Echelon Capital Markets analyst’s Stefan Quenneville’s view of DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK) is virtually unchanged after the company’s latest quarterly results. Quenneville reiterated his Top Pick status for Diagnos, his “Speculative Buy” rating and his $0.95/share target price with a projected return of 73 per cent in his most recent update to clients on Wednesday.

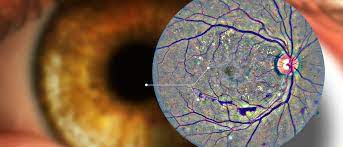

Founded in 1996 and headquartered in Montreal, DIAGNOS is an artificial intelligence company addressing diabetic retinopathy, a leading cause of blindness. Its CARA AI technology, which imports, processes, and stores original and enhanced images through computerized networks, is in the process of rolling out in New Look optical retail outlets throughout Canada in the second half of 2021.

Quenneville’s said DIAGNOS’ second quarter results were in line with his expectations.

“While optical retailers have had a challenging year due to the pandemic, DIAGNOS has been actively targeting these players in pursuit of additional deals that could provide upside to our estimates in the coming quarters and serve as a positive catalyst for the stock,” Quenneville said.

DIAGNOS reported revenues of $76,000 in the quarter, marking a 59 per cent increase between quarters, though slightly under the EWP estimate of $91,000. However, Quenneville noted that the company’s SG&A spending exceeded expectations, giving DIAGNOS a $700,000 net loss in EBITDA for the quarter against the analyst’s forecast of a $600,000 loss.

The company finished the quarter with approximately $1.2 million available in cash and short-term investments, as well as a $2 million interest-free loan from the Quebec government to be repaid within the next ten years, with Quenneville expecting the money to cover the costs required to continue ramping operations as well as the cash burn to continue developing the technology for diagnosis of other afflictions such as hypertension, glaucoma, and diabetic macular edema.

DIAGNOS announced in June its seven-year agreement with New Look Vision Group to bring its AI platforms into its outlets, but DIAGNOS has also been signing other partnerships and agreements, including a two-month pilot project with the Hospital Oftalmológico Buena Vista Sinaloa, the largest ophthalmological hospital in Sinaloa State, Mexico, along with the opening of an AI-assisted clinic at the Magrabi Hospital in Saudi Arabia.

Most recently, DIAGNOS signed an agreement with Spanish company Opticalia Group for a three-month pilot project with three of its franchisees, with potential to expand to over 1,000 independent opticians in about 600 locations in Spain, 150 in Portugal and more in Mexico, Colombia and Morocco.

“A proposal that combines optometrist knowledge, telemedicine and artificial intelligence to obtain fast results, without invasive methodology and with totally reliable results,” said Elsa Tortosa, owner and head of optometrists for Opticalia’s Pinoso franchise in the July 28 press release from DIAGNOS. “A smart retinography is also used which, once the patient is positioned, automatically searches for the retina in the eye. All the techniques used in this process are non-invasive, painless and quick for the comfort and tranquility of the patient.”

DIAGNOS is also working to diversify its offerings, having also completed a successful proof-of-concept study for its CARA-STROKE application to address stroke prevention and management, a $36 billion market according to the company’s March 9 press release.

Quenneville projects the company’s revenue to remain around the same level for the next two quarters before jumping to an estimated $600,000 in the final quarter of 2022 to help the company reach $1 million in projected annual revenues for the first time, then increasing to a $7.3 million estimate in 2023.

He also has EBITDA losses continuing to mount on a quarterly basis, bottoming out at a $900,000 loss in Q3 2022 before eventually rising to an annual figure of $1.9 million by 2023.

Quenneville is optimistic about the company from a valuation perspective, as his projections have the EV/Sales multiple dropping from 88.4x in 2021 (contrasted with an 83.6x projection from peers) to 6.8x in 2022 against 14.6x from peers, then dropping again to a projected 3.4x in 2023, in contrast to the 9.7x projection from peers.

Quenneville’s EV/EBITDA multiple projections tell a similar story, registering at a forecasted 52x for 2022 compared to peer projections of 466.2x, then dropping to a projected 7.3x compared to a 17.6x mark from industry peers.

With the CARA AI rollout in New Look outlets expected to start in September, Quenneville is keeping his DIAGNOS company projections for 2022 in place.

“From here, we expect momentum to build as pandemic restrictions subside, optical retail outlets re-open, and New Look kicks off a planned marketing push in the fall,” Quenneville said. “As the platform rolls out to the 406 New Look stores in Canada, starting with the 145 IRIS locations in Quebec, we expect to see more contract wins from other optical retailers as the technology proves its utility to this market segment.”

At press time, DIAGNOS was trading at $0.53/share on the TSX Venture Exchange, up a cent from its Wednesday closing numbers. Overall, DIAGNOS is down 4 cents (7 per cent) since January 1, with a high point of $0.75/share on January 13.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment