US Cannabis company Lowell Farms (Lowell Farms Stock Quote, Chart, News, Analysts, Financials CSE:LOWL) received a coverage initiation on Thursday from PI Financial analyst Jason Zandberg, who launched with a “Buy” rating, saying Lowell may be a single-state operator but it’s a growing fish in the big pond of California, still the world’s largest cannabis market.

US Cannabis company Lowell Farms (Lowell Farms Stock Quote, Chart, News, Analysts, Financials CSE:LOWL) received a coverage initiation on Thursday from PI Financial analyst Jason Zandberg, who launched with a “Buy” rating, saying Lowell may be a single-state operator but it’s a growing fish in the big pond of California, still the world’s largest cannabis market.

Salinas, California-based Lowell Farms emerged last month when Indus Holdings acquired Lowell Herb Co. and it brands and then changed its name to Lowell Farms. Indus itself was listed as a public company in April 2019 through a reverse takeover, with Indus acquiring cannabis topicals and oils company Humble Flower in April 2019 and concentrate products company Kaizen in May 2019.

In April of 2020, Indus closed on a $15.1-million convertible debenture financing, with investor George Allen, previous president of Acreage Holdings, becoming Indus’ Chairman and founder Mark Ainsworth becoming CEO. As Zandberg writes, the new executive re-focused the company toward reaching profitability and shifting its business away from lower-margin revenue categories such as distribution of third party brands and towards producing and selling owned brands. (All figures in US dollars except where noted otherwise.)

“We believe that this transition has largely been successful as evidenced by the breakdown of revenue in the first quarter compared to the fourth quarter. From Q1/20 to Q4/20, LOWL transitioned their revenue mix from 55 per cent owned, 29 per cent agency and 16 per cent distribution to 83 per cent of the revenue coming from owned products and only 2 per cent coming from distribution of third-party brands,” Zandberg wrote.

In his report, Zandberg made the case for why California is the place you oughta be when it comes to cannabis. He said the market in California has largely been shunned by cannabis investors due to the states unlimited license capacity, its relatively high taxes and still-strong illicit market, with investors showing favour for limited license markets like Florida, Pennsylvania and Illinois.

But Zandberg said California’s market is still growing at a fast pace. Legal adult-use sales were up 57 per cent to $4.4 billion in 2020, with the market expected to reach $7.5 billion by 2025, and while a large number of municipalities in the state currently do not allow legal cannabis sales, this is changing as more jurisdictions will be implementing legal sales programs in the coming years. That will have the carry-on effect of taking more bites out of the illicit market, as pricing and selection of legal weed will become more favourable compared to black market offerings.

Even further, in addition to being still an extremely fragmented market and thus ripe for consolidation, Zandberg argues that California’s cannabis companies will have an advantage over other single-state and multi-state operators when the US decides to de-schedule cannabis at the federal level.

“We expect cultivation and brands in California will dominate the industry similar to the wine industry [after de-scheduling],” Zandberg said. “Cannabis is synonymous with California and in an unregulated illicit market today the vast majority of weed is illegally grown in California and shipped across the US. Why would it be any different once the inter-state shackles are inevitably removed for legal cannabis? We believe that cannabis operators within California that are building scale will be ahead of the curve when this change occurs.”

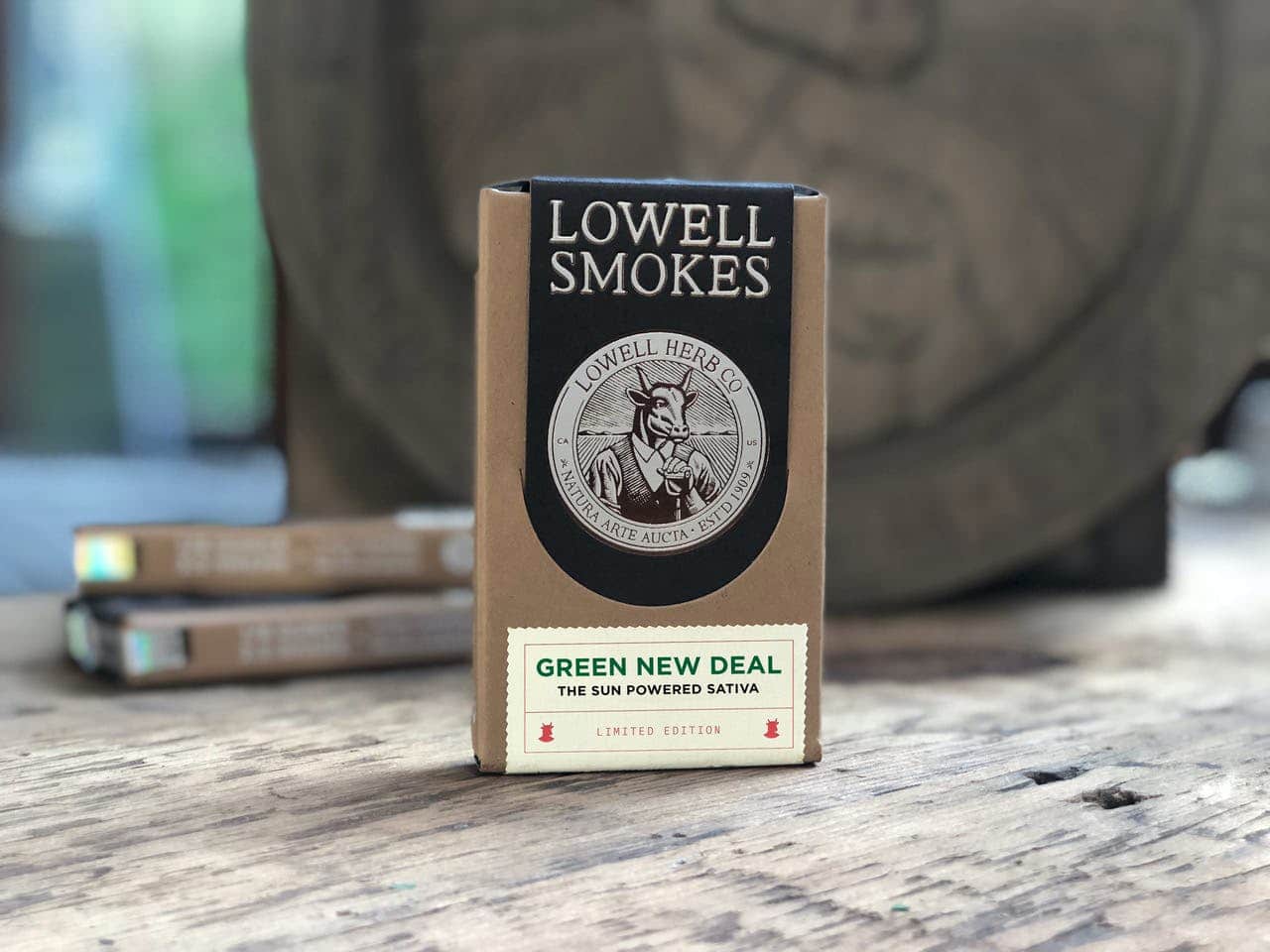

As to Lowell Farms’ attributes, Zandberg said its extensive portfolio of brands is well known across the state. Lowell Herb recorded revenues of $15 million in 2020 and were the number two pre-roll product in California ranked by sales, while the company’s social media following is big, Zandberg said, with over one million weekly impressions across all outlets and overall the second-highest number of Instagram followers out of all cannabis brands in the US.

Zandberg said Lowell Herb had been struggling with sourcing premium flower in the state, leading to supply chain disruptions and product shortages, but with Indus and its Salinas cultivation facility, there’ll be higher product output and at greater gross margins. Zandberg also said Lowell Herb had a poor distribution model and accessed only 15 per cent of California’s dispensaries, while now with Indus those products are exposed to over 90 per cent of the dispensaries in the state, likely to result in an immediate boost to sales, the analyst said.

On Lowell’s cultivation capacity, the company now stands as the largest among publicly-listed California cannabis operators at 225,000 sq ft, with others such as MSOs Curaleaf, Cresco Labs and Columbia Care all coming in under 200,000 sq ft.

“Most MSOs in the US have not yet deployed large amounts of capital in California. We believe that current operators not only have an opportunity to capture market share, these same operators will likely be attractive takeover targets when bigger capital decides to jump in. We believe Lowell Farms represent an emerging operator that has both the opportunity to build market share and potentially represent that acquisition opportunity,” Zandberg wrote.

With his “Buy” rating, Zandberg has launched on Lowell Farms with a price target of C$4.00, which at the time of publication represented a projected 12-month return of 103 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment