Is Canadian e-commerce up-and-comer Lightspeed (Lightspeed Stock Quote, Chart, News, Analysts, Financials TSX:LSPD) worth a look after all its gains over the past year? You bet, says Cole Kachur of Wellington-Altus Private Wealth, who thinks a recently closed public offering will put the company on a growth trajectory.

Is Canadian e-commerce up-and-comer Lightspeed (Lightspeed Stock Quote, Chart, News, Analysts, Financials TSX:LSPD) worth a look after all its gains over the past year? You bet, says Cole Kachur of Wellington-Altus Private Wealth, who thinks a recently closed public offering will put the company on a growth trajectory.

Lightspeed took advantage of the exemplary run in its share price over the last little while to up-size and then close on a massive $676.2-million public offering of about 9.7 million shares including over-allotment. The stock went from C$41 at the start of November to up above C$90 by mid-January, as investors piled into the name based on the company’s strong performance during the pandemic. (All figures in US dollars except where noted otherwise.)

Announcing the close of the equity raise last week, Lightspeed said it would be using the funds to strengthen its financial position along with pursuing growth strategies. On the M&A front, LSPD made a couple of big deals to close out 2020, picking up New York-based cloud commerce platform ShopKeep in November for $145.2 million and following up with the acquisition of Rhode Island-based restaurant management cloud software company Upserve in early December for $430 million.

“We believe [the Upserve] acquisition will accelerate the product innovation that has enabled Lightspeed customers to tackle the greatest challenge to their industry in decades and will add exceptional leadership to our teams in anticipation of the economic recovery of the global hospitality industry,” said Lightspeed founder and CEO Dax Dasilva in a press release.

And while the run-up in LSPD has been swift —the stock has now returned 395 per cent since its debut in March of 2019— growth prospects are looking good, making the stock a reasoned buy, according to Kachur, vice president and portfolio manager at Wellington-Altus.

“It’s been really surprising to me that during the pandemic, especially, they’ve been able to have the growth rates that they’ve had, as they’re involved in restaurants and retail and that type of thing,” said Kachur, speaking on BNN Bloomberg on Tuesday. “But essentially it’s a more efficient way for these businesses to have their online platforms and e-commerce.”

“Lightspeed did another offering within the past week so, of course, [they’re] building up the coffers and getting ready for more growth,” he said.

Lightspeed, which has its bread and butter in the small- to medium-sized business crowd including restaurants, retail and the golf industry, has so far proved fairly resilient to the downturn in those industries caused by COVID-19. In its latest financial report, the company’s third quarter fiscal 2021 for the period ended December 31, 2020, LSPD generated $57.6 million in total revenue, up 79 per cent year-over-year, and an adjusted EBITDA loss of $6.6 million compared to a loss of $5.3 million a year earlier.

During the heart of last year’s lockdowns, covering the nine months to the end of December, Lightspeed’s revenue jumped to $139.3 million compared to $84.4 million for a similar period a year earlier.

The company’s offered guidance for the upcoming fiscal fourth quarter was also strong, calling for Q4 revenue between $68 and $70 million and an adjusted EBITDA loss of $12-$14 million.

“Lightspeed’s third quarter results were strong, but we remain cautious in the short-term given an increase in government-mandated lockdowns in several of our key geographies across North America and Europe,” Lightspeed said in the Q3 press release.

“Prolonged lockdowns can increase churn, negatively impact [gross transaction volume (GTV)], delay purchase decisions and increase service suspension requests. In addition fiscal Q4 is traditionally a seasonally slow quarter for GTV, and the comparative periods have historically been slow GTV quarters for ShopKeep and Upserve as well,” Lightspeed said.

Kachur said investors could be buying LSPD right now but be wary at the same time.

“To me, Lightspeed is getting on the edge of a little bit expensive,” Kachur said. “I do think that they’re a high-growth company, so you’re just going to get a little bit more volatility with a name like that. But in terms of high growers, it’s certainly right up there on the list of Canadian companies.

“I’d probably buy it. I’m not a wide owner of it but I think it’s a very well-run company and it’s in the right industry, as far as I’m concerned,” he said.

Lightspeed got the nod from ATB Capital Markets analyst Martin Toner last month when he initiated coverage of the stock with an “Outperform” rating and a C$120 target price. Toner said the company has aggressively spent on sales, SG&A and R&D, with their sales and marketing being “highly efficient” and bearing fruit in recent years, which will ultimately help it to grow its profit margins.

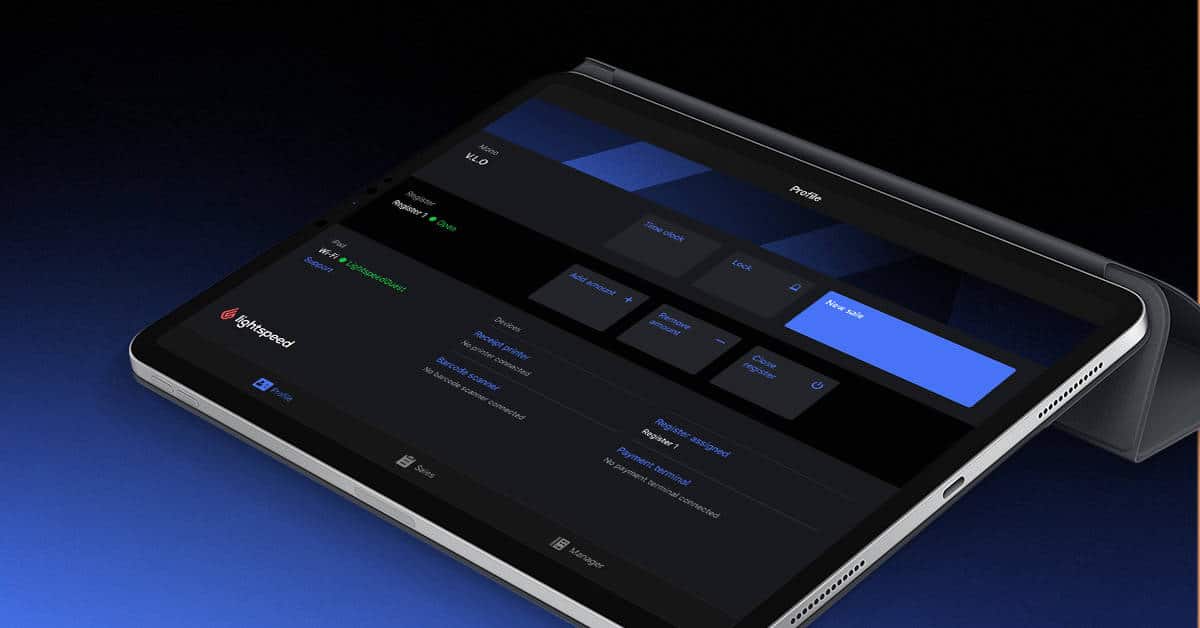

“Lightspeed POS is positioned to consolidate a fragmented industry and capture a substantial share of a large market,” Toner said. “The Company has proven the value of delivering an integrated experience, coveted by merchants for its ease of use and functionality. Lightspeed is one of the software platforms well-positioned to capture value in the payments ecosystem and add additional services in the future.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment