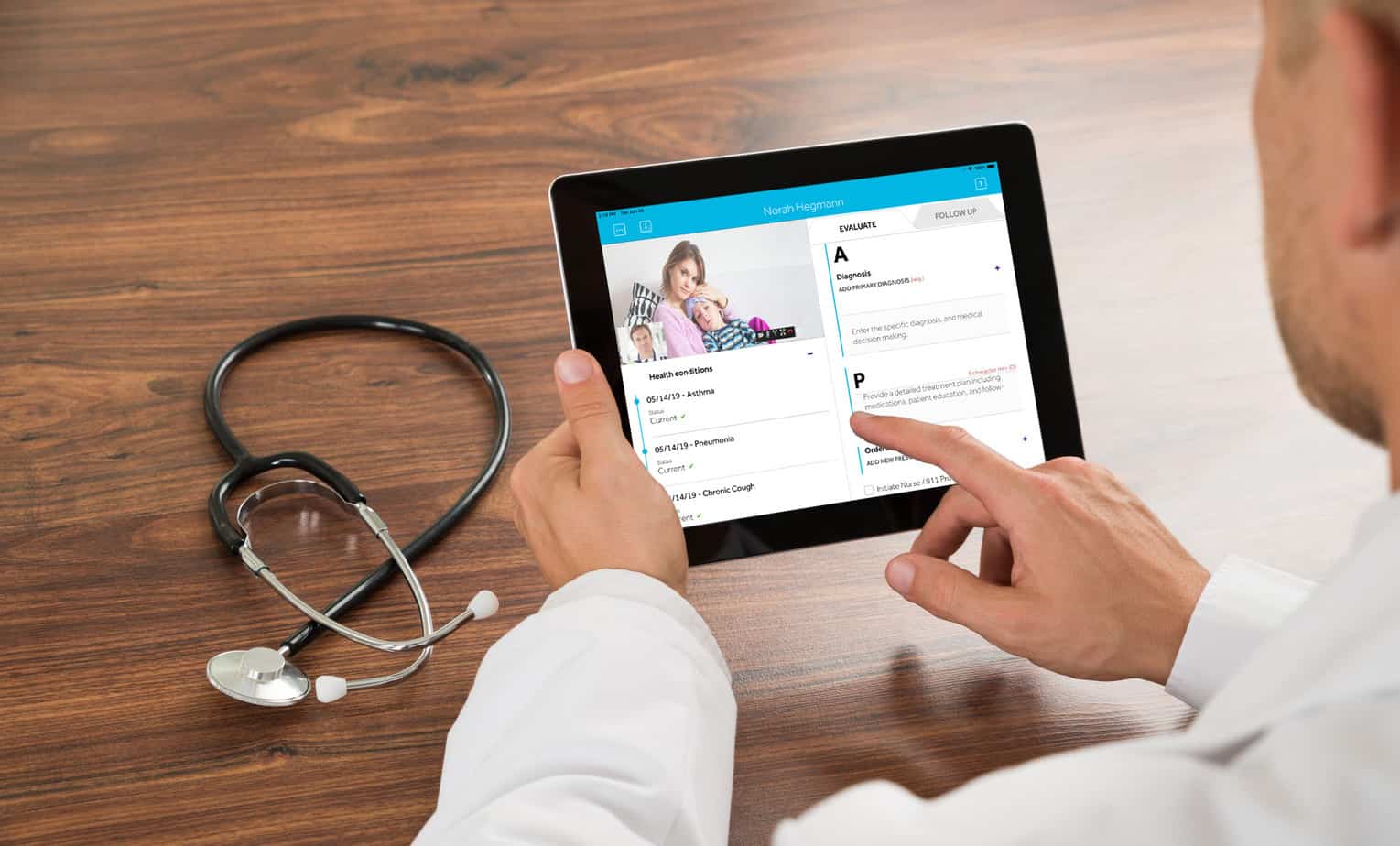

“The price target we have on TelaDoc is $166.85,” said Bolton, president and portfolio manager at Black Swan Dexteritas, speaking on BNN Bloomberg on Wednesday. “TelaDoc Health provides a platform for people to get health care from a variety of health professionals including mental health care providers and specialists.”

“It went public back in 2015 and it was founded actually back in 2002. It has grown its revenue significantly and is the leader within this category of med tech, where revenues are up 32 per cent in the past year alone,” he said.

Teladoc was a big winner over the pandemic where lockdowns pushed everything online, including medicine, with both doctors and patients finally getting acquainted with videoconferencing and virtual appointments rather than the in-person visits which up until this past year were the standard of practice.

The US Centers for Disease Control has said the use of telehealth services increased by 50 per cent over the first quarter of 2020, with a 154 per cent year-over-year spike in the month of March. Meanwhile, a report last month from McKinsey shows that telehealth usage has flattened out over the past 12 months but is still 38 times its pre-COVID levels.

The surge had its impact on Teladoc’s share price, too, which took off in early 2020, going from $83.72 to start the year to $200 per share by the end of December. The stock drove even higher over the first stretch of 2021 but a major pullback has occurred in the months since and the stock is currently trading around $150.

“It’s volatile and probably the main reason is that this is one of those companies that has yet to be profitable,” Bolton said. “The stock price has skyrocketed and it has made a number of acquisitions. It just completed earlier this year a merger with Livongo Health.”

“So, we still like it,” he said.

Teladoc reported mixed results last week for its second quarter 2021, showing huge revenue growth of 109 per cent year-over-year to $503 million. The company’s net loss grew from $0.34 a year ago to $0.86 per share. Analysts had called for $500.6 million in revenue and a loss of $0.56 per share.

“Teladoc Health delivered a strong second quarter, marked by exciting new client wins, product launches, and tremendous progress on our quest to be the category-defining provider of whole person virtual care,” said CEO Jason Gorevic in a press release. “We have solid momentum heading into the second half as the market embraces the unified care experience that only Teladoc Health has the breadth and scale to achieve.”

Teladoc reported an uptick in virtual visits to 3.5 million compared to 3.2 million for the previous quarter and 2.8 million a year earlier.

Looking ahead, Teladoc called for third quarter revenue to come between $510 and $520 million and a net loss of between $0.78 and $0.68 per share, with total visits forecasted to be between 3.4 and 3.6 million.

For the year, the company raised its revenue forecast to between $2 and $2.025 billion and a loss per share between $3.60 and $3.35. Management is expecting total US paid memberships to be between 52 to 54 million members and total visits to come in at 13.5 to 14.0 million.

“The strong momentum across our channels and geographies gives us the confidence and visibility to increase our full-year revenue guidance to $2.0 billion to $2.025 billion,” Gorevic said in the Q2 conference call.

“Teladoc’s aim is to provide whole-person virtual care. It’s not enough to simply virtualize the current healthcare experience, simply putting a doctor on the screen. The healthcare system is already fragmented, and virtual care shouldn’t simply mirror that problem. Instead, we need a single virtual solution that seamlessly takes care of all of a person’s healthcare needs, redefines the consumer experience and uses data to improve care at scale,” he said.

After the quarterly results, Deutsche Bank analyst George Hill dropped his rating from “Buy” to “Hold” with a target of $153 per share, implying just a one per cent return over the next 12 months.

“We believe Teladoc has a very good business led by a very strong management team, but that does not make TDOC a good stock,” Hill wrote in a report.

At the same time, Keybanc analyst Donald Hooker dropped his price target from $220 to $180 while reiterating his “Overweight” rating.

Piper Sandler analyst Sean Wieland gave TDOC an “Outperform” rating and $291 target, saying with the Livongo acquisition last year, Teladoc is now becoming the first fully virtual healthcare system. Teladoc is “a transformation we want to own,” Wieland wrote.