Health and wellness company Rritual Superfoods (Rritual Superfoods Stock Quote, Chart, News, Analysts, Financials CSE:RSF) should be hitting positive EBITDA by next year, according to Clarus Securities analyst George Ulybyshev making the stock a great investment opportunity within the burgeoning functional foods category. Ulybyshev kicked off coverage of Rritual with a “Speculative Buy” rating in a report to clients on Friday, saying the company is building a diversified recurring revenue stream.

Health and wellness company Rritual Superfoods (Rritual Superfoods Stock Quote, Chart, News, Analysts, Financials CSE:RSF) should be hitting positive EBITDA by next year, according to Clarus Securities analyst George Ulybyshev making the stock a great investment opportunity within the burgeoning functional foods category. Ulybyshev kicked off coverage of Rritual with a “Speculative Buy” rating in a report to clients on Friday, saying the company is building a diversified recurring revenue stream.

Just days into its public listing, the market has so far taken a shine to RSF, taking the stock from its debut on March 8 at $0.40 to $0.82 per share by Friday’s close. Rritual Superfoods announced the completion of its IPO on March 5, where the company offered 20.0 million units at $0.30 per unit for gross proceeds including over-allotment of $6.0 million. Each unit is comprised of one common share and one-half common share purchase warrant exercisable at $0.60 share.

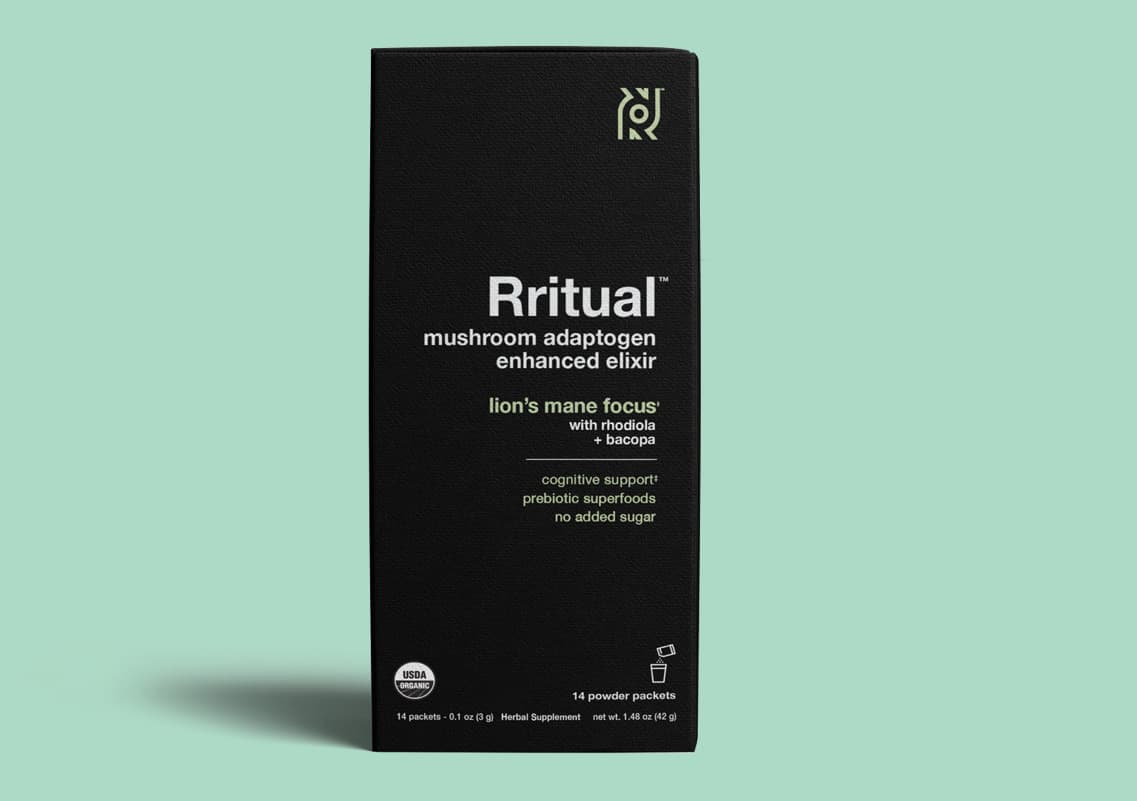

Vancouver-based Rritual Superfoods is focused on the formulation and distribution of premium plant and mushroom-based products with adaptogen (herbal pharmaceutical) ingredients. The company has three mushroom-based powdered products which are currently online under the Rritual brand, with each product based on a unique blend of mushrooms including Chaga, Reishi and Lion’s Mane along with other adaptogens and functional food supplements. Rritual’s products include its proprietary Immune-Synergy Six Mushroom Blend, have been certified USDA organic, gluten-free and vegan and were recently validated by an ECRM Buyer’s Choice award.

Functional foods, also known as nutraceuticals, are said to be foods which in addition to providing nutritional benefits have other potential pluses in that they may protect against disease, reduce inflammation or enhance immune function.

In focusing on functional foods, Ulybyshev says Rritual Superfoods is targeting a rapidly growing market segment which is ripe for consolidation.

“There has been a secular shift in the dietary habits of people over the last decade. With increased awareness of the benefits of a healthy diet, as well as of the emerging evidence of the link between poor diet and chronic conditions, consumer demand has been increasingly moving away from highly processed, artificially enhanced products towards natural and nutrient-dense alternatives, with health- conscious consumers becoming more willing to pay a premium for higher quality products which they perceive to have added health benefits,” Ulybyshev wrote in his coverage initiation.

“Many consumers are also turning to more targeted functional foods and dietary supplements to get an extra edge to address their specific health concerns and performance needs, whether it is to boost the immune system or to increase day-to-day productivity and focus. This has created an opportunity for consumer conscious health and wellness companies, like Rritual, to meet the increased demand for such products,” he wrote.

Ulybyshev said Rritual has the advantage of entering the health and wellness product market through an already established network of wholesale and retail relationships across North America and the analyst believes management is making good progress with signing up retailers, making for good prospects to hit positive earnings by 2021.

“We see a high likelihood of Rritual significantly shortening the time it typically takes for a CPG company within the health and wellness space to scale revenues and achieve profitability,” Ulybyshev said.

In terms of financials, Ulybyshev thinks Rritual will generate $0.0 million in revenue for the current quarter, $1.0 million for Q2 2021, $1.5 million for Q3 2021 and $2.6 million for Q4 2021. For the full year, he expects the company to have revenue of $5.1 million and an adjusted EBITDA loss of $3.7 million. For 2022, the analyst is calling for revenue of $21.2 million and adjusted EBITDA of $1.1 million.

The analyst said Rritual’s wholesale business is likely to be the main source of revenue over his forecast period and that it has the potential to be highly recurring, provided Rritual can achieve attractive sell-through rates for its products. The product launch will occur in two stages, starting with a product launch across a retail network of four large non-competing grocery chains in the US (combined store count of 2,500) followed by a Canadian launch targeting major retail chains and as many as 1,250 stores.

“Between additional North American store penetration, online expansion and the launch of new product lines, we see substantial upside potential to our current revenue estimates, and view Rritual as an attractive growth story for investors looking to gain exposure to a large and rapidly growing functional food and beverages market,” Ulybyshev wrote.

The analyst has started RSF off with a “Speculative Buy” rating and $1.50 target price, which at the time of publication represented a projected one-year return of 87.5 per cent.

Rritual issued a corporate update on March 11, saying the company had completed a successful launch of its US-facing e-commerce website, which in addition to its product line contains articles and information on the products, recipes and usage notes in its blog.

“We aim for our website to be a robust platform for wellness, nutrition and superfood education,” said CEO David Kerbel in the press release. “Rritual will be launching various content series to help at-home fitness, mindfulness, meditation, and yoga, amongst other things. Rritual’s goal is always to help their website visitors evolve their daily ritual, and the website will be a great place to assist with that journey.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment