Beacon Securities analyst Gabriel Leung has raised his target price on Canadian software company VitalHub (VitalHub Stock Quote, Chart, News, Analysts, Financials TSXV:VHI), which just came off a superb 2020. In an update to clients on Tuesday, Leung kept his “Buy” rating and took his target from $4.00 to $4.50 per share, saying VitalHub’s robust organic growth and potential for M&A should make the stock attractive to investors.

VitalHub, which develops and supports software for health services providers working in mental health, community health and regional hospitals. The company is a software consolidator, acquiring assets in electronic health records, case assessment, patient flow and operational assessment fields, while its software and services are used by over 275 clients in Canada, the US, the UK, Australia, the Bahamas, Qatar and Latvia.

VitalHub issued a corporate update on Tuesday, announcing organic growth in excess of $1.0 million in annualized contract value (ACV) revenue during the fourth quarter 2020. ACV represents contracted annual recurring revenue including renewable software license and maintenance fees. The company said with the strong Q4 performance its ACV is now in excess of $14.5 million, which is an increase of 7.4 per cent from the previous quarter.

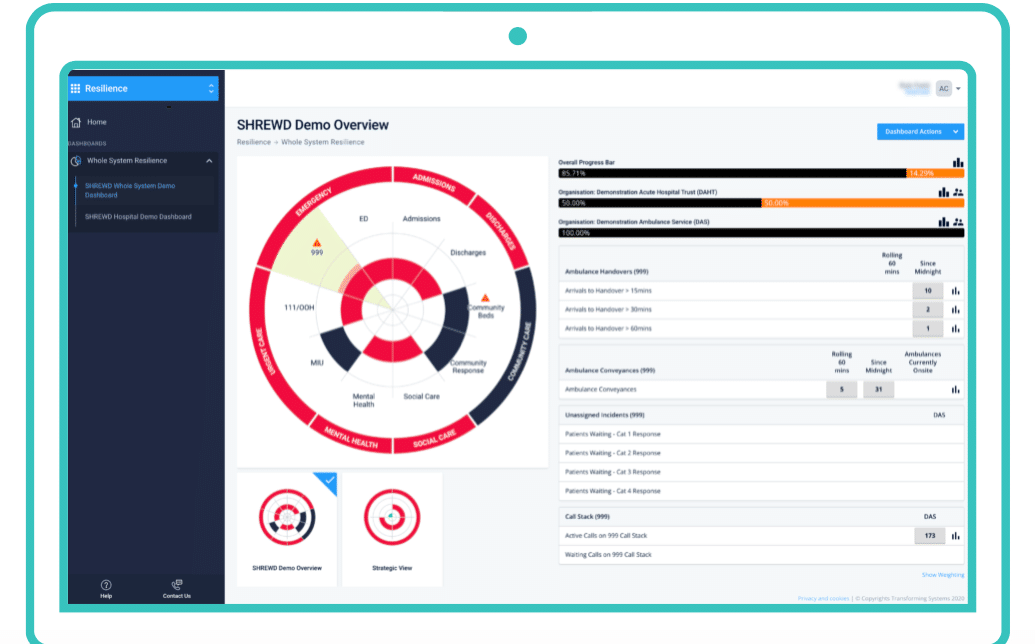

VitalHub said 75 per cent of its ACV revenue was generated from its UK market and involved the adoption and sale of the company’s Synopsis and SHREWD product sets, from recently acquired Intouch with Heath and Transforming Systems, respectively. Synopsis allows hospitals to digitally manage the entire assessment process while SHREWD is a product portfolio of real-time operational management tools.

“Our recent acquisitions in 2020 have added to our strong set of product offerings, giving VitalHub a robust suite of solutions that are currently providing a high degree of value to healthcare organizations around the world. Due in part to our great customer reference base and also to the strong team of industry experts deploying our offerings, other healthcare organizations are purchasing our digitally-enabled solutions to become more streamlined and efficient,” said Dan Matlow, CEO, in a press release.

“VitalHub has achieved its strong revenue growth not only through acquisitions. As our organic growth has been demonstrating, our solutions are each industry leaders in their respective markets,” Matlow said. “This organic growth is further proof that we are able to grow both organically and through M&A via our two-pronged growth strategy.”

Commenting on the corporate update, Leung wrote, “While the company’s recurring revenue business appears to be generating strong traction, we continue to await data points on how the non-recurring (~30 per cent of revenues) is faring.”

“The company does have long-term contracts in place to support this revenue line; however, we would remind investors that work has been constrained by COVID within certain projects,” Leung said.

After the update, the analyst has mostly left his 2021 estimates unchanged and has introduced 2022 numbers, which call for about 11 per cent recurring revenue growth, about 12 per cent total revenue growth and 21 per cent EBITDA margins.

Leung thinks VitalHub will deliver full 2020 revenue and EBITDA of $13.1 million and $2.0 million, respectively, 2021 revenue and EBITDA of $21.0 million and $3.3 million, respectively, and 2022 revenue and EBITDA of $23.6 million and $5.0 million, respectively. Leung called for VitalHub’s EBITDA margins to go from 15.3 per cent in 2020 to 15.7 per cent in 2021 to 21.1 per cent in 2022.

Leung’s new target of $4.50 which has been increased “largely due to the passage of time,” he said, is based on a 6x multiple of Leung’s 2022 EV/Sales and at press time represented a projected one-year return of 45 per cent. After a fairly flat 2019, VHI delivered a return of 63 per cent.

Comparing VitalHub to its peers, Leung wrote, “We would point out that many of our recurring revenue SaaS names under coverage have experienced a multiple expansion over the past few months and are now trading in excess of 5x forward EV/Sales.”

“With VitalHub currently trading at ~3.8x forward EV/Sales, we view it as a compelling investment opportunity, particularly given the strong organic growth in its recurring revenue business, along with potential M&A opportunities leveraging its ~$24-million cash war chest,” Leung said.

VitalHub last reported earnings in November where its third quarter 2020 delivered revenue up 33.2 per cent year-over-year to $3.2 million and adjusted EBITDA of $502,595 compared to $523,669 a year earlier.

During the fourth quarter, VitalHub closed on a bought deal for about $17 million involving about 5.9 million shares at a price of $2.90. The company plans to use the proceeds for growth initiatives, working capital and general corporate purposes and described its M&A as focused on “the acquisition of third-party enterprises in the health care industry which provide synergistic opportunities for the Company,” according to a November 17, 2020, press release.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment