But underneath all the bluster, crypto simply has to work if it is to replace a legacy system. In other words, if something is broken it ultimately has to be put back together. Especially when you are talking about how people get paid.

Banxa (Banxa Stock Quote, Chart, News, Analysts, Financials TSXV:BNXA) was formed to be a decidedly modern solution to what seems like an inevitable transition. In some way, in some form, digital is the future of currency.

Banxa Chairman & Founder Domenic Carosa talked to Cantech Letter about how his company is building the payments bridge between fiat currency and digital assets such as Bitcoin or Ethereum.

Domenic, can you explain to our readers how Banxa came together?

Banxa was founded in 2014, originally after I experimented with mining bitcoin. We decided to start trying to help people buy cryptocurrencies easily. We saw the potential in digital assets, allowing people who were unbanked or outside the traditional system to access to financial opportunities. Our first iteration, bitcoin.com.au grew significantly during 2017, but when the market went into contraction, we, like many other cryptocurrency companies, felt the pinch. Early in 2018, we re-evaluated our technology stack and our IP that we had built over the previous years and saw the opportunity that would become BANXA. Cryptocurrency exchanges like Binance were growing and were very technology focused. However, while we are a technology company, our real area of expertise was the marriage of our technology and our realisation that the whole digital asset sector would grow more regulated over time. We’d gone through a process of struggling to open bank accounts at the time when banks were very wary of crypto. We saw that our expertise was of value and we could bring that value to digital asset businesses.

What problem is Banxa trying to solve?

For us, we really see a massive opportunity. Cash is shrinking as an asset class. All money is digital, yet banks and governments are using legacy systems set up when cash was the primary medium of exchange. If all money is digital, why does it still take 2-3 days for money to get sent around the world via either the SWIFT or ACH networks? Cryptocurrencies provide instantaneous transfer of value, and the networks are much more secure. Blockchain is still maturing, but it will be the technology for future payments.

There’s no doubt that digital assets are the future – China has launched its own digital currency, in Latin America (LatAm) El Salvador was first to make Bitocoin legal tender, and Argentina and other countries are also beginning to make moves to embrace digital assets. Nearly every Wall Street bank (Goldman, JPMorgan, and even Fidelity) have launched some type of digital asset product. This is the future.

As the market matures, we can see fairness in the more mature parts of the digital asset space – it provides financial opportunities for the huge section of the global population that are unbanked, or marginalised, or poor. Digital assets have the opportunity to empower people to the same degree that the internet is democratising knowledge.

The question that we envisaged when we founded Banxa is very simple, how do these people safely enter this new market? Who will provide them the “gateway” to move assets easily and securely into and out of the cryptocurrency space. We are looking to be the gateway for the bulk of the world’s 7 billion people who haven’t yet moved into the space.

You have mentioned that Banxa is building the payments bridge between fiat currency and digital assets such as Bitcoin or Ethereum. What do you mean by this?

Most of the the significant activity in the digital asset space is development led. Cryptocurrency exchange leaders come mainly from the technology space – Chaopeng Zhao (CZ) of Binance came out of Financial Technology space, Joe Lubin and Vitalik Buterin were developers, the first movers build the technology. At Banxa, we see that these trailblazers don’t focus on the integration with the existing financial system. This can impact them later as their businesses scale. They have to manage the order matching, the trading engines, the security, development, the technology stacks – they don’t have the bandwidth or time to handle the part that we are expert at, building simple yet safe ways to confirm identity, handle the transfer of funds, and provide technical and customer support for the millions of users moving into digital assets for the first time or those who want to move some of their digital assets back into cash. This combination of compliance-based payments processing, and technology is the core of our business. All the methods to do so have high fees, patchy integrations, and can cause headaches – At Banxa we aim to simplify and strengthen this “gateway” so customers feel safe buying and selling digital assets.

Who are your customers and how do you make money from them?

Our clients, who we refer to as partners, because our relationship is very much a collaboration or partnership – as we work with them to grow their business are a mix of both some of the largest cryptocurrency companies in the world, some of the newest, and the most innovative. We’ve had some of our relationships a long time – our early-stage investors included OK Group (OKex exchange) and Kucoin, some of the largest global exchanges. Later, we partnered with Huobi, another big player. In 2019/20 we partnered with Binance, Shapeshift and a host of others. Currently BANXA has over 65 partners, and we are adding more every month. Our aim is to have 150 by the end of next year, and 300 by the end of 2023. The payments and compliance business is one of scale – with scale we can provide the best rates to our customers and the best service to our partners.

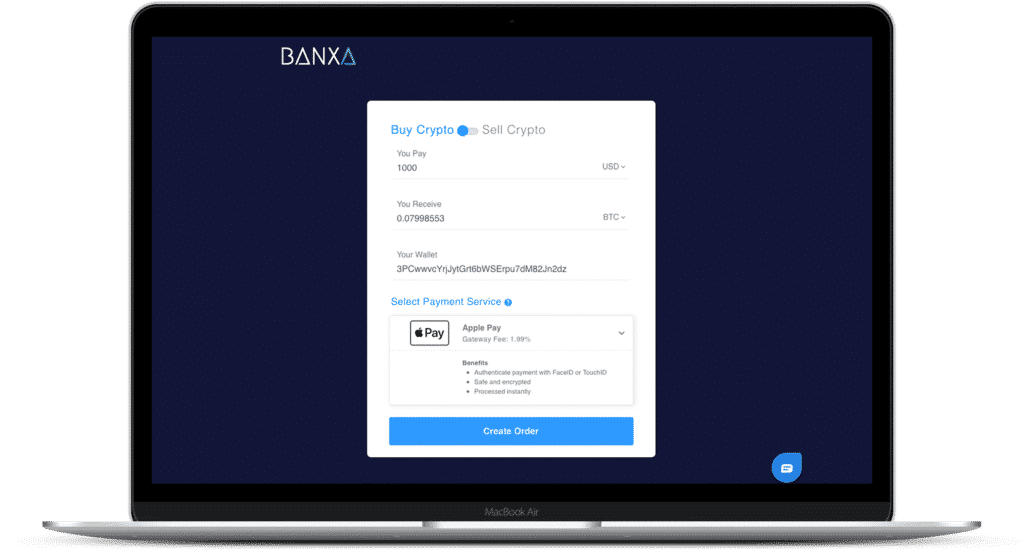

We provide these partners with the ability to let their end users purchase crypto simply and securely via a range of payment methods depending on their geographical location. We have the widest number of payment options in the space. BANXA doesn’t just do the payment, instead, we handle the whole process – the identification (known as KYC- Know-Your-Customer) the verification and compliance checks, and the coin delivery. We integrate into our partners platform directly, so for their end users, it is a seamless transaction inside whatever platform they are using. We take a small fee of each of these transactions. So, for both us and the partner, it is all about volume.

You posted Revenue of $21-million for the three months ended March 31 of this year. That was an increase of 1,479% from the same period a year earlier. What’s driving this growth?

There are two things to consider – the first is the bull market that started a month or so after our IPO, that has driven significant sustained interest in the cryptocurrency space in general. That has benefited us in the short term. More interesting is our technology platform, our global crypto licences/registrations and our team – We’ve invested more into both of those than any of our competitors, and we are the fastest growing company in our sector. We’ve built a technology stack that handles more payment methods than our competitors, and we’ve layered robust compliance features over the top of that. This means that unlike other market entrants, we do not handle coins that are considered by regulators such as the SEC to be securities, nor do we enter a new market without being very familiar with the regulatory landscape. This tech/product functionality makes us a very trusted player in the market, especially in times of regulatory uncertainty or volatility.

You recently inked a new partnership with Hoo.com in which you will provide Anti-Money Laundering services. Can you tell us about this aspect of your business?

This is not a specific service, but as I mentioned above, it is part of the complete solution we offer. KYC and AML (That’s Anti-Money Laundering) are two closely linked functions. We check identity, verify that identity, check source of funds and tie the transaction to an actual person. This allows our partners to be confident that none of their users are in breach of any regulations in the markets they serve.

What does Banxa’s balance sheet look like? What are your margins like and how do you plan to improve them?

At the last reporting period, we reported $25m in cash and cash equivalents. There’s a host of expenses involved in a business like ours, staffing and development costs, then specifically there’s Forex and bank charges in the type of activity we do. Last, but as equally as important, is delivery costs. With cryptocurrency transfers, there’s gas fees etc. that are impacted by the amount of traffic on the network. Our Finance Team has scaled very quickly, and our Group CFO, Shyam Deo, has launched a number of projects to minimise these Forex and other charges. For network fees (such as Gas) we are trailing both on and off chain transfers, and other new infrastructure technologies to make us more cost efficient. There’s a lot of opportunity for us to optimise these costs. Technology and staffing are more challenging – Obviously, we are growing the business very fast, and we want to be the biggest player in this space – there’s an expense to that kind of growth.

In March, Fundamental Research launched coverage of Banxa with a “Fair Value” target of $15.88. The stock has trailed off since then. Why do you think this is?

I can’t really comment on external analyses with certainty, but I think Fundamental used a straightforward valuation approach. If we take the annual revenues of any company and look at a multiple of 3-5x, that used to give the standard methodology that VC’s and PE firms looked at as a guide. In the technology space, you can see companies that buck this trend, and look at multiples as high as 15-20x. In our sector, as a Fintech (Financial Technology) company, similar companies fall pretty solidly into that second range. I think Fundamental Research looked at comparable companies scaling as fast as we are and assumed we were undervalued based on that.

It’s an interesting question, prospectively. We are currently up 3x from our IPO, so, it’s been a very successful run for us, and we see it continuing. In the irrational exuberance of May 2021when digital asset prices were sky high and rising, we saw our share price move with the market. Overall, the market has settled down, and this caused a market correction. We think perhaps Fundamental predicted the bull run would continue for longer than it did, and that influenced their estimation. However, based on Bitcoin moving from $40-47 k USD in the last few days, the bulls may have another run.

What do you want to accomplish in the next year?

As I mentioned above, our goal is to provide increasingly better service to our partners – this means more payment methods for their end users, faster and cheaper transactions, and additional services such as those being seen in the Decentralised Finance (DeFi) space – interest bearing accounts, wallet solutions, etc. One of our main milestones in the next few months is bringing online our cryptocurrency sell function country by country – This will allow people to move in and out of digital assets as easily as they transfer and pay through their bank account.

More generally, we also want to increase our partner network. Our target is 150 partners this financial year, and 300 by the end of the following year. I imagine that we will have our US operation up and running, and a significant expansion to our European operations as well.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment