Canadian air cargo services company Cargojet (Cargojet Stock Quote, Chart, News, Analysts, Financials TSX:CJT) had a bang-up 2020, but there’s more where that came from, says Beacon Securities analyst Ahmad Shaath, who reviewed the company’s new first quarter financials in an update to clients on Tuesday. Shaath maintained his “Buy” rating on CJT, saying the solid quarterly results are a testament to the company’s strengths as well as favourable industry dynamics.

Canadian air cargo services company Cargojet (Cargojet Stock Quote, Chart, News, Analysts, Financials TSX:CJT) had a bang-up 2020, but there’s more where that came from, says Beacon Securities analyst Ahmad Shaath, who reviewed the company’s new first quarter financials in an update to clients on Tuesday. Shaath maintained his “Buy” rating on CJT, saying the solid quarterly results are a testament to the company’s strengths as well as favourable industry dynamics.

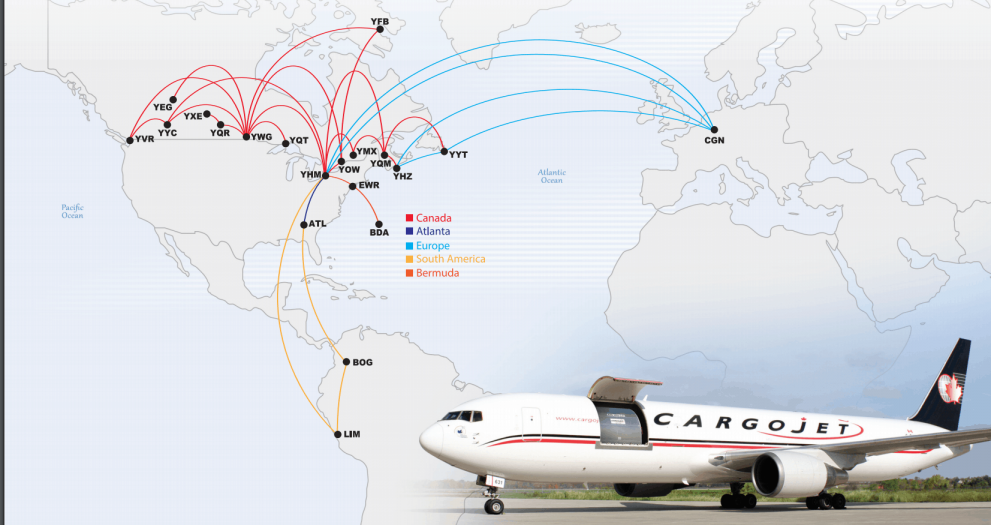

Cargojet, which has three main businesses in domestic overnight cargo, an aircraft, crew, maintenance and insurance (ACMI) segment and a charter plane segment, announced its first quarter 2021 numbers on Monday, with revenue coming in at $160.3 million compared to $123.0 million a year earlier and adjusted EBITDA at $64.2 million compared to $44.6 million for Q1 2020. Adjusted free cash flow for the quarter was $35.2 million compared to $29.8 million a year ago.

“With a fundamental shift in consumer shopping habits in several key categories, Cargojet has spent the last few quarters laying the foundation to capture the next phase of e-Commerce growth,” said Dr. Ajay Virmani, President and CEO, in a press release. “We strengthened our balance sheet, invested in fleet expansion, broadened our portfolio of services and are investing in attracting and retaining top talent.”

The $160 million topline was ahead of the consensus call for $154 million as well as Shaath’s estimate of $147 million, while adjusted EBITDA of $64 million was also above the Street’s $58 million and Shaath’s $56 million. EBITDA margin of 40 per cent was also better than Shaath’s and the consensus call for about 38 per cent.

“Cargojet reported Q1/FY21 results that beat our forecast and consensus, with continued strong mid-double-digit growth in the domestic network,” Shaath wrote in his report.

“Core revenues (ex. lease, FBO, fuel and other pass-throughs) were $126 million, slightly ahead of our $122 million estimate. CJT continued to post very strong growth in its domestic network revenue, with 15.5 per cent year-over-year growth ahead of our 13.1 per cent estimate,” he said.

“The strength in the domestic network continued to be driven by the shift towards e-commerce, which now stands at 14 per cent of total retail sales, up from 12 per cent as of FY20 end and more than double on a year-over-year basis. The second pocket of strength was the all-in-charter revenues, which came in at $10 million (versus $8 million forecast),” Shaath wrote.

Cargojet announced with the quarterly report that it had signed an LOI to purchase one additional B757-200 aircraft for its ACMI business, with the deal expected to close and the plane delivered during the second quarter and the plane expected to be operational in June 2021.

Shaath wrote, “While the aircraft has been earmarked for a new ACMI contract, the company is currently working on optimizing its revenue potential and could eventually place it on its domestic network and take out one B767 to place on the new ACMI opportunity instead. The company did not provide an indication of the would-be customer but confirmed discussions are on going with its main partner DHL as well as a second party.”

Shaath said CJT’s fleet growth plans remain on track, with the company looking to add five new B767s at a rate of one per quarter starting in Q3 2021.

The analyst said demand trends are likely to continue to drive strength across all of Cargojet’s key revenue lines. The company announced on April 1 a new Air Transportation Services Agreement with Amazon Canada Fulfillment Services, by which CJT will operate two Amazon-owned B767s as part of the Amazon Air network on a CMI basis, starting mid this year.

Shaath said the expansion of its business with Amazon is likely to result in some revenue dilution on CJT’s scheduled domestic network, but the analyst still sees the relationship as a net positive for the company.

“Management confirmed that all of its discussions with Amazon leading to this contract were done with the view that this capacity expansion is driven by overall growth. The revenue attrition is only expected in the first handful of months as CJT gets a better understanding of the volumes Amazon is shifting to its CMI contracts. With demand continuing to be very strong (CJT’s overall volume grew 35 per cent year-over-year in Q1/FY21), we believe CJT will have minimal challenges in filling up the extra capacity as Amazon’s CMI capacity fully ramps up,” Shaath said.

Shaath has pushed up his estimates for Cargojet on the basis of the new ACMI contract and is now calling for full 2021 revenue and EBITDA of $676 million and $272 million, respectively, and 2022 revenue and EBITDA of $722 million and $294 million, respectively.

With the update, Shaath has maintained his $290.00 price target, which at press time represented a projected one-year return of 60 per cent.

“We continue to be bullish on CJT, with Q1/FY21 results solidifying our thesis regarding the structural changes in both the retail industry and the air cargo market overall. The continued strength in the domestic network along with the new CMI contract for Amazon, new ACMI contract win and the relatively-strong showing of the all-in-charter business are strong validation points,” Shaath wrote.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment